Tòa án phán quyết chống lại các trung tâm khu vực trong vụ kiện về việc gia hạn visa.

Ngày 13 tháng 10 năm 2024

Một phán quyết của tòa án đã chặn nỗ lực của IIUSA trong việc ngăn chặn việc chuyển đổi các visa EB-5 chưa sử dụng từ danh mục dành riêng sang danh mục không dành riêng, đảm bảo có thêm visa cho các nhà đầu tư trước RIA, đặc biệt là những người đến từ Trung Quốc và Ấn Độ, từ đó giảm thời gian chờ đợi của họ. Quyết định này duy trì hiện trạng, mang lại lợi ích cho các nhà đầu tư trước RIA đồng thời duy trì khả năng tồn đọng cho các nhà đầu tư sau RIA trong danh mục dành riêng, và AIIA tiếp tục theo dõi vụ việc và bảo vệ quyền lợi của nhà đầu tư.

Một phán quyết mới của tòa án đã tránh được một rắc rối lớn cho các nhà đầu tư EB-5. Gần đây, Invest in the USA (IIUSA), một mạng lưới các Trung tâm Khu vực EB-5, Đã khởi kiện Bộ Ngoại giao Hoa Kỳ. về các chính sách của mình liên quan đến việc phân bổ thị thực cho các hạng mục di trú dựa trên việc làm (EB) khác nhau.

Tại cốt lõi, vụ kiện của IIUSA nhằm mục đích ngăn chặn Bộ Ngoại giao Hoa Kỳ từ chuyển giao, hoặc “Chuyển tiếp”Thị thực EB-5, ban đầu được cấp cho các danh mục “được dành riêng”, sẽ được chuyển sang danh mục không dành riêng nếu không được sử dụng trong năm tài chính trước đó. AIIA đã phản đối quan điểm pháp lý của IIUSA kể từ đó, vì nó sẽ gây hại nghiêm trọng cho các nhà đầu tư đã nộp đơn xin tình trạng EB-5 trước khi Luật Cải cách và Tính liêm chính EB-5 (RIA) được thông qua (tức là các nhà đầu tư trước RIA).”.

IIUSA đã yêu cầu Tòa án Quận Hoa Kỳ cho Khu vực Đông Wisconsin ban hành một lệnh cấm tạm thời, theo đó trong suốt thời gian diễn ra vụ kiện, Bộ Ngoại giao Hoa Kỳ sẽ không được phép cho phép các visa EB-5 chưa sử dụng từ ngân sách năm tài chính 2023 được chuyển sang danh mục visa EB-5 không giới hạn trong năm tài chính 2025. Vào ngày 26 tháng 9 năm 2024, tòa án Tòa án đã bác đơn yêu cầu áp dụng biện pháp khẩn cấp tạm thời của IIUSA..

Những gì Thẩm phán đã nói

Trang 6-7 của quyết định từ chối đơn xin tạm thời cấm là trích dẫn liên quan đến quan điểm của thẩm phán:

Luật RIA quy định rằng các visa EB-5 dự trữ chưa sử dụng “phải” được chuyển sang cuối năm tài chính. … Theo quy định của luật, các visa EB-5 dự trữ chưa sử dụng sẽ được chuyển sang danh mục không dự trữ vào cuối năm tài chính. Do đó, ngay cả khi tôi ra lệnh cho bị đơn ngăn chặn việc chuyển các visa EB-5 dự trữ chưa sử dụng sang danh mục không dự trữ, họ không thể tuân thủ lệnh này vì luật quy định rằng các visa này phải được chuyển sang danh mục không dự trữ vào cuối năm tài chính. … Do đó, tôi sẽ từ chối đơn yêu cầu của nguyên đơn trong phạm vi yêu cầu cấm bị đơn cho phép các visa EB-5 được phân bổ nhưng chưa sử dụng của năm tài chính 2023 chuyển sang danh mục không phân bổ vào cuối năm tài chính..

Quan điểm của chúng tôi

AIIA hoan nghênh phán quyết của thẩm phán trong vụ kiện này, Chúng tôi kiên quyết phản đối. Vì điều đó sẽ gây thiệt hại cho các nhà đầu tư. Nếu đề xuất này được thông qua, các ứng viên xin visa EB-5 không thuộc diện ưu tiên sẽ mất quyền truy cập vào khoảng 4.200 visa trong năm tài chính 2025. Các trung tâm khu vực đã tìm cách lấy visa từ danh sách chờ của các nhà đầu tư trước đây, những người đã đủ điều kiện và đang chờ visa, và thay vào đó tạo ra ảo tưởng về sự sẵn có của visa dành riêng – mặc dù trên thực tế, các ứng viên visa dành riêng không thể sử dụng thêm visa trong năm tài chính 2025. Điều này là do Hầu hết trong số họ vẫn chưa được USCIS xem xét đơn I-526/I-526E của mình. và hiện tại chưa thể nộp đơn xin visa. May mắn thay, thẩm phán đã đồng ý với chúng tôi rằng luật pháp quy định rõ ràng về việc chuyển tiếp visa chưa sử dụng. Nếu tòa án ra lệnh cho Bộ Ngoại giao làm ngược lại, điều đó sẽ buộc họ vi phạm luật pháp, điều này nằm ngoài phạm vi quyền lực cấm đoán của tòa án.

Quyết định này có nghĩa là tình trạng hiện tại, trong đó các visa EB-5 chưa sử dụng được chuyển sang danh mục không được đặt trước, sẽ tiếp tục được duy trì. Điều này sẽ ảnh hưởng đến các nhà đầu tư EB-5 theo các cách sau:

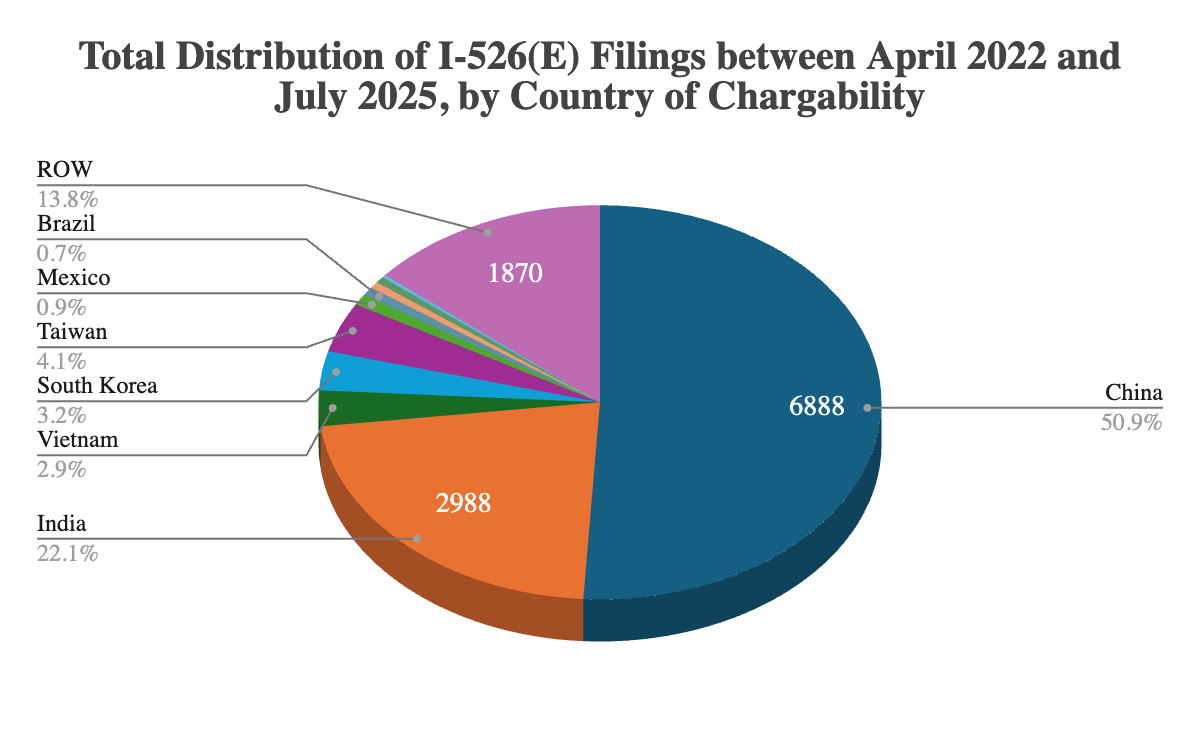

- Giảm thiểu thời gian chờ đợi trong việc cấp visa cho các nhà đầu tư trước RIA: Lệnh cấm nhằm ngăn chặn việc chuyển đổi các visa “set-aside” chưa sử dụng sang danh mục không giới hạn trong phân loại EB-5. Việc chuyển đổi visa là yếu tố quan trọng để đảm bảo rằng các nhà đầu tư từ Trung Quốc đại lục và Ấn Độ có đơn I-526 đã được phê duyệt, hiện đang phải đối mặt với... Nợ tồn đọng kéo dài cả năm Do nhu cầu cao từ các quốc gia của họ, các nhà đầu tư có thể nhanh chóng nhận được tình trạng Thường trú nhân Hợp pháp (LPR). Cho phép các visa chưa sử dụng được chuyển sang danh mục chưa được phân bổ sẽ tăng số lượng visa có sẵn cho các nhà đầu tư trước RIA, từ đó rút ngắn thời gian chờ đợi của họ để nhận được tình trạng LPR.

Nhận thức được tình trạng bất công hiện tại, USCIS đã đẩy nhanh quá trình xử lý các đơn xin thị thực không thuộc diện ưu tiên, nộp trước khi có quyết định của Tòa án (RIA), nhằm giảm bớt gánh nặng của thời gian chờ đợi kéo dài. Việc bác bỏ đơn yêu cầu hoãn thi hành quyết định ủng hộ thực tiễn này bằng cách đảm bảo nguồn cung thị thực ổn định cho diện không ưu tiên thông qua cơ chế chuyển tiếp.

- Giữ nguyên khả năng tồn đọng đối với các nhà đầu tư “set-aside” sau RIA: Việc chuyển tiếp chỉ xảy ra khi các visa trong một phân loại cụ thể không được sử dụng trong một năm tài chính (tức là chúng không được cấp cho đủ số nhà đầu tư đủ điều kiện). Dự báo về tình trạng tồn đọng như vậy là không chỉ do việc chuyển sang danh mục không dự trữ. Các chuyên gia cho rằng Thời gian xử lý chậm trễ của USCIS là nguyên nhân dẫn đến việc không cấp tất cả các visa “set-aside” trong một năm tài chính, dẫn đến việc chuyển tiếp theo quy định của luật. Ngoài ra, sự phổ biến cao của các khoản đầu tư “set aside” cũng là một yếu tố góp phần. Do yêu cầu vốn thấp (tức là $800.000), sự sẵn có của visa (đặc biệt đối với nhà đầu tư sinh ra tại Ấn Độ và Trung Quốc đại lục), và tỷ lệ visa "set aside" thấp, nhu cầu cao đối với phân loại này có tiềm năng gây ra tình trạng ùn tắc đáng kể.

Tóm lại, IIUSA đã thất bại Tại tòa án, IIUSA đã lợi dụng quyền lợi của các Trung tâm Khu vực để bảo vệ lợi ích cá nhân của mình, gây thiệt hại cho nhà đầu tư. Sự thất bại này là một phần của mô hình hành vi của IIUSA, trong đó tổ chức này tìm cách lạm dụng quyền kiểm tra tư pháp để áp đặt các chính sách mới trái với Luật Đầu tư Khu vực (RIA), vốn quy định các biện pháp bảo vệ mạnh mẽ cho nhà đầu tư trước lợi ích của các Trung tâm Khu vực.

Mặc dù thẩm phán đã từ chối đơn yêu cầu tạm thời này, vụ việc vẫn chưa kết thúc. Như chúng tôi đã thảo luận trong bài viết trước, AIIA sẽ tiếp tục theo dõi vụ việc và bất kỳ nỗ lực nào khác của IIUSA và các trung tâm khu vực nhằm khai thác thị trường tương lai bằng cách chiếm đoạt quyền lợi của các nhà đầu tư trước đó. Chúng tôi có thể quyết định can thiệp và/hoặc nộp đơn tham gia ý kiến (amicus brief) nếu thấy cần thiết.

Như thường lệ, công việc của chúng tôi sẽ không thể thực hiện được nếu không có sự ủng hộ của cộng đồng nhà đầu tư EB-5 và các bên liên quan trong ngành, những người luôn đặt lợi ích của nhà đầu tư lên trên lợi nhuận. Xin vui lòng xem xét. Ủng hộ AIIA hoặc Tham gia chương trình thành viên của chúng tôi Để chúng ta có thể tiếp tục đấu tranh vì quyền lợi của các nhà đầu tư nhập cư.

Bài viết liên quan

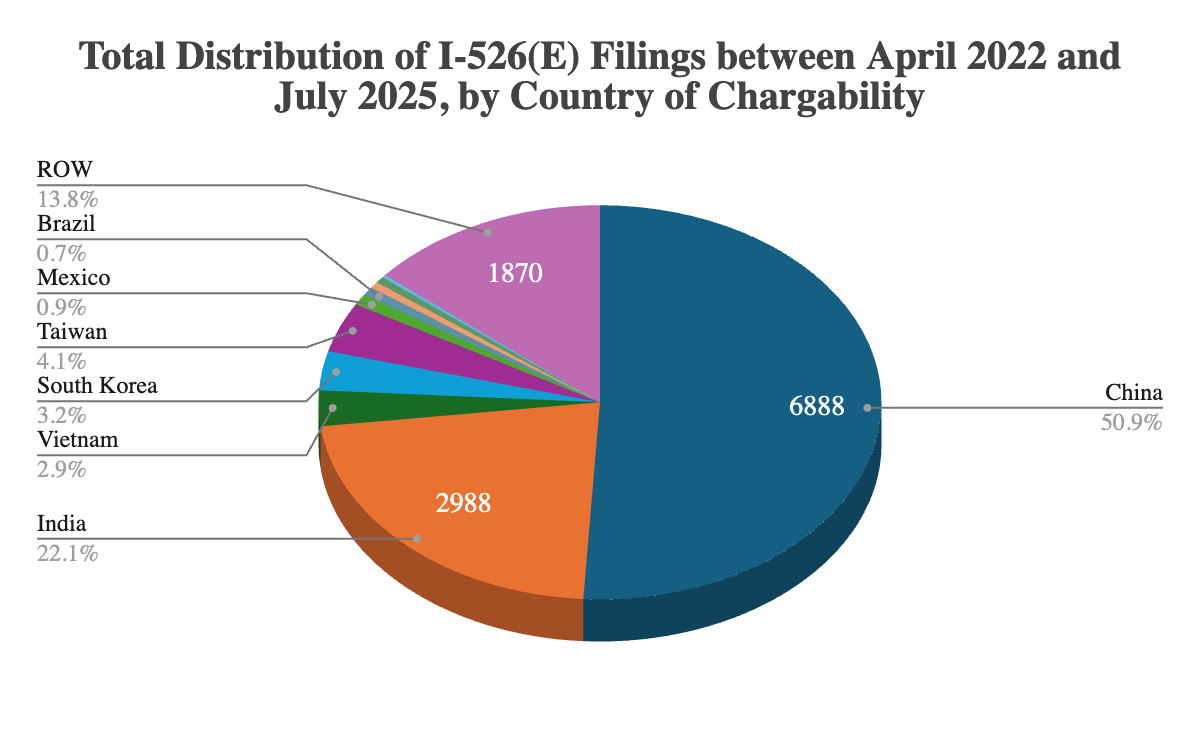

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

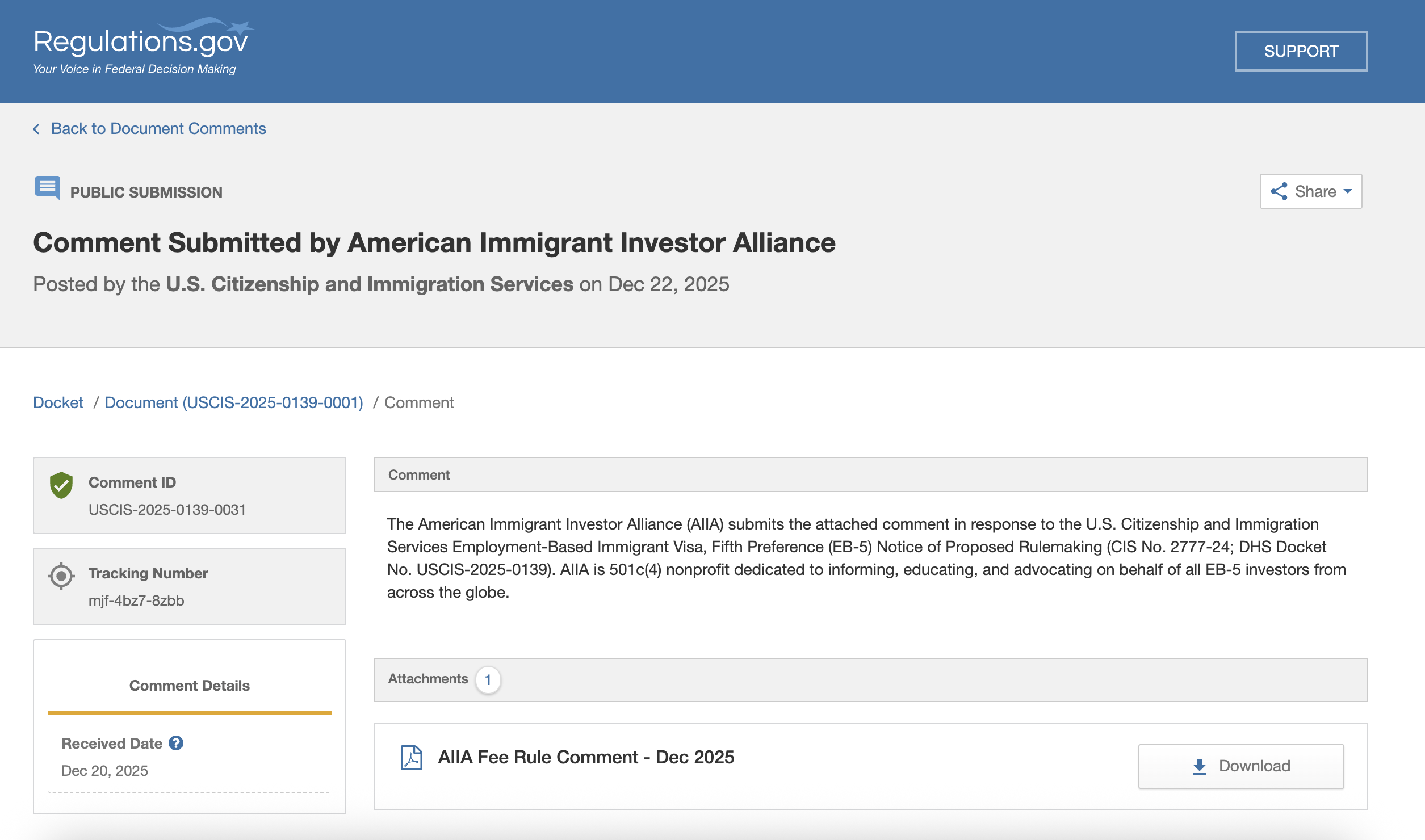

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

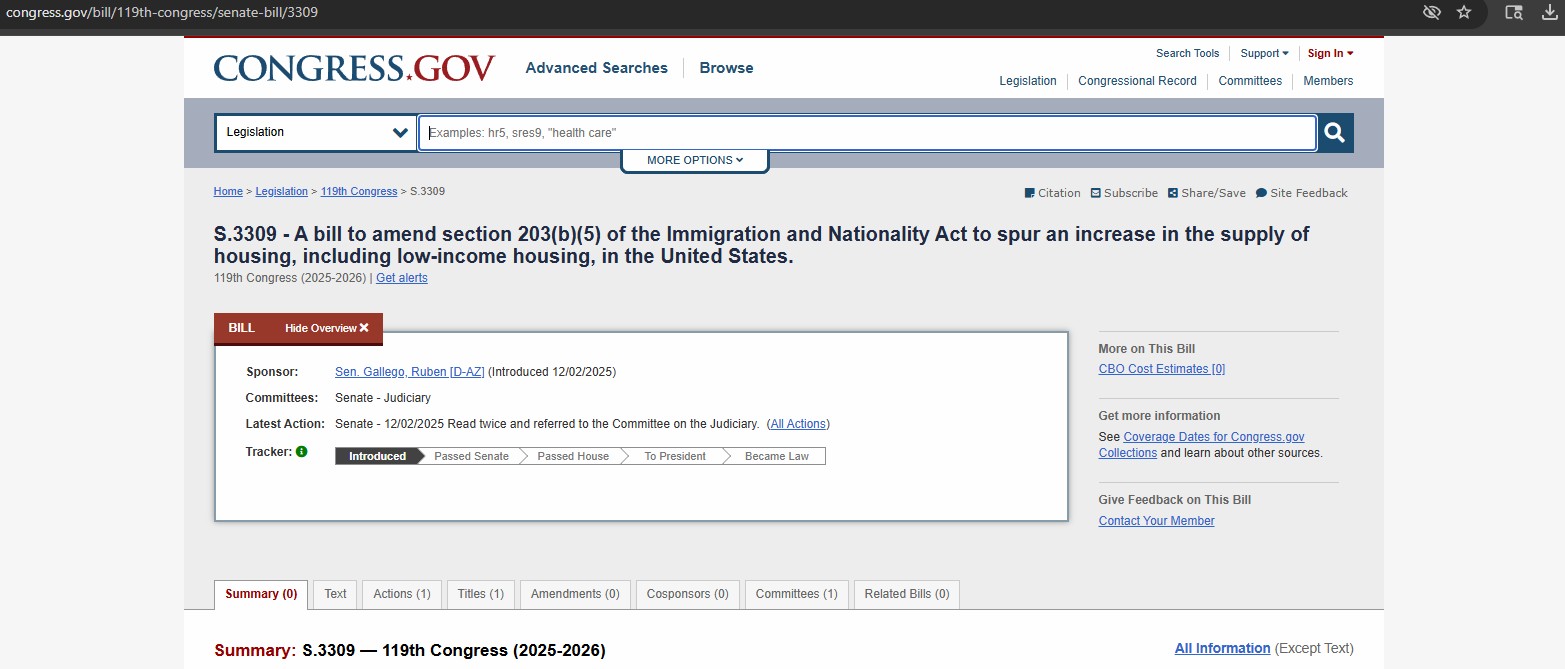

Chúng tôi xin chúc mừng Thượng nghị sĩ Gallego về dự luật mới tận dụng Chương trình EB-5 để xây dựng nhà ở giá rẻ.

Chúng tôi đã thắng kiện vụ kiện về việc tăng phí EB-5.

Cập nhật thông tin mới nhất từ AIIA

Đăng ký nhận bản tin của chúng tôi để cập nhật thông tin mới nhất về chương trình EB-5.

Bằng cách đăng ký, bạn đồng ý với Chính sách Bảo mật của chúng tôi và đồng ý nhận các cập nhật từ công ty chúng tôi.

Nguồn tài liệu được khuyến nghị

Vấn đề về việc hết hạn tuổi trong chương trình EB-5

Luật Bảo vệ Tuổi của Trẻ em (CSPA) giúp giữ nguyên tuổi của trẻ em trong các đơn xin visa EB-5, nhưng tình trạng ùn tắc visa kéo dài vẫn tiềm ẩn rủi ro...

Đọc thêm

Việc bán các đợt chào bán chứng khoán EB-5

Bán chứng khoán EB-5 thường sử dụng các quy định miễn trừ theo Quy định D (nhà đầu tư Mỹ) và Quy định S (nhà đầu tư nước ngoài) để tránh đăng ký với Ủy ban Chứng khoán và Giao dịch Hoa Kỳ (SEC) trong khi...

Đọc thêm

Lựa chọn giữa tài trợ EB-5 trực tiếp và thông qua Trung tâm Khu vực

Chương trình EB-5 trực tiếp dành cho các nhà đầu tư cá nhân tạo ra việc làm trực tiếp; Chương trình EB-5 Trung tâm Khu vực tập hợp nhiều nhà đầu tư, tính cả việc làm trực tiếp và gián tiếp cho...

Đọc thêmBài viết mới nhất trên blog

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

Tìm hiểu thêm

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

Tìm hiểu thêm

Chúng tôi xin chúc mừng Thượng nghị sĩ Gallego về dự luật mới tận dụng Chương trình EB-5 để xây dựng nhà ở giá rẻ.

Dự luật EB-5 của Thượng nghị sĩ Gallego huy động vốn nước ngoài để xây dựng nhà ở giá rẻ. Sự hợp tác này đã củng cố mối quan hệ và uy tín của AIIA với Quốc hội...

Tìm hiểu thêm

Chúng tôi đã thắng kiện vụ kiện về việc tăng phí EB-5.

AIIA đã thắng kiện thành công trong vụ kiện chống lại việc tăng phí EB-5 của USCIS vào tháng 4 năm 2024, với phán quyết của một thẩm phán liên bang rằng cơ quan này...

Tìm hiểu thêmLiên hệ với chúng tôi

Nếu quý vị có bất kỳ câu hỏi, thắc mắc hoặc đề xuất hợp tác nào, xin vui lòng liên hệ với chúng tôi mà không ngần ngại.

Phản hồi (0)