开发商、企业主和政府

准备 EB-5 项目

准备 EB-5 融资项目的指南和最佳做法

从 EB-5 投资者处筹集资金的过程首先要确保风险投资项目适合 EB-5 投资,并且结构合理、执行得当。确保采取必要的步骤--由合格的专业人士进行勤勉、详细和严格的审查--将为您的项目和投资者的移民带来最大的成功机会。.

此外,美国移民局还要求在区域中心的年度申报(I-956G 表)和项目的 I-956F 表中记录直接但详细的投资提议。.

为EB-5项目做准备不仅仅是为了募集资金:而是为了向移民局展示您对该计划要求的了解、遵守规定的决心以及以道德和机智的方式营销该项目。要知道,如果没有充分准备好项目,可能会阻碍您现在和将来筹集EB-5资金或营销您的项目。.

在阅读本节之前,我们建议您阅读 EB-5 基础知识 (投资者)和 为什么要进行 EB-5 融资 (针对项目发起人/开发商),涵盖 EB-5 计划的基础知识。.

筹集 EB-5 资金需要适当的结构、详细的准备工作以及遵守美国移民局的要求。道德营销、信任和良好的记录是成功的关键。从《EB-5 基础知识》和《为什么要进行 EB-5 融资》开始了解基础知识。.

面向开发商、企业主和政府

准备 EB-5 项目的资源

参与 EB-5 投资计划的各方

成功的 EB-5 项目需要专家团队--移民和证券律师、经济学家、商业计划书撰写人、基金管理人以及提供全方位服务的 NCE 经理,以确保合规性和效率。.

了解更多

选择直接 EB-5 融资还是区域中心 EB-5 融资

直接 EB-5 适合创造直接就业机会的单个投资者;区域中心 EB-5 则汇集多个投资者,为需要更多资金的大型项目计算直接和间接就业机会。.

了解更多

满足创造就业机会的要求

EB-5 项目必须在两年内为每位投资者创造 10 个新的全职工作岗位,区域中心允许间接工作岗位,但要求至少有 10% 个直接工作岗位,并有安全工作岗位缓冲。.

了解更多

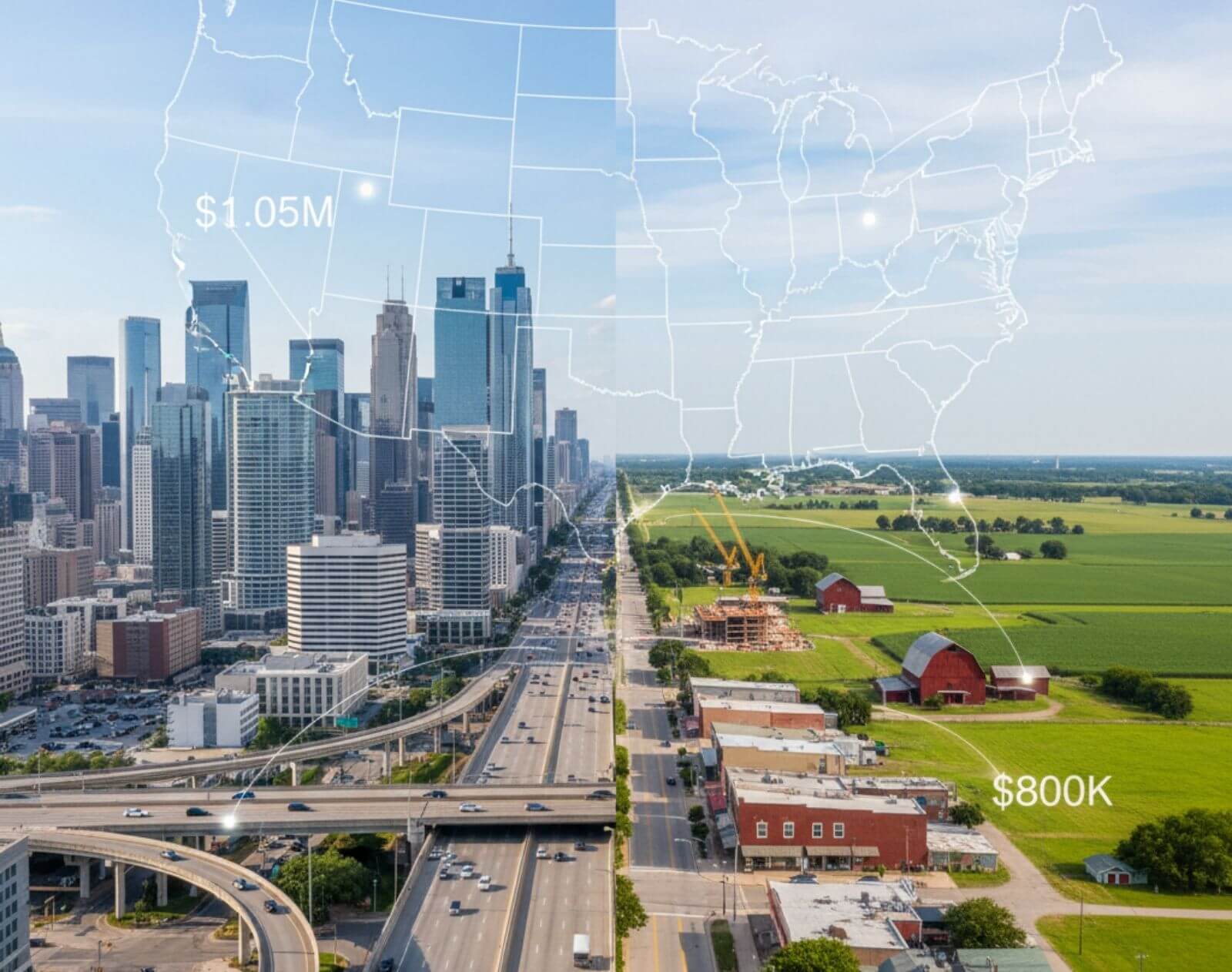

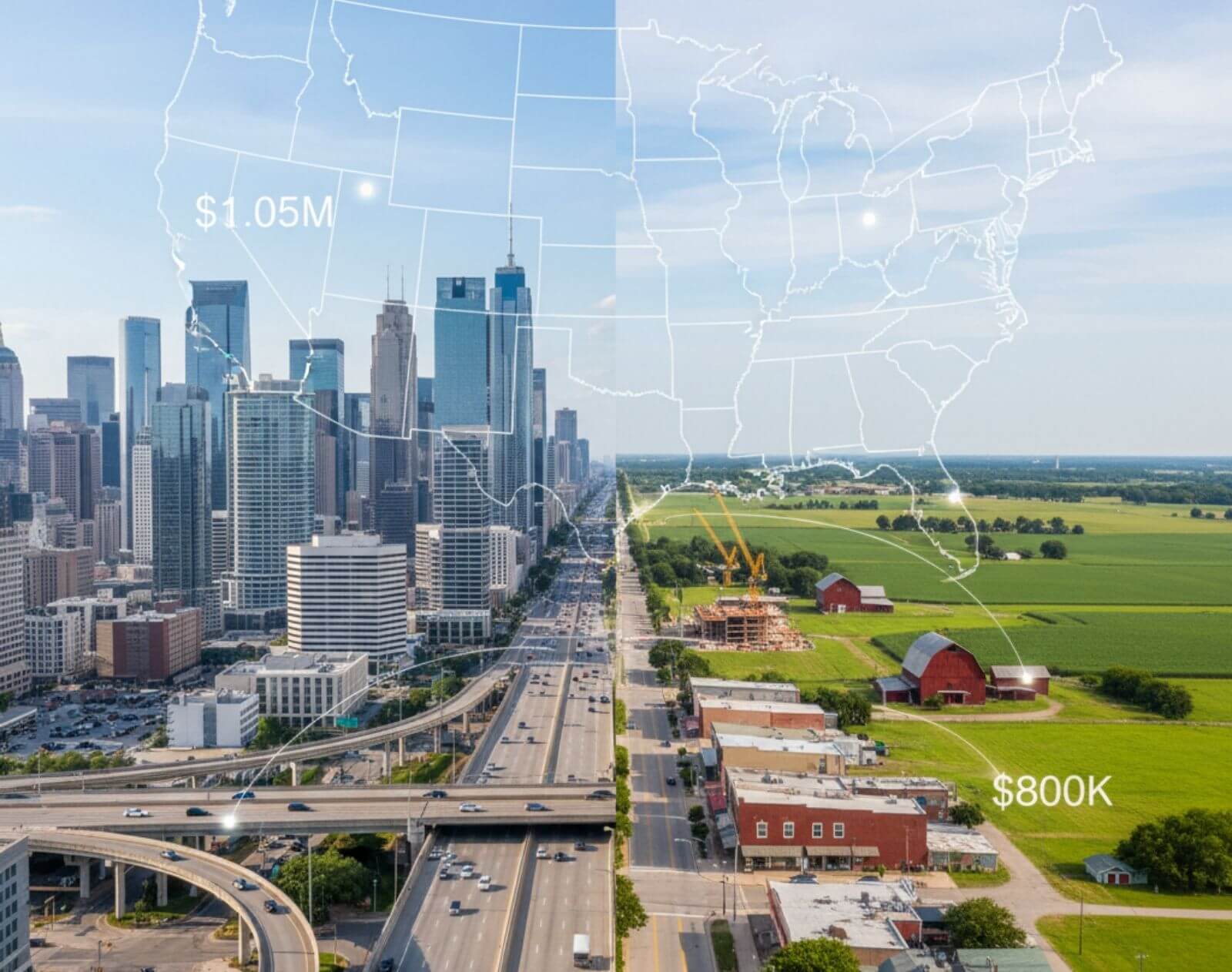

EB-5 投资额、目标就业区和预留类别

EB-5 投资最低限额取决于地点:在技术经济区为 $800,000,其他地区为 $10.5M;为农村、高失业率和基础设施项目预留签证。.

了解更多

区域中心项目运作

开发商可通过美国移民局 I-956 表加入或创建区域中心,要求尽职调查、地理范围、经济计划、年费和严格的管理职责。.

了解更多

EB-5 项目的设立成本

EB-5 项目的设立成本差异很大;与直接项目相比,区域中心的法律、经济报告、备案、营销和管理费用较高。.

了解更多

打造 EB-5 产品

准备您的 EB-5 团队、商业模式和资本计划;最终确定经济影响报告、商业计划和私募备忘录,使其符合美国移民局(USCIS)和美国证券交易委员会(SEC)的规定。.

了解更多

构建 EB-5 区域中心项目

EB-5 项目要求无担保的股权投资;在资本结构上平衡投资者的风险偏好,并包括后备融资,以提高项目的可行性和吸引力。.

了解更多

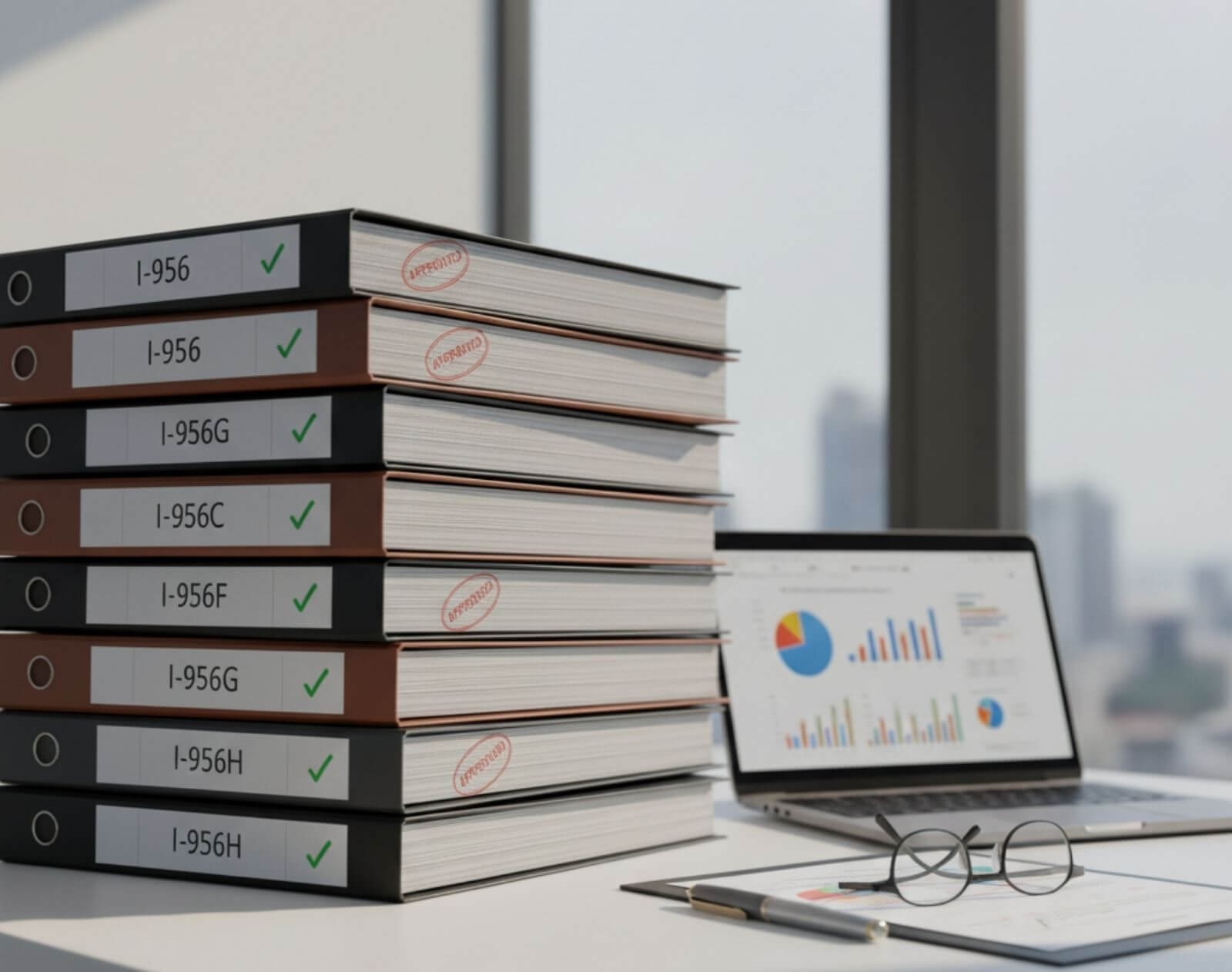

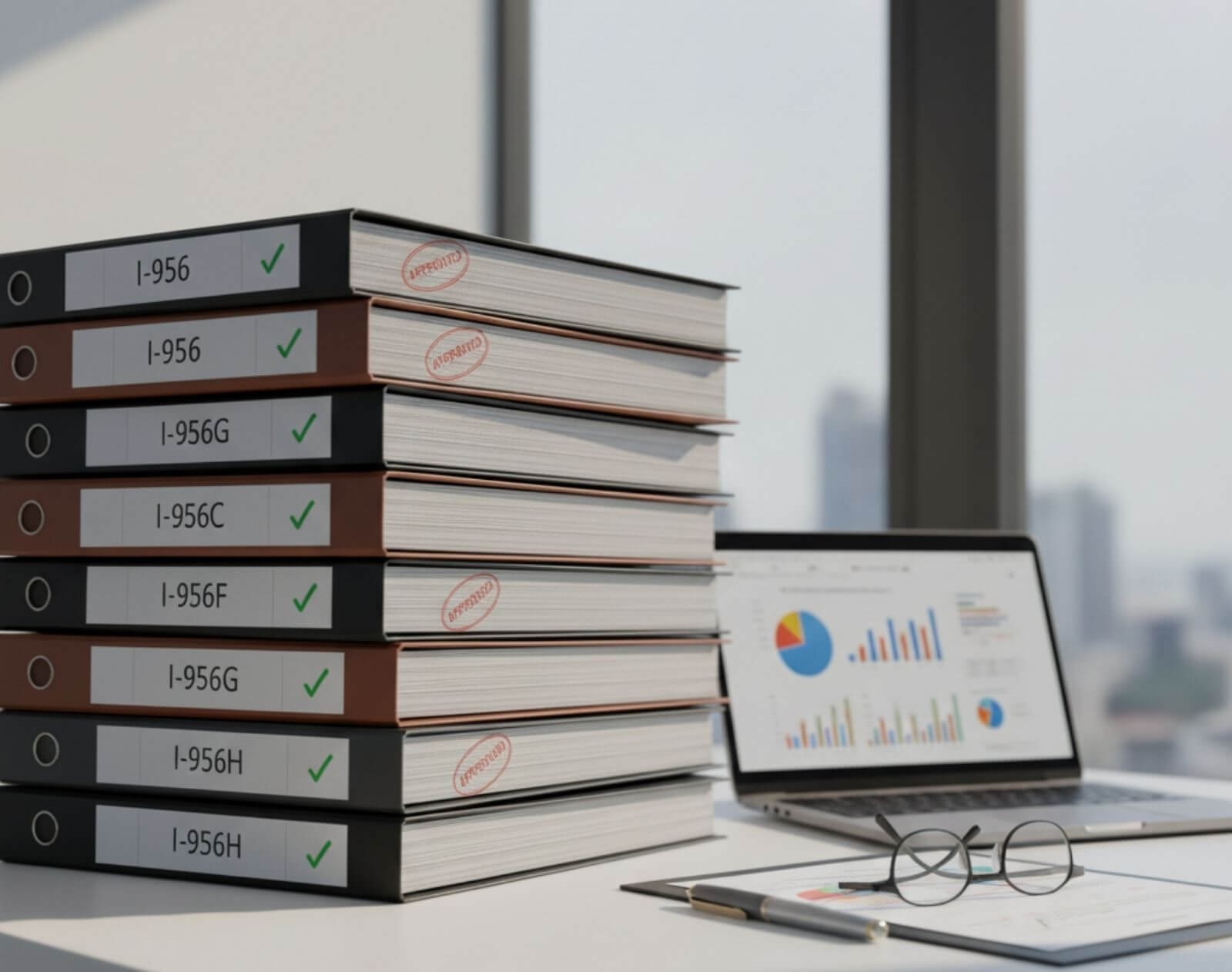

EB-5 纸质跟踪导航:项目文件和合规性

清晰、合规的文件和及时的美国移民局备案(各种 I-956)对于避免延误、确保透明度以及保持 EB-5 区域中心和投资者的合规性至关重要。.

了解更多

参与 EB-5 投资计划的各方

成功的 EB-5 项目需要专家团队--移民和证券律师、经济学家、商业计划书撰写人、基金管理人以及提供全方位服务的 NCE 经理,以确保合规性和效率。.

了解更多

选择直接 EB-5 融资还是区域中心 EB-5 融资

直接 EB-5 适合创造直接就业机会的单个投资者;区域中心 EB-5 则汇集多个投资者,为需要更多资金的大型项目计算直接和间接就业机会。.

了解更多

满足创造就业机会的要求

EB-5 项目必须在两年内为每位投资者创造 10 个新的全职工作岗位,区域中心允许间接工作岗位,但要求至少有 10% 个直接工作岗位,并有安全工作岗位缓冲。.

了解更多

EB-5 投资额、目标就业区和预留类别

EB-5 投资最低限额取决于地点:在技术经济区为 $800,000,其他地区为 $10.5M;为农村、高失业率和基础设施项目预留签证。.

了解更多

区域中心项目运作

开发商可通过美国移民局 I-956 表加入或创建区域中心,要求尽职调查、地理范围、经济计划、年费和严格的管理职责。.

了解更多

EB-5 项目的设立成本

EB-5 项目的设立成本差异很大;与直接项目相比,区域中心的法律、经济报告、备案、营销和管理费用较高。.

了解更多

打造 EB-5 产品

准备您的 EB-5 团队、商业模式和资本计划;最终确定经济影响报告、商业计划和私募备忘录,使其符合美国移民局(USCIS)和美国证券交易委员会(SEC)的规定。.

了解更多

构建 EB-5 区域中心项目

EB-5 项目要求无担保的股权投资;在资本结构上平衡投资者的风险偏好,并包括后备融资,以提高项目的可行性和吸引力。.

了解更多

EB-5 纸质跟踪导航:项目文件和合规性

清晰、合规的文件和及时的美国移民局备案(各种 I-956)对于避免延误、确保透明度以及保持 EB-5 区域中心和投资者的合规性至关重要。.

了解更多专业人员名录

美国投资移民协会(AIIA)为所有 EB-5 利益相关者策划了一份从律师、投资专家到商业计划书撰写者的顶级专业人士名单。

查看专业人员名录与专业人士联系

美国投资移民协会策划了一份顶级专业人士名单,从律师、投资专家到商业计划书撰写者,为所有 EB-5 利益相关者提供支持、 投资专家、商业计划书撰写者,为所有 EB-5 利益相关者提供支持

面向开发商、企业主和政府官员

更多资源

找不到合适的资源

请使用此工具找到最适合您需要的 EB-5 资源。

联系我们

如果您有任何问题、咨询或合作建议,请随时联系我们。