AIIA gặp gỡ với Thanh tra viên của CIS

20th Tháng mười, 2023

Đội ngũ AIIA đã tham dự cuộc họp đầu tiên do Văn phòng Thanh tra CIS tổ chức vào ngày 6 tháng 10, nơi đội ngũ đã thảo luận về các vấn đề ảnh hưởng đến cộng đồng nhà đầu tư EB-5. Chủ yếu, sự chậm trễ và thời gian xử lý kéo dài đối với các đơn xin EB-5 là nguyên nhân chính gây ra hầu hết các vấn đề mà nhà đầu tư nhập cư phải đối mặt, dẫn đến sự gia tăng nguy hiểm trong tỷ lệ tái phân bổ, từ chối đơn xin và tình trạng quá tuổi.

In one of the most exciting updates in our advocacy since the reinstatement of the EB-5 program, AIIA held a meeting with the Citizenship and Immigrant Services Ombudsman (CISOMB) to discuss some of the most pressing issues facing EB-5 investors. On October 5th, 2023 our team met directly with these officials, and we can proudly announce that nearly a week later, we are already seeing results: USCIS has now updated their policy on sustainment and good faith investor protections. We are floored that the CISOMB team actively listened to our calls for action and the stories of our community – but our work is far from over. While we celebrate this win, we are keenly aware of the massive work still to come in our fight for EB-5 investors, especially those that invested before March 2022.

The sustainment period, and subsequently, redeployment, are still huge issues, and the majority of EB-5 investors will still be subjected to them until congress can pass a new law for pre-RIA sustainment. However, this meeting is a great foundation for us to use for future advocacy, and we are dedicated to an ongoing engagement with the CISOMB regarding this and other issues prevalent in the program.

Our Meeting with the CIS Ombudsman

The CIS Ombudsman (commonly referred to as the CISOMB) is an officer of the Department of Homeland Security (DHS), who is responsible for acting as a “liaison between the public and USCIS.” The office is primarily tasked with helping individuals resolve casework issues with the agency, but also for holding meetings with the public and special interest groups and making non-policy orientated recommendations to USCIS officials. The main goal of their office is to improve USCIS operations and efficiency. This makes the CISOMB the perfect team to hear some of the most pressing issues faced by EB-5 investors from across the world from the source.

This is the first time that an EB-5 investor group has met with the CISOMB. Previously, only EB-5 industry groups had met with the CISOMB to discuss issues faced by their members in the EB-5 program. Clearly, this approach leaves all EB-5 investors – the majority of stakeholders impacted by the EB-5 program – out of the conversation surrounding the fate of their immigration and investment. The meeting was crucial for this reason, as AIIA would be working alongside all other major stakeholders involved in administering the EB-5 program.

Prior to the call, we asked our community to send us the biggest issues they were facing with their EB-5 process to integrate into our agenda. We received an outpouring number of messages from investors, and we gathered those to focus on the issues we felt were most likely to be addressed by CISOMB. Thank you to those who contacted us.

Issue 1: Lack of Transparency regarding I-526 and I-526E petition inventories

Lack of transparency by USCIS about incoming EB-5 demand has already facilitated devastating backlogs in the legacy 5th unreserved visa category. For example, the July 2023 Visa Bulletin has a final action date of September 8, 2015 for China mainland-born petitioners in the unreserved category. This means Chinese EB-5 applicants who invested and filed their I-526 before September 2015 are only now receiving conditional green cards, eight years after investing. Some risk waiting for many more years. We believe that expectations regarding the visa wait time could be controlled had USCIS published country-specific I-526 receipt data or provided stakeholders with an indication of the then-current petition inventory held at IPO.

As a ‘by investor for investor’ organization, we do not want history to repeat itself. Therefore, we raised the issue of the lack of transparency surrounding the current petition inventory at USCIS. Without any transparency from USCIS, unreserved EB-5 investors entered a queue of unknown length, received priority dates of unknown value, and are still waiting years later to reach the end of the queue and claim the visas that incentivized their investment.

USCIS risks oversubscription to the new set-aside categories without a public disclosure of the incoming petition count held at IPO. Oversubscription would mean each category accumulating massive wait times due to the small number of visas offered in each, in which case, oversubscribed countries would suffer through the same excruciating backlog endured by the unreserved category’s petitioners.

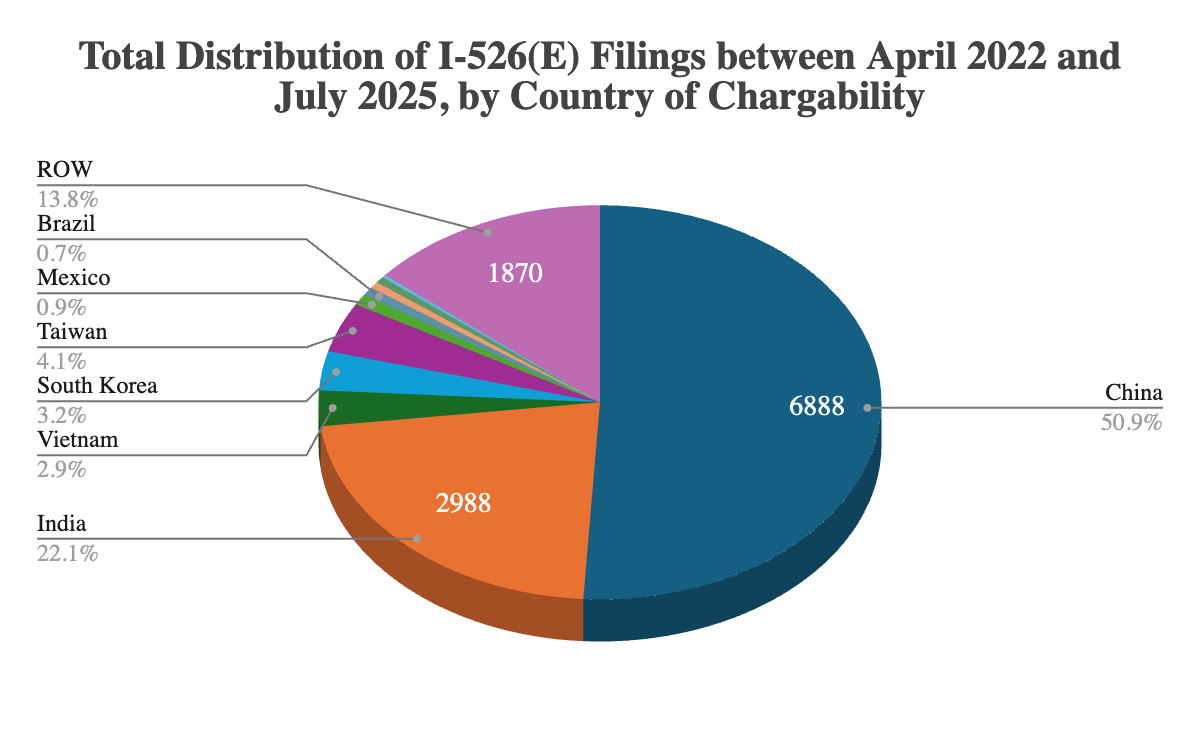

We stressed the importance of inventory transparency for current and prospective investors who may invest in these categories, and also for professionals who are advising their clients on the path forward. We recently received data from our FOIA request for the number of petitions received by the IPO in the set-aside categories. While this data is helpful, the information gap between April and October 2023 doesn’t allow for investors to have the most up to date information necessary to make an informed decision about their immigration. To their credit, CISOMB requested a copy of our FOIA request to understand the level of detail required from the data and the possibility of regular public releases of future datasets.

Issue 2: Processing Delays and Lack of Receipt Issuance

It is clear that USCIS has struggled with its internal efficiency for the past eight years, as EB-5 immigrants have watched their petitions remain stagnant at the IPO. Additionally, the passage of the Reform and Integrity Act (RIA), alongside all new immigration and registration forms, adds heaps of administrative responsibilities on USCIS’s plate. However, this also means there is a backlog of processing delays continuing to accumulate after the program’s lapse even prior to the pandemic. USCIS will have to address the delays in tandem with the administrative workload from the RIA. The main delays we discussed with the CISOMB include:

- Delays in issuing of I-526E and I-956F receipt notices

- Approval of I-526s without concurrent approval of I-485s

- Delay in transferring files from IPO to the National Visa Center

- Delays in adjudicating I-131s (application for Advance Parole) and erroneous issuance of I-512L (Advance Parole documents)

- Outstanding delays in I-829 adjudications

- Non issuance of I-956K receipts for foreign intermediaries and immigration agents

Many of these issues were brought to our attention by our industry partners and immigrant investor community. Although we focused on some issues, such as I-829 adjudication, more than others, each one of these delays harms immigrant investors and are likely to cause issues in both their immigration and investment processes.

Issue 3: The Sustainment Period and Redeployment

Up until this month, USCIS had refused to clarify the start date of an investor’s sustainment period for immigrants investing after March 2022. As a result, the mystery surrounding the definition of a sustainment period caused EB-5 investors to fear for their investment. This issue became even more contentious between the EB-5 industry, which makes hefty profits off of the cycle of redeployment, and the EB-5 investor community, which bears the entire burden of an extensive sustainment period.

At AIIA, we have vehemently stood against the practice of redeployment (and the underlying sustainment period issue) which we believe is unfair to all EB-5 investors. If the definition of the sustainment period remained unchanged – meaning the investor would only be eligible to be repaid after their conditional green card period – then the investors are at high risk of having their money redeployed or reinvested into other projects, often without consent.

The CISOMB recognized the contentious nature of this issue and was interested in learning more about the real-life implications of the sustainment period. The RIA provided a perfect opportunity to protect EB-5 investors by defining the time period in which sustainment takes place, and the CISOMB team seemed to understand the harm caused by USCIS’s lack of clarity. Additionally, the team understood that USCIS was faced with a time crunch, as the first I-526E was approved by the agency very recently, and it is only a matter of time before that investor receives their conditional green card.

It would seem that all of our work on this matter has paid off, as USCIS’s newest guidance that was released a week after our meeting with them holds promise for eliminating the need for redeployment, for good.

Issue 4: Arbitrary denials on Path of Funds

Sources of funds are routinely being re-examined by IPO adjudicators at the I-829 stage, forgoing deference to I-526 adjudications of the same source of funds. This is particularly true for immigrants from countries with exchange controls, such as Vietnam and China. We find that despite the source of funds being approved on an I-526 petition, the same source of funds is denied after being reexamined by I-829 adjudicators. Much of this is related to the use of “third party exchangers” or “currency swaps”.

There have been over 30 years of precedence for investors using third-party exchangers not affiliated with traditional banks for currency exchanges. The agency refers to these exchanges as “informal value transfers” or IVTs. Given that these transfers are predominantly formal, we reject the labeling of these exchanges as informal or having any association with “hawala”. However, third party currency transfers usually transpire when an individual gives their foreign currency equivalent funds in local currency to a registered money service business (MSB) through a formal contract. The MSB will usually then wire the EB-5 investment on the investor’s behalf from a U.S. bank account, which is not titled in the investor’s name and held outside the territory of a currency-controlled country.

With no public regulatory or policy changes, USCIS began denying EB-5 petitions with materially identical facts to those adjudicated years prior. Furthermore, denials related to source of funds issues skyrocketed for EB-5 investors without any warning, especially those from exchange controlled countries.

It is not clear how USCIS distinguishes lawful and unlawful exchangers, and there is no public policy regarding the use of IVTs and currency swaps in USCIS’s policy manual. Even in USCIS’s recent FOIA response to us, the definition of licensed and unlicensed exchangers were redacted throughout. Without USCIS clarity on the distinguishing factors between each type of exchanger, nor a public release regarding the updated policy of currency swap/IVT usage, EB-5 investors will continue to use these services without knowing if they are disqualifying themselves from the EB-5 program.

We stressed these issues to the CISOMB team, specifically on USCIS’s lack of transparency regarding its policy change on currency swaps. We also highlighted a number of recently adjudicated cases that had all used one specific MSB to transfer funds out of Vietnam. All of them had been arbitrarily denied due to path of funds issues for using the same MSB for exchange purposes. Yet, for years, EB-5 stakeholders have used funds from that particular exchanger to facilitate approvals on their source of funds. We hope that the Ombudsman’s office will encourage the agency to provide clear guidance regarding what evidence is required to demonstrate a lawful transfer of funds.

Issue 5: Child Status Protection Act and “Aging Out”

Trong USCIS’s policy manual, an applicant’s child can only benefit from the Child Status Protection Act’s (CSPA) age protections when the child’s parents satisfy the “seek to acquire” requirement within one year of a visa becoming available to them.

One of the main events which qualifies as “seeking to acquire” for EB-5 immigrants is paying the immigrant fee levied on their adjustment of status or consular processing paperwork. After paying this fee, the child’s age is frozen until a visa is issued to the child. However, if an approved I-526 is not sent to NVC for over a year and no fee bill is levied, the “seek to acquire” requirement cannot be satisfied by the petitioners. The child could age out before the main petitioners are even issued a fee bill by the NVC. The delay in sending these documents has huge implications for individual investors who risk family separation and are disincentivized from using the program because of this risk.

Additionally, there is a large debate in the legal community on whether a U.S.-based immigrant petitioner fulfills the “seek to acquire” requirement if they concurrently file an I-485 with their I-526/I-526E. If the filing fee is paid upon filing the I-485 with the I-526/I-526E, are the children included on the petition protected until visa issuance? Is this the case even if a visa is not available when concurrently filing?

Furthermore, the Department of State and USCIS have separate and incompatible interpretations of what constitutes “visa availability”. At AIIA, we favor USCIS’s current interpretation of visa availability, because it offers immigrants a greater opportunity to protect their children listed on their immigration petition. We explained to CISOMB how this lack of a uniform definition will cause issues in the EB-5 program in the future.

Issue 6: Form I-829 delays and stamping

It is common knowledge that USCIS has not been processing the I-829s at an acceptable rate. While Congress has mandated that adjudications of I-829 must take place within 90 days or less, the adjudication often takes several years for most investors. This delay is so long that USCIS now is providing immigrants evidence of an extension of status for 48 months after the expiry of the conditional green card, which is a welcome adjustment for those who are struggling for expired I-829 status, but a temporary and fragile solution at best.

An in-person appointment at a local USCIS service center is required for EB-5 investors if they wish to extend their conditional residency even though other immigrant visa petitioners are eligible for such extension stamps to be mailed to their registered address with USCIS. We shared with CISOMB how much of a pain it is for immigrants to be traveling around the world with expired green cards and I-797 notices, and the unequal treatment between EB-5 and other EB visa applicants.

Action from USCIS

In a welcome surprise, less than a week after our meeting, USCIS released new guidance surrounding the sustainment period and “good faith investor” protections. This update was brought about by the CISOMB team following our presentation, and we celebrate the collaboration between AIIA and USCIS to make change for EB-5 investors.

USCIS has now clarified that the Reform and Integrity Act “removed the requirement that the investor must sustain their investment throughout their conditional residence.” Previously, investors had to keep their funds invested until after filing the I-829, so as to comply with the informal interpretation of the sustainment period that coincided with the conditional residence period. Now, post-RIA investors (EB-5 petitioners who filed after March 15th, 2022) only need to keep their investment sustained for at least two years and the job creation requirements have been met for their project. Furthermore, the sustainment period has now been defined as starting on “the date the investment was contributed to the new commercial enterprise (NCE) and placed at risk in accordance with applicable requirements, including being made available to the job-creating entity”. This means that as soon as the investor contributes the total investment amount to the NCE, the two year clock begins before they will be eligible to withdraw their funds.

“Good faith investor” protections, which protect investors associated with terminated regional centers, have been extended to include pre-RIA investors- something the RIA did not do. This is another huge win, but requires further analysis from legal professionals to fully understand how these protections will be implemented in practice.

Our next goal is to convince the CISOMB to recommend extending sustainment period regulations to pre-RIA investors, as the majority of investors who are affected by the sustainment period are not affected by the new guidance. Although we are disappointed that the new guidance regarding sustainment does not include pre-RIA investors, the principles USCIS employed to implement these rules are the same for pre-RIA investors. We believe this is a strong foundation for us to push for extension of the two-year sustainment period to pre-RIA investors. We are also grateful that USCIS has demonstrated their willingness towards relieving EB-5 investors of some of the financial and bureaucratic burdens they currently bear.

Next steps

AIIA will be seeking out further collaboration with the CISOMB office to resolve outstanding issues mentioned on our call and other priorities brought forth by our investor community. As of now, we have provided the CISOMB with copies of our FOIA requests, exemplary cases of denied I-829s, and informal receipt notices issued by USCIS.

We are incredibly grateful for all investors, attorneys, and others who have come forward to support us, tell their stories, and donate towards our cause. We could not have reached this point without the support of our dedicated community, and we are grateful for the growth in our community this past year.

A special thank you to the CISOMB office, especially Gary Merson and Fred Troncone, for their perceptive questions and dedication to seeking a common resolution. The EB-5 investor community is grateful for the relief this guidance has given to immigrant investors from across the globe.

Stay tuned for more updates about our advocacy campaign and our ongoing conversations with the CISOMB and USCIS officials. If you would like to join our community and get involved, consider signing up for our e-list, making a donation to our cause, hoặc Trở thành thành viên for exclusive access to our FOIA requests and more.

Hãy để lại bình luận của bạn

Phản hồi (3)

Bài viết liên quan

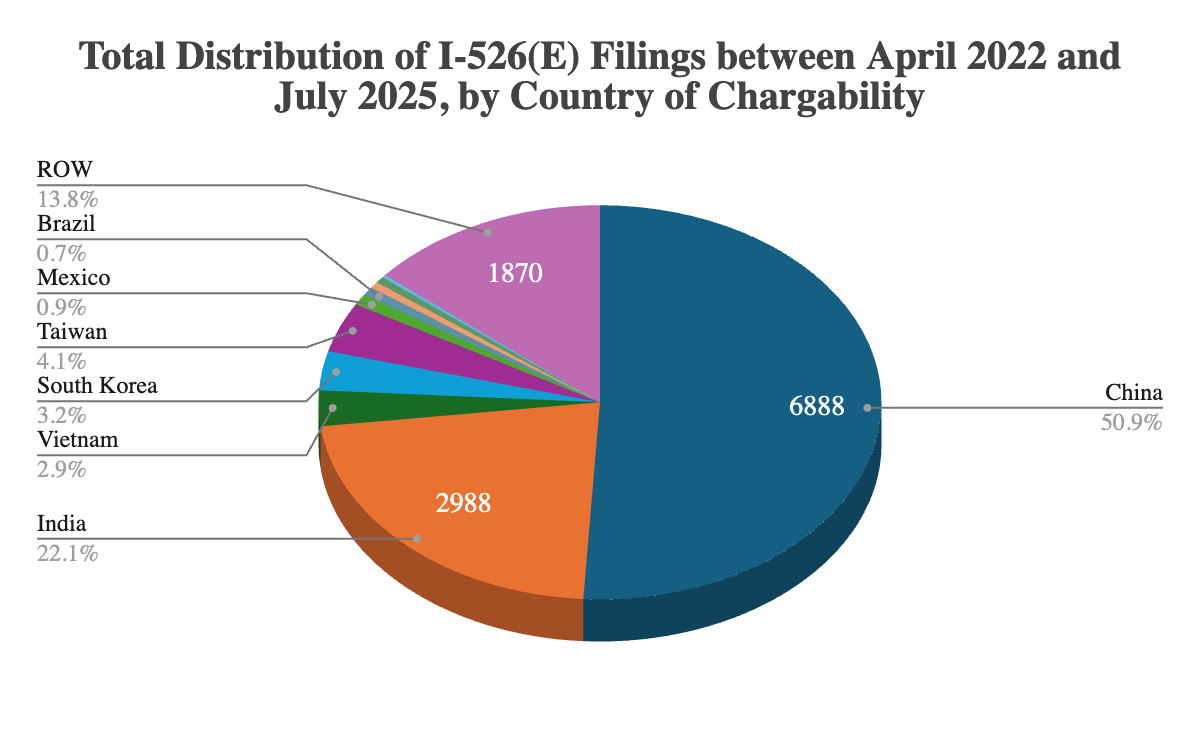

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

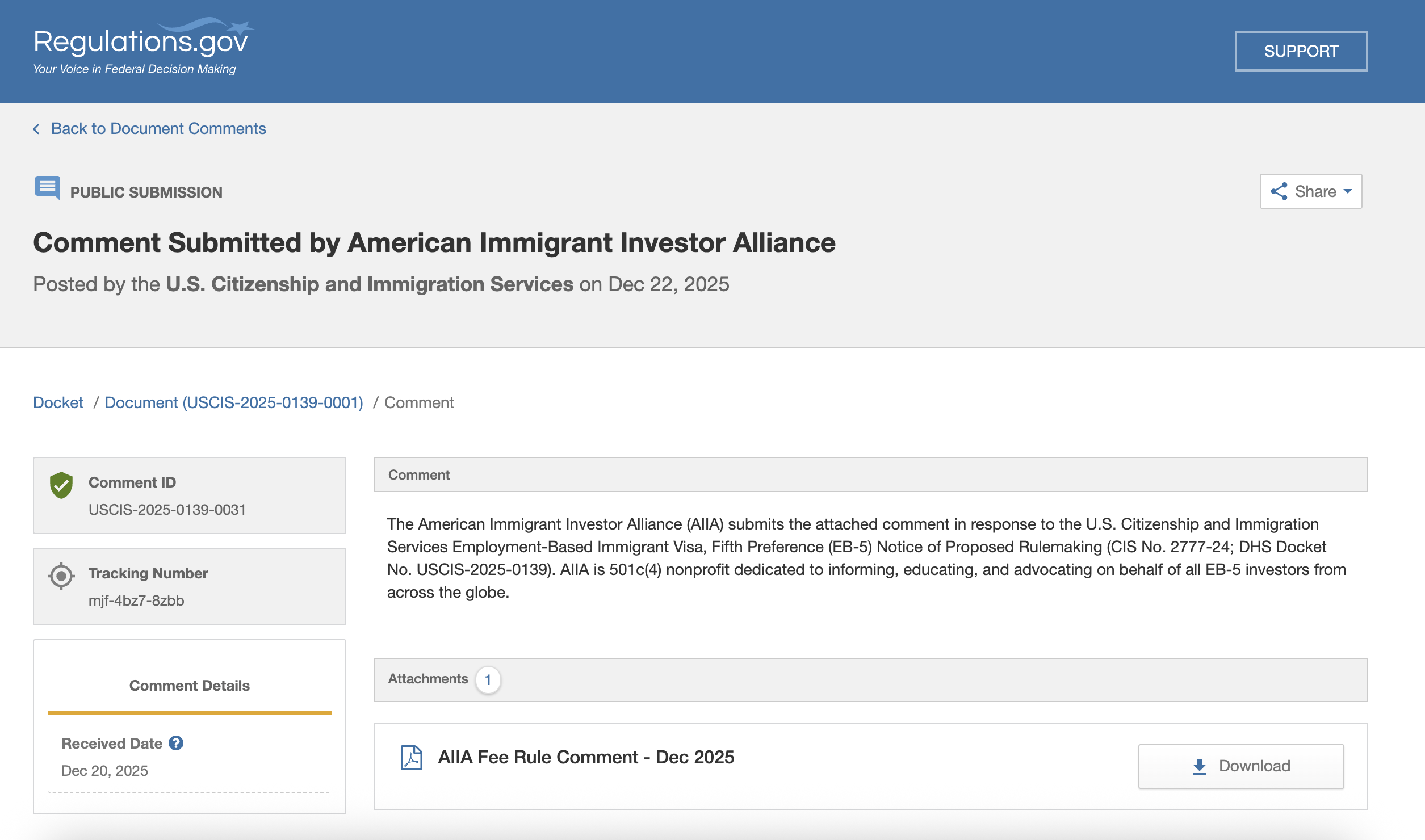

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

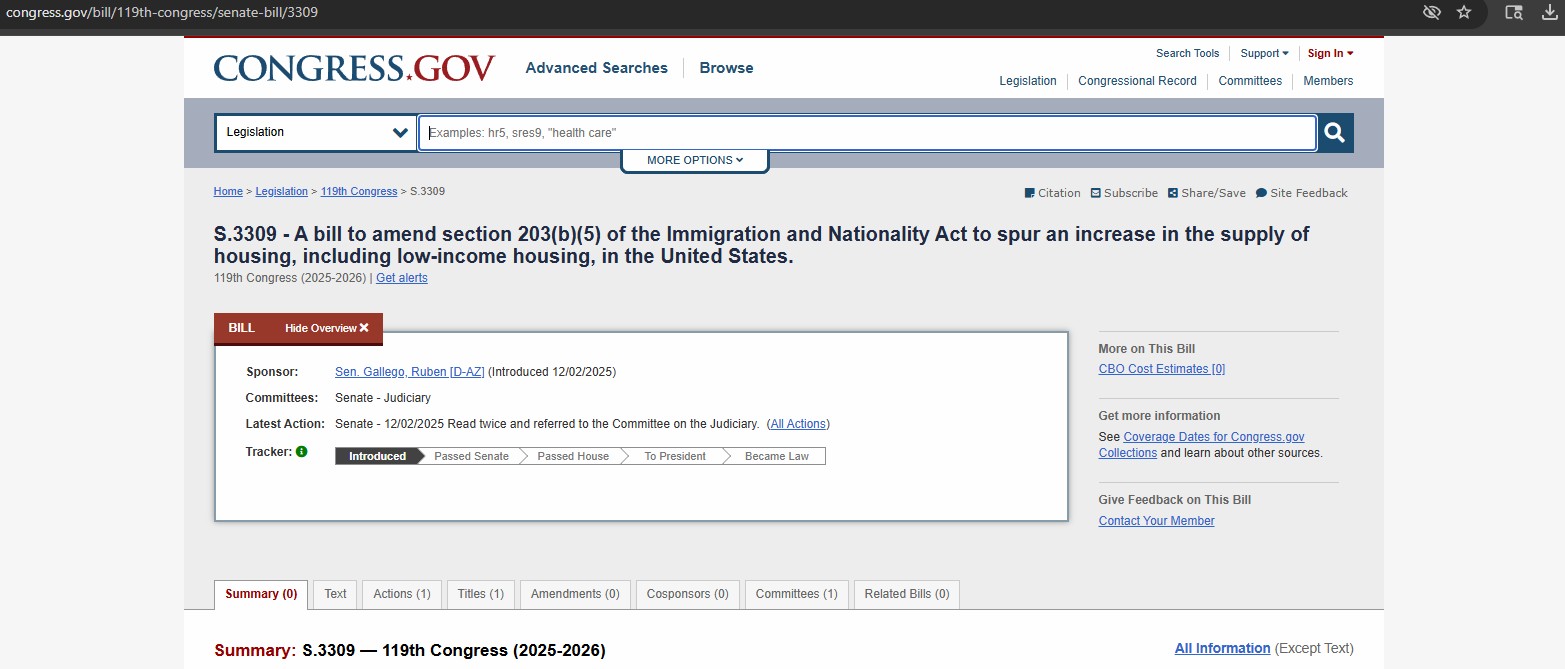

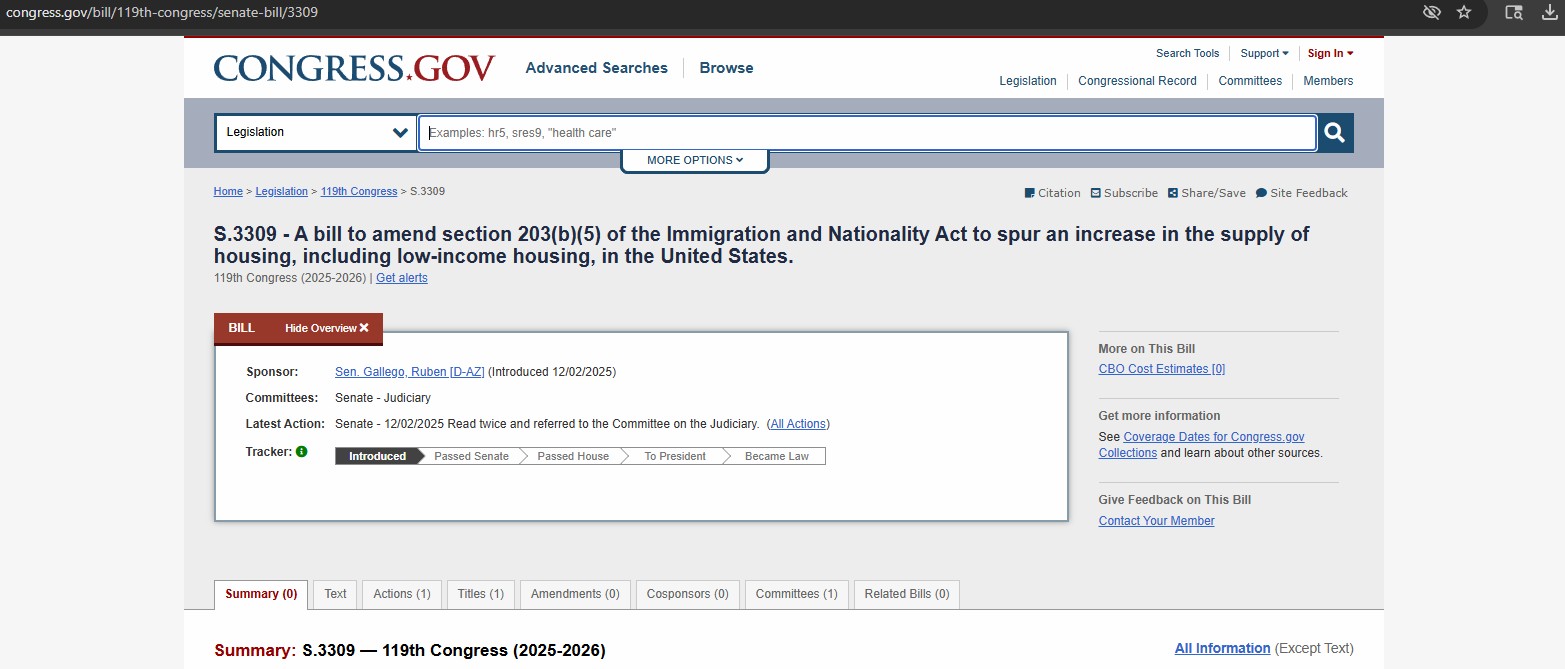

Chúng tôi xin chúc mừng Thượng nghị sĩ Gallego về dự luật mới tận dụng Chương trình EB-5 để xây dựng nhà ở giá rẻ.

Chúng tôi đã thắng kiện vụ kiện về việc tăng phí EB-5.

Cập nhật thông tin mới nhất từ AIIA

Đăng ký nhận bản tin của chúng tôi để cập nhật thông tin mới nhất về chương trình EB-5.

Bằng cách đăng ký, bạn đồng ý với Chính sách Bảo mật của chúng tôi và đồng ý nhận các cập nhật từ công ty chúng tôi.

Nguồn tài liệu được khuyến nghị

Cách tìm một luật sư giỏi về tranh tụng EB-5

Chọn một luật sư có kinh nghiệm về EB-5 và tranh tụng, người có tổ chức, chú trọng đến chi tiết và tránh đưa ra các cam kết. Bạn có thể cần một...

Đọc thêm

Vấn đề về việc hết hạn tuổi trong chương trình EB-5

Luật Bảo vệ Tuổi của Trẻ em (CSPA) giúp giữ nguyên tuổi của trẻ em trong các đơn xin visa EB-5, nhưng tình trạng ùn tắc visa kéo dài vẫn tiềm ẩn rủi ro...

Đọc thêm

Việc bán các đợt chào bán chứng khoán EB-5

Bán chứng khoán EB-5 thường sử dụng các quy định miễn trừ theo Quy định D (nhà đầu tư Mỹ) và Quy định S (nhà đầu tư nước ngoài) để tránh đăng ký với Ủy ban Chứng khoán và Giao dịch Hoa Kỳ (SEC) trong khi...

Đọc thêmBài viết mới nhất trên blog

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

Tìm hiểu thêm

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

Tìm hiểu thêm

Chúng tôi xin chúc mừng Thượng nghị sĩ Gallego về dự luật mới tận dụng Chương trình EB-5 để xây dựng nhà ở giá rẻ.

Dự luật EB-5 của Thượng nghị sĩ Gallego huy động vốn nước ngoài để xây dựng nhà ở giá rẻ. Sự hợp tác này đã củng cố mối quan hệ và uy tín của AIIA với Quốc hội...

Tìm hiểu thêm

Chúng tôi đã thắng kiện vụ kiện về việc tăng phí EB-5.

AIIA đã thắng kiện thành công trong vụ kiện chống lại việc tăng phí EB-5 của USCIS vào tháng 4 năm 2024, với phán quyết của một thẩm phán liên bang rằng cơ quan này...

Tìm hiểu thêmLiên hệ với chúng tôi

Nếu quý vị có bất kỳ câu hỏi, thắc mắc hoặc đề xuất hợp tác nào, xin vui lòng liên hệ với chúng tôi mà không ngần ngại.

Just as USCIS can only abide by the statute in its recent “clarification” of the new RIA rule as to post-RIA investors, it is equally bound by the statute in continuing to enforce the old sustainment requirement (to end of conditional residence) for pre-RIA investors, because RIA specifically says that the rules in effect at time of I-526 filing govern. Only Congress could change that, and there might be problems about retroactive effect on NCEs and JCEs if Congress tried.

I have a I 131 aplication approved and produced on 16th June ’23 and it has not been mailed to my address yet. I have written to USCIS E request and to the USCIS California centre.Please suggest if I should reach out to the CIS Ombudsman or get in touch with a USCIS field office.If yes please send me the email id of the CIS. I am based in Boston. Many thanks

@Robert Divine – USCIS is also supposed to abide by the rule to process applications in less than 180 days, so the point can be made from an administrative justice perspective that investors have more than fulfilled the investment period after 4+ years of I-526 adjudication time. USCIS cannot pick and choose which statutes to abide by.