Dự án FOIA của AIIA: Cập nhật thống kê kho hàng I-526E cho tháng 1 năm 2025

27 tháng 4 năm 2025

Dữ liệu FOIA của USCIS do AIIA thu thập cho thấy nhu cầu EB-5 sau RIA vượt xa giới hạn visa hàng năm—khoảng 10 lần đối với khu vực có tỷ lệ thất nghiệp cao và 4 lần đối với khu vực nông thôn—gây ra thời gian chờ đợi tiềm năng kéo dài, đặc biệt là đối với Trung Quốc và Ấn Độ. Chúng tôi kêu gọi quý vị xem xét đóng góp để duy trì các vụ kiện FOIA và hoạt động vận động cho tính minh bạch của nhà đầu tư.

Nền tảng: Trong khuôn khổ sứ mệnh bảo vệ quyền lợi cho các nhà đầu tư EB-5, AIIA thường xuyên nộp đơn yêu cầu theo Đạo luật Tự do Thông tin (FOIA) để thu thập thông tin từ USCIS về các vấn đề ảnh hưởng đến cộng đồng nhà đầu tư di trú EB-5. Do USCIS không cung cấp phản hồi kịp thời cho các yêu cầu FOIA, AIIA thường xuyên khởi kiện chống lại họ để buộc cơ quan này phải phản hồi. Trả lời cho vụ kiện gần đây của chúng tôi, USCIS đã cung cấp cho chúng tôi dữ liệu về việc nộp đơn, chấp thuận và từ chối đối với các nhà đầu tư sau RIA tính đến tháng 1 năm 2025. Đây là bộ dữ liệu quan trọng giúp các nhà đầu tư di trú xác định thời gian chờ đợi để nhận thẻ xanh. Chúng tôi đề nghị quý vị xem xét quyên góp Để giúp chúng tôi tiếp tục thực hiện các nỗ lực này. Các thành viên AIIA có thể yêu cầu bản sao đầy đủ của các phản hồi của chính phủ đối với các yêu cầu FOIA của AIIA bằng cách liên hệ với chúng tôi qua trang web của chúng tôi. Biểu mẫu liên hệ. AIIA xin chân thành cảm ơn Alexandra George của Văn phòng Luật sư Galati để dẫn dắt nỗ lực kiện tụng theo Đạo luật Tự do Thông tin (FOIA) chống lại USCIS nhằm thu thập dữ liệu này.

(Độc giả từ Trung Quốc có thể truy cập bản dịch bài viết này trên tài khoản WeChat của AIIA qua liên kết sau: https://mp.weixin.qq.com/s/sByvBRo5uKSdhuN9GJ2t8Q)

Chúng tôi đã từng báo cáo dữ liệu chính thức mà chúng tôi nhận được từ USCIS thông qua việc nộp nhiều đơn kiện chống lại cơ quan này. Điều này bao gồm dữ liệu chi tiết về các đơn I-526 và I-526E đã được tiếp nhận từ Tháng 4 năm 2023, Tháng 11 năm 2023 và Tháng 7 năm 2024. USCIS đã cung cấp cho AIIA một báo cáo đến ngày 31 tháng 1 năm 2025, với dữ liệu được tra cứu bởi Văn phòng Hiệu suất và Chất lượng của USCIS vào tháng 2 năm 2025. Dữ liệu cập nhật bao gồm phân phối các đơn I-526 và I-526E theo danh mục TEA và quốc gia chịu trách nhiệm, điều này rất quan trọng để hiểu tình trạng ùn tắc visa và ước tính thời gian chờ đợi trong các danh mục visa được dành riêng.

Dữ liệu do USCIS cung cấp cho AIIA là báo cáo I-526E sau RIA đầy đủ nhất cho đến nay vì (1) báo cáo cung cấp số lượng đơn được tiếp nhận theo tháng, điều này quan trọng để thể hiện xu hướng, và (2) báo cáo cung cấp dữ liệu mà USCIS đã tra cứu gần đây, vào tháng 2 năm 2025. Ngày truy vấn là quan trọng vì USCIS cần thời gian để nhập các đơn vào cơ sở dữ liệu. Báo cáo mà USCIS cung cấp cho AIIA cho biết tổng cộng có 9.878 đơn (tức là I-526 và I-526E) đã được nộp từ tháng 4 năm 2022 đến tháng 1 năm 2025.

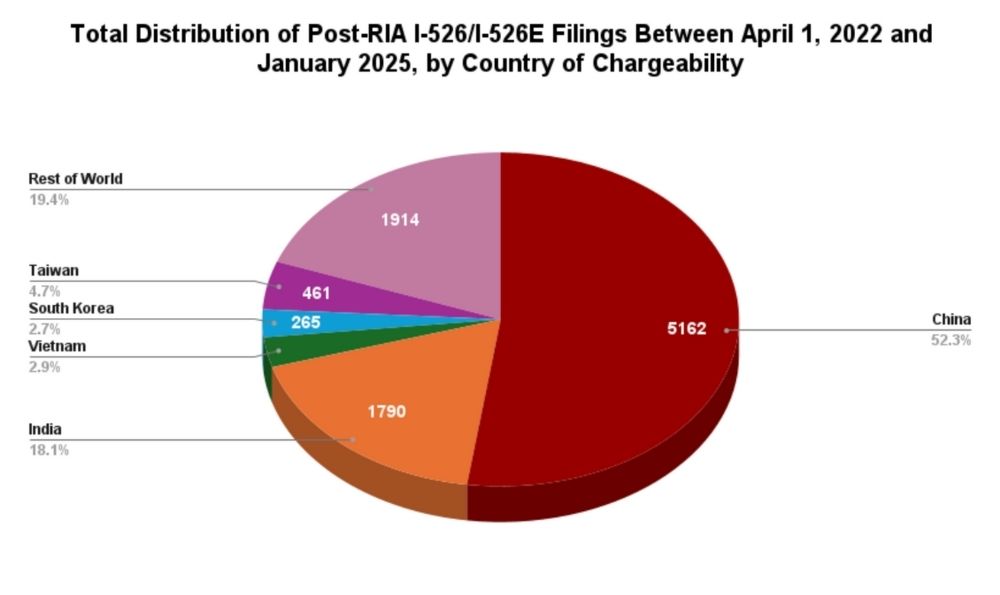

Tổng số đơn I-526/I-526E được nộp từ ngày 1 tháng 4 năm 2022 đến ngày 31 tháng 1 năm 2025 theo từng loại TEA và quốc gia chịu trách nhiệm (thống kê mới nhất dựa trên dữ liệu của USCIS được tra cứu vào tháng 2 năm 2025 theo yêu cầu FOIA của AIIA)

| Trung Quốc | Ấn Độ | Phần còn lại của thế giới | Tổng cộng | % Tổng cộng | |

| Nông thôn | 2,684 | 847 | 798 | 4,329 | 44% |

| Tỷ lệ thất nghiệp cao | 2,380 | 883 | 1,928 | 5,191 | 53% |

| Hạ tầng | 0% | ||||

| Khác | 98 | 60 | 200 | 358 | 4% |

| Tổng cộng | 5,162 | 1,790 | 2,926 | 9,878 | 100% |

| % Tổng cộng | 52% | 18% | 30% | 100% |

Đến cuối tháng 1 năm 2025, tổng cộng có 5.191 nhà đầu tư đã nộp đơn I-526/I-526E trong danh mục dành riêng cho khu vực có tỷ lệ thất nghiệp cao (HUA), và 4.329 nhà đầu tư đã nộp đơn trong danh mục khu vực nông thôn. Các con số này tương ứng với nhu cầu khoảng 10.400 visa HUA và 8.700 visa khu vực nông thôn (tính đến số lượng ước tính của các đơn xin visa phụ thuộc, như vợ/chồng và con cái, cũng như tỷ lệ từ chối). Các con số này vượt xa số lượng visa hàng năm theo quy định là 1.000 visa HUA và 2.000 visa khu vực nông thôn.

Xu hướng nhu cầu theo loại TEA

Xu hướng nộp đơn I-526/I-526E sau RIA trên toàn cầu, theo các danh mục dự trữ visa

Biểu đồ trên cho thấy các đơn kiến nghị từ khu vực nông thôn đã dần thu hẹp khoảng cách với các đơn kiến nghị từ HUA kể từ lần cập nhật gần nhất của chúng tôi. Tháng 7 năm 2024.

Xu hướng nhu cầu theo quốc gia

Xu hướng nộp đơn I-526/I-526E sau RIA trên toàn cầu, theo quốc gia về khả năng thay đổi cho danh mục HUA

Xu hướng nộp đơn I-526/I-526E sau RIA trên toàn cầu, theo quốc gia về tính linh hoạt cho hạng mục nông thôn

Xu hướng đơn kiến nghị trên toàn cầu đã bắt đầu ổn định sau sự biến động vào tháng 3 năm 2024 do việc tăng phí, với Trung Quốc đại lục và Ấn Độ đã khôi phục lại khối lượng đơn kiến nghị bình thường của mình trong những tháng gần đây. Các đơn kiến nghị được nộp bởi tất cả các quốc gia khác cũng duy trì mức độ mạnh mẽ sau tháng 3 năm 2024.

Trung Quốc Nông thôn so với HUA

Đơn xin I-526/I-526E từ Trung Quốc đại lục: So sánh giữa khu vực nông thôn và khu vực có tỷ lệ thất nghiệp cao

Ấn Độ Nông thôn vs HUA

Đơn xin I-526/I-526E từ Ấn Độ: So sánh giữa khu vực nông thôn và khu vực có tỷ lệ thất nghiệp cao

So sánh nhu cầu EB-5 tại các thị trường hàng đầu

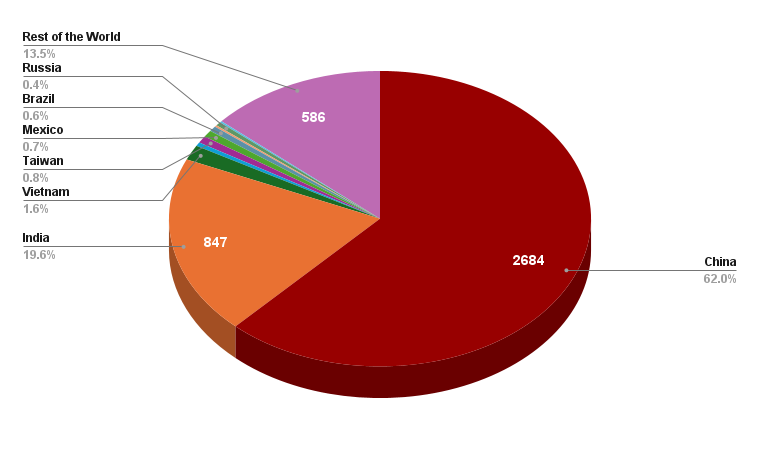

Phân phối hồ sơ I-526E cho hạng mục nông thôn (từ tháng 4 năm 2022 đến tháng 1 năm 2025)

Phân phối hồ sơ I-526E cho nhóm có tỷ lệ thất nghiệp cao (từ tháng 4 năm 2022 đến tháng 1 năm 2025)

Tỷ lệ đơn kiến nghị đến từ cả Trung Quốc đại lục và Ấn Độ trong cả hai nhóm "Nông thôn" và "Tỷ lệ thất nghiệp cao" đã duy trì ổn định kể từ lần công bố dữ liệu FOIA gần nhất.

Dữ liệu này có ý nghĩa gì đối với tình trạng ùn tắc visa không được công bố?

Tính đến tháng 1 năm 2025, nhu cầu về visa Thất nghiệp cao gấp 10 lần và visa Nông thôn gấp 4 lần so với số lượng visa được cấp hàng năm tương ứng.

| Tỷ lệ thất nghiệp cao | Nông thôn | |

| Đơn xin đầu tư thực tế I-526 / I-526E được nộp từ năm 2022 đến tháng 1 năm 2025. | 5,191 | 4,329 |

| Dự kiến nhu cầu visa trung bình cho mỗi đơn I-526/I-526E được nộp. | 2 | 2 |

| Dự báo nhu cầu visa trong ống dẫn tính đến tháng 1 năm 2025 | 10,382 | 8,658 |

| Nguồn cung cấp visa hàng năm cơ bản | 1,000 | 2,000 |

| Nhu cầu đường ống trên toàn cầu / Nguồn cung cấp visa hàng năm cơ bản | 10,4 x | 4,3 × |

Nếu visa được cấp theo nguyên tắc "đến trước, được phục vụ trước" (FIFO) mà không có giới hạn quốc gia, điều này có nghĩa là thời gian chờ đợi khoảng 10 năm đối với các nhà đầu tư có tỷ lệ thất nghiệp cao và 4 năm đối với các nhà đầu tư ở khu vực nông thôn có ngày ưu tiên sau tháng 1 năm 2025. Do có giới hạn quốc gia trong việc phân bổ visa, thời gian chờ đợi thực tế có thể ngắn hơn nhiều đối với các nhà đầu tư mới từ "Các quốc gia khác" và dài hơn nhiều đối với các nhà đầu tư mới từ Trung Quốc đại lục và Ấn Độ.

Hãy lấy ví dụ về một nhà đầu tư Ấn Độ hiện nay đang xem xét đầu tư vào khu vực TEA. Anh ta có nên kỳ vọng phải chờ đợi từ 5 đến 10 năm hoặc lâu hơn để có được visa, xét đến số lượng nhà đầu tư ở khu vực nông thôn và có tỷ lệ thất nghiệp cao đã xếp hàng chờ đợi? Câu trả lời sẽ là “Có”, nếu các nhà đầu tư TEA chỉ có thể nhận được visa TEA. Tuy nhiên, một nhà đầu tư TEA cũng có thể... Chọn sau khi được phê duyệt I-526E để được cấp thị thực không giới hạn.. Danh mục Không giới hạn cũng có các đơn tồn đọng, nhưng các đơn tồn đọng trước RIA của danh mục Không giới hạn đối với người nộp đơn sinh ra tại Ấn Độ có thể được giải quyết. trong vòng 5 năm – có thể là visa có sẵn sớm nhất cho các nhà đầu tư sinh ra tại Ấn Độ vào năm 2025, bất kể họ chọn đầu tư vào khu vực nông thôn hay khu vực có tỷ lệ thất nghiệp cao (TEA). Nếu tồn đọng chưa được giải quyết của Trung Quốc trước RIA có thể Có thể được giải quyết trong khoảng 8 năm., thì danh mục Không giới hạn cũng có thể là phương án dự phòng cho các nhà đầu tư TEA sinh ra tại Trung Quốc. Tình trạng tồn đọng và thời gian chờ visa cho các nhà đầu tư TEA từ Trung Quốc và Ấn Độ cũng có thể được cải thiện nếu nhiều nhà đầu tư TEA từ các quốc gia khác chọn visa không giới hạn sau khi được phê duyệt I-526E. Ngược lại, nếu các nhà đầu tư TEA từ Trung Quốc và Ấn Độ thực sự bị giới hạn bởi các hạn ngạch của danh mục TEA và quốc gia, thì thời gian chờ sẽ vô cùng dài, vì nhu cầu visa từ Trung Quốc và Ấn Độ vượt xa 7% visa cho khu vực nông thôn và tỷ lệ thất nghiệp cao.

Tóm tắt

Những điểm nổi bật chính mà chúng ta có thể thấy từ bộ dữ liệu này là: 1) Nhu cầu về visa EB-5 đã tăng kể từ tháng 4 năm 2024, trong mọi nhóm TEA và mọi nhóm quốc gia; 2) Nhu cầu về visa TEA vùng nông thôn luôn cao hơn nhu cầu về visa TEA vùng có tỷ lệ thất nghiệp cao; và 3) Trung Quốc tiếp tục cho thấy mức tăng trưởng nhu cầu mạnh mẽ nhất. Bằng cách nghiên cứu Dữ liệu cấp thị thực hàng tháng Và thực tế là chỉ có 3% trong số các visa cho năm nay đã được cấp, rất có khả năng bản tin visa sẽ tiếp tục được cập nhật cho phần còn lại của năm. Chúng ta có thể đưa ra dự đoán này với một mức độ tin cậy nhất định, dựa trên thực tế là chỉ có 351 HUA và 1.126 đơn xin visa khu vực nông thôn đã được phê duyệt tính đến tháng 1 năm 2025. Chủ đề này sẽ được thảo luận chi tiết hơn trong một bài viết blog sắp tới.

Với tư cách là một tổ chức phi lợi nhuận, AIIA dành nhiều thời gian và nguồn lực để thu thập, phân tích và phổ biến dữ liệu này. Chúng tôi hoàn toàn phụ thuộc vào các khoản đóng góp để duy trì các hoạt động của mình, bao gồm tài trợ cho các vụ kiện theo Đạo luật Tự do Thông tin (FOIA), vận động chính sách và hoạt động hàng ngày. Chúng tôi kêu gọi bất kỳ ai đánh giá cao công việc của chúng tôi trong việc nâng cao tính minh bạch của Chương trình EB-5 hãy xem xét ủng hộ chúng tôi bằng cách Thực hiện một khoản đóng góp hoặc Phí thành viên. Sự ủng hộ của quý vị là vô cùng quan trọng để chúng tôi có thể tiếp tục thúc đẩy tính minh bạch và công bằng trong Chương trình EB-5, mang lại lợi ích cho cả nhà đầu tư và các chuyên gia trong ngành.

Bài viết liên quan

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

Chúng tôi xin chúc mừng Thượng nghị sĩ Gallego về dự luật mới tận dụng Chương trình EB-5 để xây dựng nhà ở giá rẻ.

Chúng tôi đã thắng kiện vụ kiện về việc tăng phí EB-5.

Cập nhật thông tin mới nhất từ AIIA

Đăng ký nhận bản tin của chúng tôi để cập nhật thông tin mới nhất về chương trình EB-5.

Bằng cách đăng ký, bạn đồng ý với Chính sách Bảo mật của chúng tôi và đồng ý nhận các cập nhật từ công ty chúng tôi.

Nguồn tài liệu được khuyến nghị

Vấn đề về việc hết hạn tuổi trong chương trình EB-5

Luật Bảo vệ Tuổi của Trẻ em (CSPA) giúp giữ nguyên tuổi của trẻ em trong các đơn xin visa EB-5, nhưng tình trạng ùn tắc visa kéo dài vẫn tiềm ẩn rủi ro...

Đọc thêm

Việc bán các đợt chào bán chứng khoán EB-5

Bán chứng khoán EB-5 thường sử dụng các quy định miễn trừ theo Quy định D (nhà đầu tư Mỹ) và Quy định S (nhà đầu tư nước ngoài) để tránh đăng ký với Ủy ban Chứng khoán và Giao dịch Hoa Kỳ (SEC) trong khi...

Đọc thêm

Lựa chọn giữa tài trợ EB-5 trực tiếp và thông qua Trung tâm Khu vực

Chương trình EB-5 trực tiếp dành cho các nhà đầu tư cá nhân tạo ra việc làm trực tiếp; Chương trình EB-5 Trung tâm Khu vực tập hợp nhiều nhà đầu tư, tính cả việc làm trực tiếp và gián tiếp cho...

Đọc thêmBài viết mới nhất trên blog

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

Tìm hiểu thêm

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

Tìm hiểu thêm

Chúng tôi xin chúc mừng Thượng nghị sĩ Gallego về dự luật mới tận dụng Chương trình EB-5 để xây dựng nhà ở giá rẻ.

Dự luật EB-5 của Thượng nghị sĩ Gallego huy động vốn nước ngoài để xây dựng nhà ở giá rẻ. Sự hợp tác này đã củng cố mối quan hệ và uy tín của AIIA với Quốc hội...

Tìm hiểu thêm

Chúng tôi đã thắng kiện vụ kiện về việc tăng phí EB-5.

AIIA đã thắng kiện thành công trong vụ kiện chống lại việc tăng phí EB-5 của USCIS vào tháng 4 năm 2024, với phán quyết của một thẩm phán liên bang rằng cơ quan này...

Tìm hiểu thêmLiên hệ với chúng tôi

Nếu quý vị có bất kỳ câu hỏi, thắc mắc hoặc đề xuất hợp tác nào, xin vui lòng liên hệ với chúng tôi mà không ngần ngại.

Phản hồi (0)