Nhà đầu tư EB-5 Quy trình đầu tư EB-5

Cấu trúc tài chính của dự án EB-5

Last Updated: Tháng mười hai 8, 2025

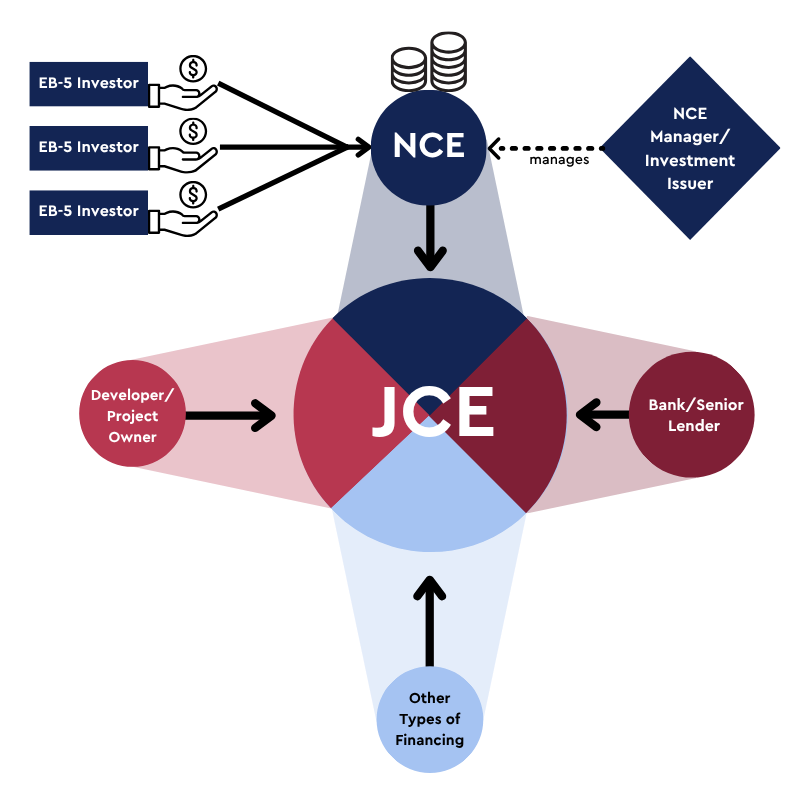

Regional Center (RC) projects are funded by multiple sources of capital outside of EB-5 investment capital. The hierarchy of parties funding a development project is called the Capital Stack. The order of the stack determines who is repaid first, who owns the business, and how much risk is taken on by each party.

Most RC offerings have a mix of financing sources, which can include equity from the developer, equity from private investors, EB-5 debt or equity, lenders like commercial banks or hedge funds, tax credits, federal, state, or local grants, and more. Each source holds varying collateral, return terms, and repayment priority.

The parties listed below are the most common sources comprising an EB-5 project’s capital stack.

Developer/Project Owner

The developer is the individual or corporation directly managing the project construction and operation. Developers are either independent from or directly tied to the New Commercial Enterprise (NCE) manager, in which case the affiliation will be disclosed in a project’s offering documents. The developer usually holds common equity in a Job Creating Entity (JCE) and will contribute cash equity or use assets as collateral for the Project. The Developer or project owner is also responsible for planning the project, measuring project feasibility, acquiring the necessary licenses/permits/certifications for construction and operation, and raising other financing required for the project All EB-5 funds raised are deployed for project development, pursuant to the business plan and terms outlined in the Private Placement Memorandum. Developers with common equity are always in the lowest priority of all creditors in the capital stack.

Banks or Lenders

Financing from banks, hedge funds, or other commercial lenders account for some portion of the sources of capital in most EB-5 projects. When a bank issues a loan for an EB-5 project, it is typically positioned in the senior, or first priority, position in the capital stack. When a bank holds a senior loan in a project, it will secure the loan with a mortgage or deed of trust with the developer, meaning that if the loan is not repaid, the property will be foreclosed by the bank.

Other types of financing

Developers and Banks constitute a large portion of financing in most EB-5 projects, but there are various other sources of funds. Private equity investors, other lenders, and in certain cases even federal, state, or local government(s) can provide funding to a EB-5 project.

Summary of Project Structure and Capitalization

This image summarizes the various sources of funds which constitute an EB-5 project offering and how EB-5 investors fit into the larger project ecosystem. Note that share of the capital stack is often disproportionately balanced between these sources of financing.

Đối với nhà đầu tư EB-5

Nhiều tài nguyên hơn

Logistics của Chương trình EB-5: Đầu tư trực tiếp so với Trung tâm Khu vực

Đầu tư EB-5 có hai loại: đầu tư trực tiếp và đầu tư qua trung tâm khu vực. Trung tâm khu vực tập hợp vốn và tính toán việc làm gián tiếp, trong khi đầu tư trực tiếp yêu cầu quản lý tích cực và chỉ tính toán việc làm trực tiếp.

Tìm hiểu thêm

Cơ bản về Chương trình EB-5

Đang cân nhắc đầu tư theo chương trình EB-5? Bắt đầu ngay tại đây!

Tìm hiểu thêmKhông thể tìm thấy tài nguyên phù hợp.

Sử dụng công cụ này trước để tìm nguồn tài nguyên EB-5 phù hợp nhất với nhu cầu của bạn.

Liên hệ với chúng tôi

Nếu quý vị có bất kỳ câu hỏi, thắc mắc hoặc đề xuất hợp tác nào, xin vui lòng liên hệ với chúng tôi mà không ngần ngại.