EB-5 Issue

Immigration

Systemic problems with the EB-5 Immigration Process and U.S. Citizenship and Immigrant Services

What We’re Fighting For

The landscape of EB-5 immigration is fraught with challenges that require urgent attention and reform. Foremost among these issues are the prolonged visa processing delays and backlogs at the U.S. Citizenship and Immigration Services (USCIS). These delays not only introduce uncertainty but also impede the timely realization of investors’ immigration goals. Addressing these inefficiencies is pivotal to fostering a more responsive and investor-friendly environment.

Children “aging-out” of visa eligibility is an additional concern that underscores the need for reform. The rigid age restrictions in the current immigration system fail to account for extended processing times, leading to family separations and undermining the program’s familial objectives. Advocacy for reforms to rectify this issue is imperative, emphasizing the importance of preserving family unity within the EB-5 program.

The sustainment period and arbitrary denials of visa petitions represent other critical challenges. The inflexibility of the sustainment period requirements hampers investors’ ability to adapt to changing circumstances, affecting their investments and the success of EB-5 projects. Simultaneously, arbitrary denials erode investor confidence, as the lack of transparency in adjudication processes introduces uncertainty. Reforms addressing these concerns, including a more adaptable sustainment period and increased transparency in the visa adjudication process, are essential to fortifying the integrity and attractiveness of the EB-5 program.

Newsroom

Immigration News & Articles

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization of Rural cases, severe neglect of High Unemployment petitions, unclear handling of Infrastructure cases, and no imminent risk of Visa Bulletin cut-off dates in 2026 for set-aside categories. The data underscores serious transparency and processing failures at USCIS and highlights why continued AIIA advocacy and FOIA litigation are essential to protect EB-5 investors.

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid 2024 fees, codification of RIA processing timelines, transparency around the new technology fee, investor-protective implementation of new Form I-527, tiered fees to preserve market choice, and technical fixes for derivative investors.

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

Sen. Gallego's EB-5 bill mobilizes foreign capital to build affordable housing. This collaboration has boosted AIIA's Congressional ties & credibility in this space.

We Won The EB-5 Fee Increase Lawsuit

AIIA successfully won its lawsuit against USCIS’s April 2024 EB-5 fee increases, with a federal judge ruling that the agency unlawfully raised fees without conducting the required fee study and acted arbitrarily under the APA; the old, lower fees are now back in effect while litigation continues, and AIIA is exploring a potential class action to seek refunds for investors and regional centers who paid the higher fees.

The Fight to Protect Good Faith EB-5 Investors

The RIA was designed to protect “good faith” EB-5 investors when projects fail due to no fault of their own, but USCIS has failed to implement these protections, leading to lawsuits like those by AIIA co-founder Rajvir Batra and seven other investors. AIIA supports these legal actions to ensure timely notices, 180-day cure periods, and preservation of investors’ immigration status.

AIIA FOIA Series: Hidden USCIS Adjudication Standards – National Security Checks

FOIA disclosures reveal that USCIS’s FDNS uses opaque, often subjective “national security” indicators—especially for investors from countries of concern like China—to flag EB-5 cases for lengthy reviews or denials, with triggers ranging from military ties to certain university affiliations. These reviews can occur at any stage and cause years of delays unless addressed through litigation or political intervention.

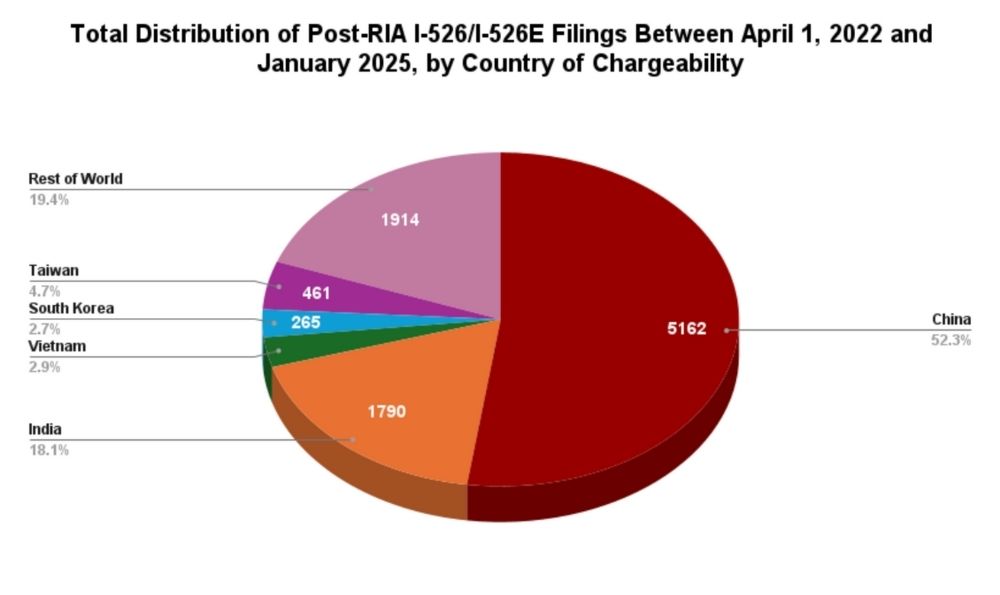

AIIA FOIA Series: Post RIA Petition Approval Statistics for January 2025

USCIS FOIA data shows post-RIA EB-5 adjudications are slow, with rural cases moving faster than high unemployment cases but both far from clearing the backlog—meaning long waits ahead, especially for HUA investors.

AIIA FOIA Series: Updated I-526E Inventory Statistics for January 2025

USCIS FOIA data obtained by AIIA shows post-RIA EB-5 demand far exceeds annual visa limits—about 10× for high unemployment and 4× for rural—creating long potential wait times, especially for China and India. We ask you to consider donating to sustain FOIA litigation and advocacy for investor transparency.

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2024

AIIA has filed FOIA requests to USCIS for data on I-526 and I-526E filings, revealing trends from April 2022 to July 2024. The data shows a rise in demand for high unemployment and rural TEA visas, with wait times increasing due to limited annual visa availability. The backlog is especially concerning for applicants from China and India.

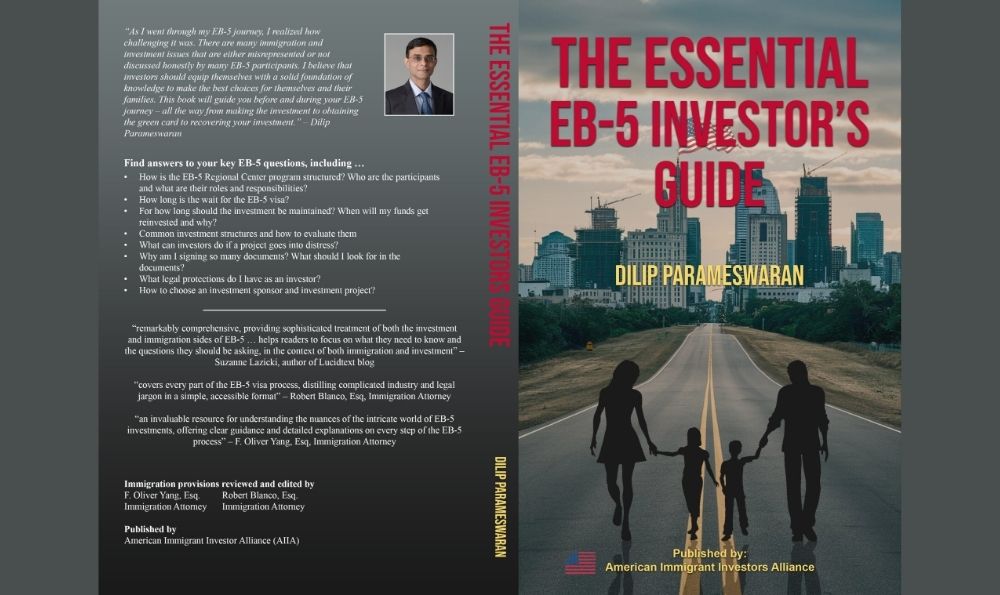

Announcing the Publication of The Essential EB-5 Investor’s Guide authored by Dilip Parameswaran

AIIA is proud to release The Essential EB-5 Investor’s Guide by Dilip Parameswaran, a seasoned investment banker who has successfully navigated the EB-5 process. This guide offers key insights into the immigration and investment aspects of EB-5, with expert contributions from EB-5 attorneys. Available on Amazon in both digital and paperback editions, it’s an essential resource for current and prospective EB-5 investors.

AIIA FOIA Series: Pre-RIA I-526 data as of July 2024

AIIA's recent FOIA requests have uncovered detailed data on pending EB-5 I-526 petitions as of July 2024, highlighting the backlog of pre-RIA investors, particularly from China, India, and the Rest of World. The data emphasizes the significant wait times for pre-RIA investors, while also shedding light on the growing backlog for post-RIA investors, especially from China, where there may not be enough visas to clear the backlog by 2030.

Courts Rule Against Regional Centers on Visa Rollover Lawsuit

A court ruling has blocked IIUSA's attempt to prevent the rollover of unused EB-5 set-aside visas into the unreserved category, ensuring more visas for pre-RIA investors, especially those from China and India, reducing their wait times. This decision preserves the status quo, benefiting past investors while maintaining potential backlogs for post-RIA set-aside investors, and AIIA continues to monitor the case and protect investor interests.

Issues Within Immigration

Select any of the issues before to access resources, news articles, and blog posts about that issue.

For EB-5 Stakeholders

Featured Immigration Resources

The Dark Side of EB-5 - A Summary of the Risks Involved

The "at-risk" requirement, redeployment clauses, potential fraud, delayed processing, petition denials, and children aging out.

Learn More

File an Expedite Request for the EB-5 petition

EB-5 expedite requests are limited to project or individual cases, requiring strong evidence like financial loss, humanitarian need, or national interest for USCIS approval.

Learn More

Writ of Mandamus (WOM) for Delayed EB-5 Processing

A Writ of Mandamus compels USCIS to act on delayed EB-5 petitions, but requires legal expertise and offers no guarantee of faster processing.

Learn More

Securities and Corporate Law vs. Immigration Law in the EB-5 Context

EB-5 investment disputes and immigration outcomes involve separate legal systems, so pursuing litigation against an issuer typically does not harm an investor’s immigration case. Investors should act quickly if they suspect fraud or project issues, since delays can jeopardize both their capital and immigration status.

Learn More

“Requests for Evidence” (RFE) and “Notices of Intent to Deny”(NOID) in the EB-5 context

USCIS issues RFEs and NOIDs to request missing evidence or flag serious issues in EB-5 petitions; failing to respond risks denial or visa disqualification.

Learn More

What if an EB-5 petition is Denied?

Investors can appeal EB-5 petition denials through USCIS’s AAO or federal courts, but must act quickly and consult experienced immigration attorneys to preserve eligibility.

Learn More

The Issue of Aging Out in EB-5

The Child Status Protection Act (CSPA) helps freeze a child’s age on EB-5 petitions, but long visa backlogs still risk children aging out and losing immigration eligibility.

Learn MoreConnect With A Professional

AIIA has curated a list of the top professionals from attorneys, investment specialists, to business plan writers to support all all EB-5 stakeholders

Directory of Professionals

AIIA has curated a list of the top professionals from attorneys, investment specialists, to business plan writers to support all all EB-5 stakeholders

View Directory of ProfessionalsFrequently Asked Questions

What are the main immigration challenges currently faced by EB-5 investors?

EB-5 investors face several systemic challenges, including severe visa processing delays, large backlogs at USCIS, and a lack of transparency in petition adjudications. These issues create uncertainty and hinder investors from achieving their immigration and investment goals on time. Addressing these inefficiencies is critical to maintaining investor confidence and ensuring the EB-5 program operates as intended.

Why are visa processing delays such a serious issue in the EB-5 program?

Long processing times can stretch across several years, delaying investors’ immigration status and complicating project timelines. These delays also contribute to family and financial stress, particularly for investors whose dependent children may lose visa eligibility due to aging out during the waiting period. AIIA advocates for faster adjudication and greater transparency to make the process more predictable and fair.

Get In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.