Developers Business Owners and Governments

Preparing a Project for EB-5

Guides and best practices for preparing your project for EB-5 financing

The process of raising capital from EB-5 investors starts with ensuring the venture is a good fit for EB-5 investment and is structured and executed appropriately. Ensuring the necessary steps are taken – with diligence, detail, and scrutiny from qualified professionals – will facilitate the greatest chance of success for both your project and your investors’ immigration.

Additionally, USCIS requires a straightforward yet heavily-detailed investment offering to be documented in a regional center’s annual filing (form I-956G) and in the project’s form I-956F.

Preparing a project for EB-5 is not just about the offering: it’s about demonstrating to USCIS your knowledge of the program’s requirements, a dedication to comply, and marketing said project with ethics and tact. Know that failure to adequately prepare an offering may hinder you from raising EB-5 capital or marketing your offering(s) both now, and in the future.

Before reviewing this section, we recommend reading EB-5 Basics (for investors) and Why EB-5 Financing (for project sponsors/developers) to cover the foundational knowledge of the EB-5 program.

Raising EB-5 capital requires proper structuring, detailed preparation, and compliance with USCIS requirements. Ethical marketing, trust, and a proven track record are critical for success. Start with EB-5 Basics and Why EB-5 Financing for foundational knowledge.

For Developers, Business Owners, and Governments

Resources For Preparing a Project for EB-5

Parties involved in creating an EB-5 investment offering

Successful EB-5 offerings require expert teams—immigration and securities attorneys, economists, business plan writers, fund administrators, and full-service NCE managers ensure compliance and efficiency.

Learn More

Choosing between Direct vs Regional Center EB-5 financing

Direct EB-5 suits single investors creating direct jobs; Regional Center EB-5 pools multiple investors, counting direct and indirect jobs for larger projects needing more capital.

Learn More

Meeting the Job Creation requirement

EB-5 projects must create 10 new full-time jobs per investor within two years, with regional centers allowing indirect jobs but requiring at least 10% direct jobs and a job cushion for safety.

Learn More

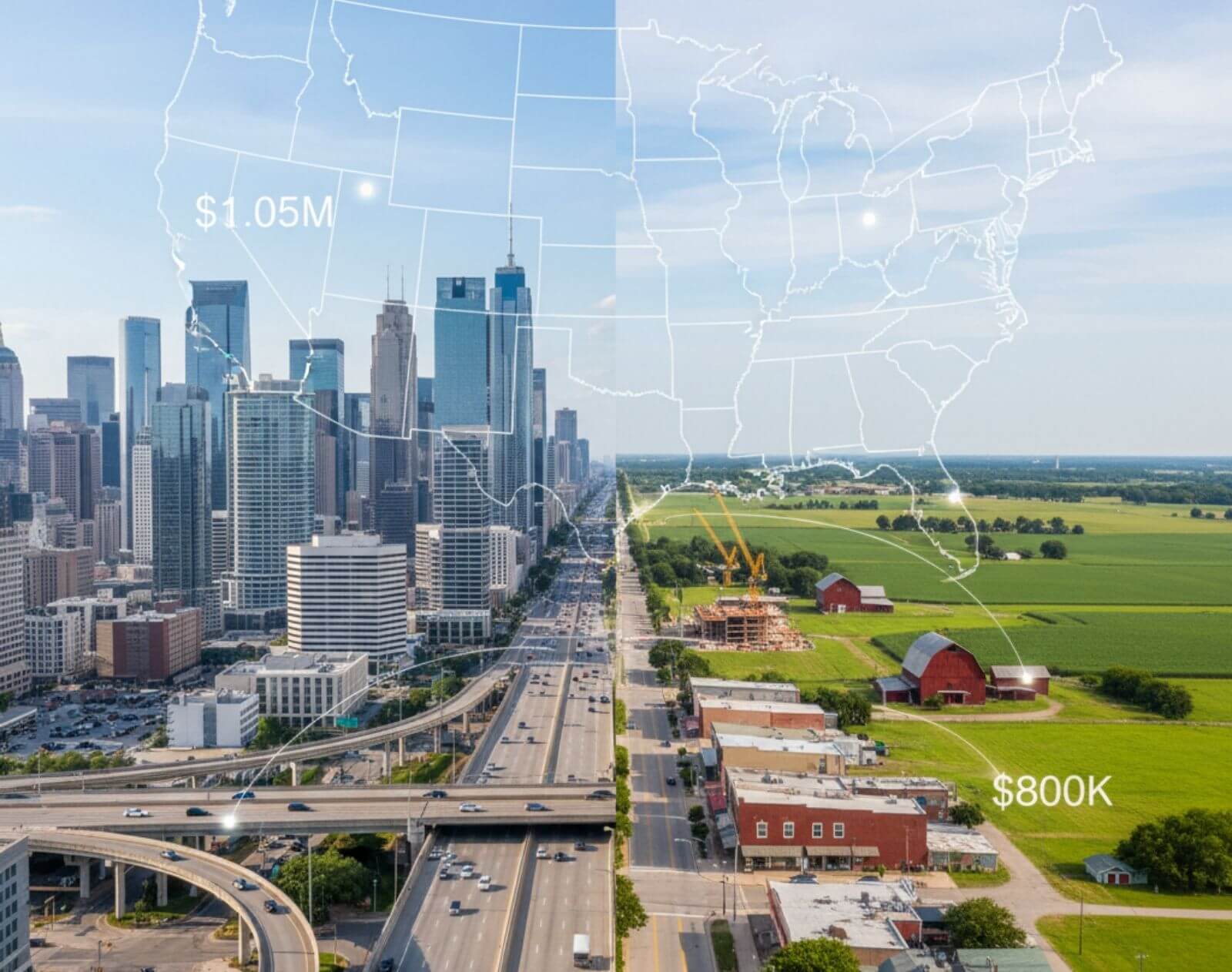

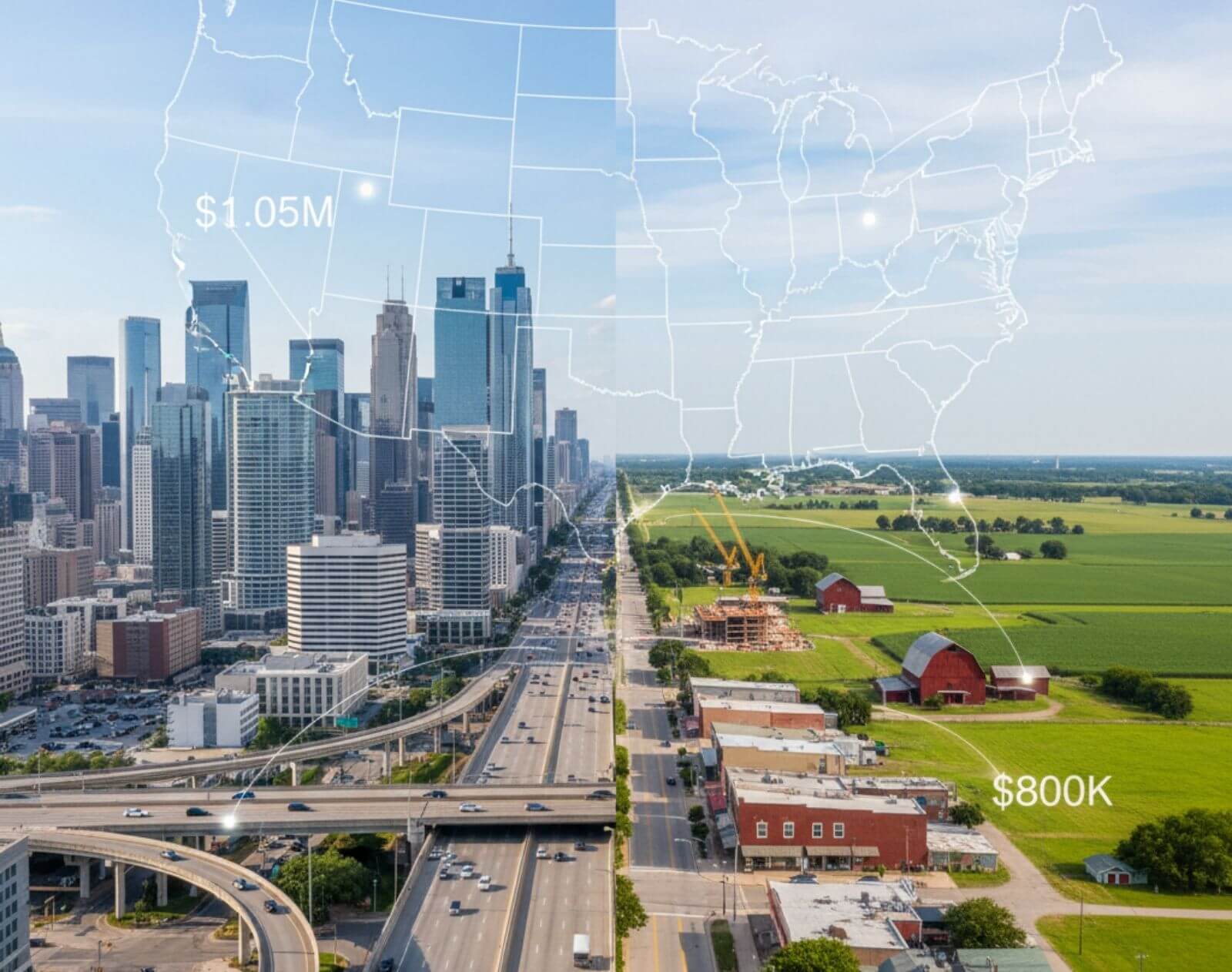

The EB-5 Investment Amounts, Targeted Employment Areas and Set Aside Categories

EB-5 investment minimums depend on location: $800K in TEAs, $1.05M elsewhere; visas are set aside for rural, high-unemployment, and infrastructure projects.

Learn More

Regional Center Project Operations

Developers can join or create regional centers via USCIS Form I-956, requiring due diligence, geographic scope, economic plans, annual fees, and strict management duties.

Learn More

Setup costs of an EB-5 Project

EB-5 project setup costs vary widely; regional centers incur higher fees for legal, economic reports, filings, marketing, and management compared to direct projects.

Learn More

Building an EB-5 Offering

Prepare your EB-5 team, business model, and capital plan; finalize economic impact reports, business plans, and Private Placement Memorandum compliant with USCIS and SEC rules.

Learn More

Structuring an EB-5 Regional Center Offering

EB-5 offerings require equity investment with no guarantees; structure capital stacks balancing investor risk preferences and include backup financing to enhance project viability and appeal.

Learn More

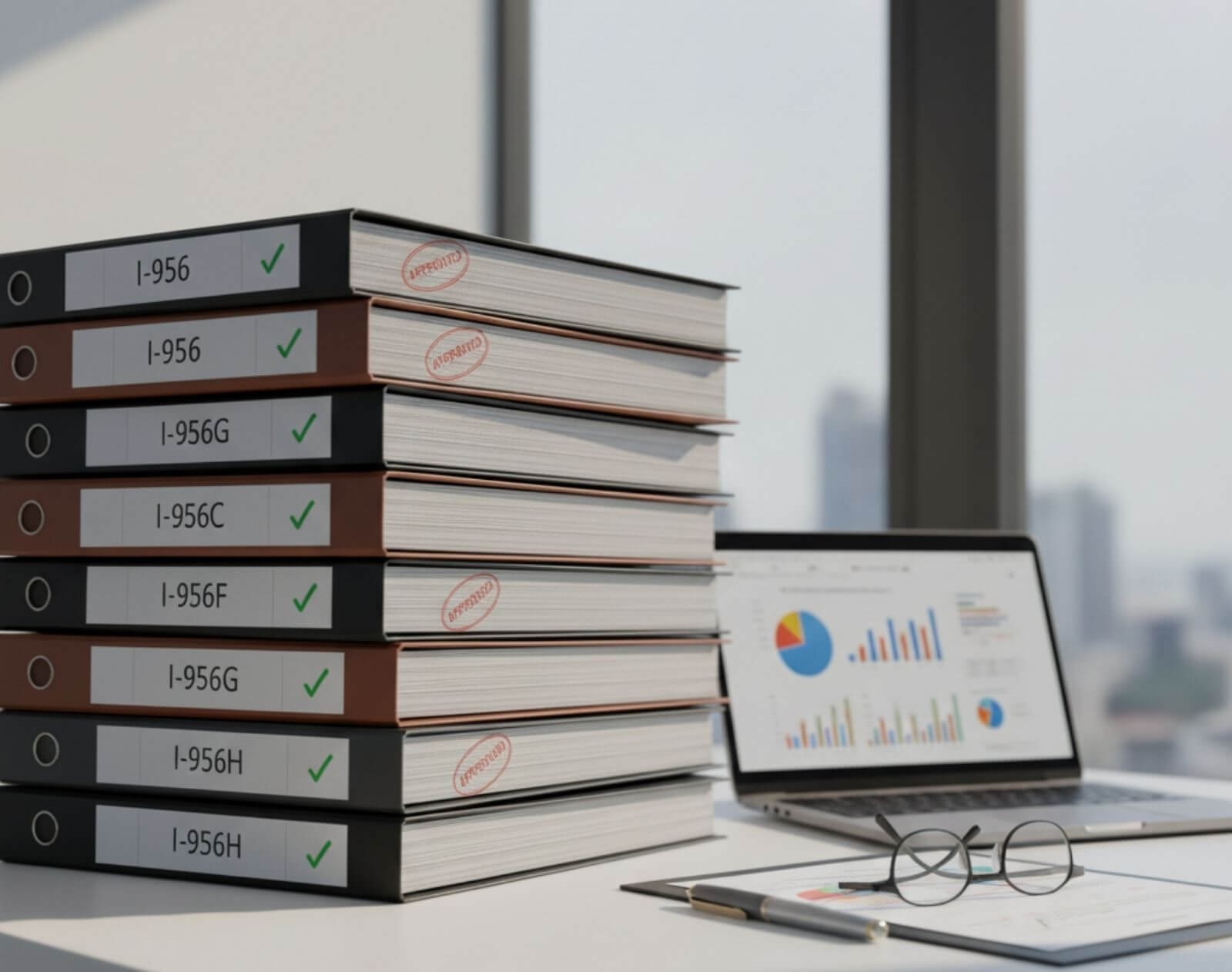

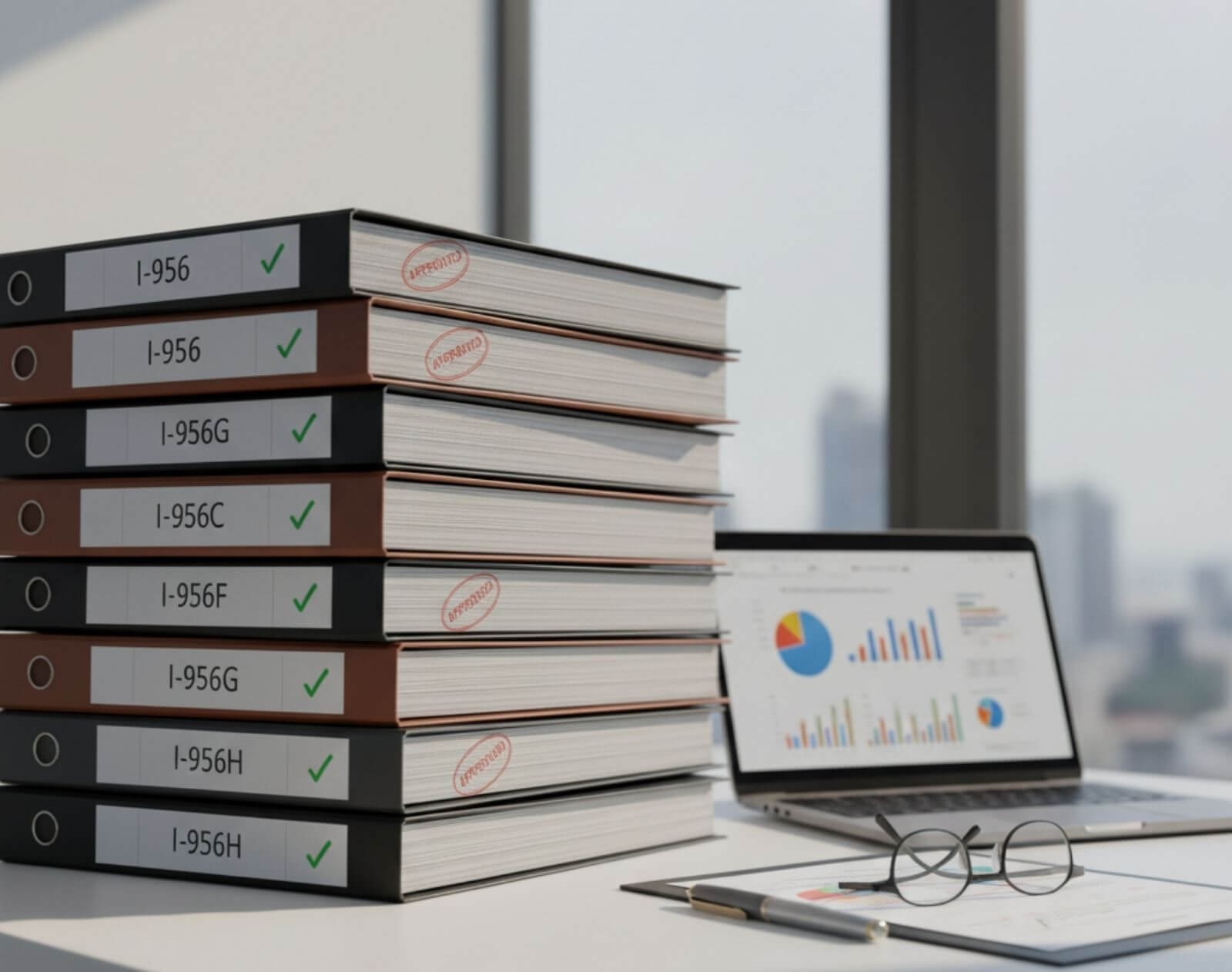

Navigating the EB-5 Paper Trail: Project Documentation and Compliance

Clear, compliant documentation and timely USCIS filings (various I-956s) are essential to avoid delays, ensure transparency, and maintain EB-5 regional center and investor compliance.

Learn More

Parties involved in creating an EB-5 investment offering

Successful EB-5 offerings require expert teams—immigration and securities attorneys, economists, business plan writers, fund administrators, and full-service NCE managers ensure compliance and efficiency.

Learn More

Choosing between Direct vs Regional Center EB-5 financing

Direct EB-5 suits single investors creating direct jobs; Regional Center EB-5 pools multiple investors, counting direct and indirect jobs for larger projects needing more capital.

Learn More

Meeting the Job Creation requirement

EB-5 projects must create 10 new full-time jobs per investor within two years, with regional centers allowing indirect jobs but requiring at least 10% direct jobs and a job cushion for safety.

Learn More

The EB-5 Investment Amounts, Targeted Employment Areas and Set Aside Categories

EB-5 investment minimums depend on location: $800K in TEAs, $1.05M elsewhere; visas are set aside for rural, high-unemployment, and infrastructure projects.

Learn More

Regional Center Project Operations

Developers can join or create regional centers via USCIS Form I-956, requiring due diligence, geographic scope, economic plans, annual fees, and strict management duties.

Learn More

Setup costs of an EB-5 Project

EB-5 project setup costs vary widely; regional centers incur higher fees for legal, economic reports, filings, marketing, and management compared to direct projects.

Learn More

Building an EB-5 Offering

Prepare your EB-5 team, business model, and capital plan; finalize economic impact reports, business plans, and Private Placement Memorandum compliant with USCIS and SEC rules.

Learn More

Structuring an EB-5 Regional Center Offering

EB-5 offerings require equity investment with no guarantees; structure capital stacks balancing investor risk preferences and include backup financing to enhance project viability and appeal.

Learn More

Navigating the EB-5 Paper Trail: Project Documentation and Compliance

Clear, compliant documentation and timely USCIS filings (various I-956s) are essential to avoid delays, ensure transparency, and maintain EB-5 regional center and investor compliance.

Learn MoreDirectory of Professionals

AIIA has curated a list of the top professionals from attorneys, investment specialists, to business plan writers to support all EB-5 stakeholders.

View Directory of ProfessionalsConnect With A Professional

AIIA has curated a list of the top professionals from attorneys, investment specialists, to business plan writers to support all all EB-5 stakeholders

For Developers, Business Owners, and Govs

More Resources

Can't Find The Right Resource

Use this tool before to find the most applicable EB-5 resource for your needs.

Get In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.