EB-5 Investors The EB-5 Investment Process

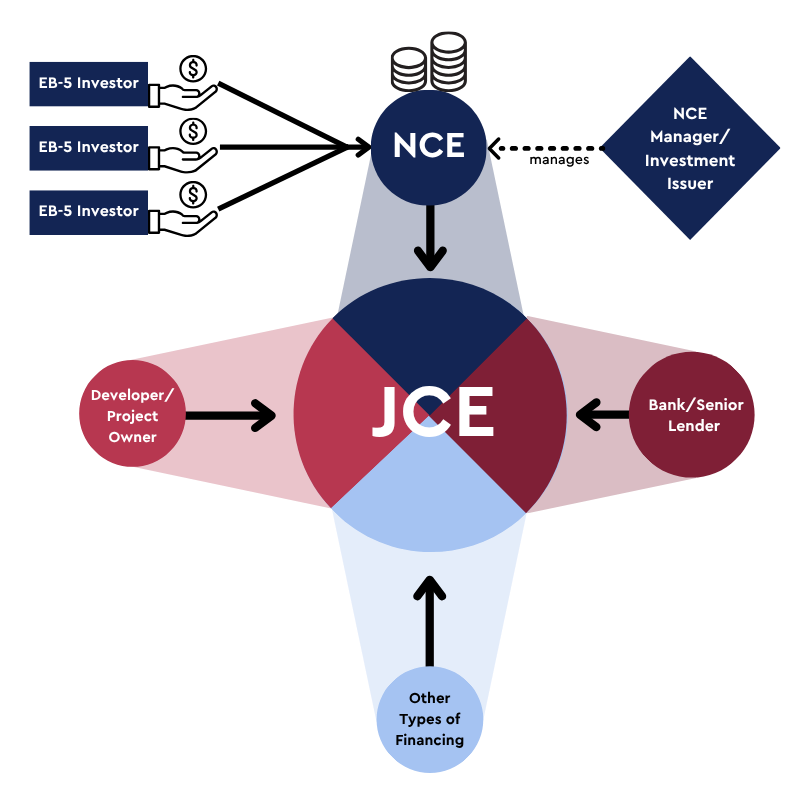

Funding Structure of an EB-5 project

Last Updated: December 8, 2025

Regional Center (RC) projects are funded by multiple sources of capital outside of EB-5 investment capital. The hierarchy of parties funding a development project is called the Capital Stack. The order of the stack determines who is repaid first, who owns the business, and how much risk is taken on by each party.

Most RC offerings have a mix of financing sources, which can include equity from the developer, equity from private investors, EB-5 debt or equity, lenders like commercial banks or hedge funds, tax credits, federal, state, or local grants, and more. Each source holds varying collateral, return terms, and repayment priority.

The parties listed below are the most common sources comprising an EB-5 project’s capital stack.

Developer/Project Owner

The developer is the individual or corporation directly managing the project construction and operation. Developers are either independent from or directly tied to the New Commercial Enterprise (NCE) manager, in which case the affiliation will be disclosed in a project’s offering documents. The developer usually holds common equity in a Job Creating Entity (JCE) and will contribute cash equity or use assets as collateral for the Project. The Developer or project owner is also responsible for planning the project, measuring project feasibility, acquiring the necessary licenses/permits/certifications for construction and operation, and raising other financing required for the project All EB-5 funds raised are deployed for project development, pursuant to the business plan and terms outlined in the Private Placement Memorandum. Developers with common equity are always in the lowest priority of all creditors in the capital stack.

Banks or Lenders

Financing from banks, hedge funds, or other commercial lenders account for some portion of the sources of capital in most EB-5 projects. When a bank issues a loan for an EB-5 project, it is typically positioned in the senior, or first priority, position in the capital stack. When a bank holds a senior loan in a project, it will secure the loan with a mortgage or deed of trust with the developer, meaning that if the loan is not repaid, the property will be foreclosed by the bank.

Other types of financing

Developers and Banks constitute a large portion of financing in most EB-5 projects, but there are various other sources of funds. Private equity investors, other lenders, and in certain cases even federal, state, or local government(s) can provide funding to a EB-5 project.

Summary of Project Structure and Capitalization

This image summarizes the various sources of funds which constitute an EB-5 project offering and how EB-5 investors fit into the larger project ecosystem. Note that share of the capital stack is often disproportionately balanced between these sources of financing.

For EB-5 Investors

More Resources

EB-5 Program Logistics: Direct vs Regional Center

EB-5 investments are direct or regional center types; regional centers pool funds and count indirect jobs, while direct requires active management and counts direct jobs only.

Learn More

EB-5 Basics

Thinking about doing EB-5? Get started here!

Learn MoreCan't Find The Right Resource

Use this tool before to find the most applicable EB-5 resource for your needs.

Get In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.