开发商、企业主和政府 准备 EB-5 项目

打造 EB-5 产品

Last Updated: 11 月 5, 2025

By the time you are ready to construct an EB-5 offering, you must have all the necessary preparations completed:

- Your EB-5 team prepared, vetted, and ready to assist.

- A firm idea of the type of project and business you are creating.

- Where the business will operate.

- General idea of how much capital should be raised.

Once these prerequisites are hammered out, you should proceed with narrowing your geographic area of operation for the regional center (RC) and refining the business model with your economist and/or immigration attorney.

Once the business model has been drafted and refined, and all United States Citizenship and Immigration Services(USCIS) regulations met, the securities attorneys should then draft an offer structure, which includes where all forms of capital would be sourced from, interest incurred on each type of investment, etc. Ensure that your business plan writer is consulted for all these drafts, as making changes later in the process can bring about unforeseen consequences.

As with traditional private investments, the budget and pro forma are the foundation of fundraising, as the overtime performance of a project determines the prospective benefits to investors. These factors also play an important role in determining an EB-5 investor’s eligibility for the immigration program.

Economic Impact Report

Economic impact reports (EIRs), or econometric analyses, are studies based on preset formulas which take into account all projects being operated or developed by a regional center to determine the jobs created by the projects, as well as the economic impact of their creation in the surrounding area. EIRs utilize aspects of the business plan and the proposed revenue brought in by the project as variables for their statistical calculations. This report also describes how the regional center will have a positive, measurable impact on the local economy.

The economist must choose a model out of the many to reflect the type of project, the industry it caters to, and its unique constraints to maintain the utmost accuracy when creating an EIR. Each model requires different evidence presented at the investors’ I-829 stage and uses different variables to come to their final calculations. No one model is “one size fits all” and none are endorsed or favored by USCIS. It is important to meet with your economist early on to determine which model works best for your project and its needs to ensure compliance with USCIS’s regulations.

USCIS requires an econometric analysis to be tailored for each industry the regional center has proposed plans for. Hotels, retail businesses, and infrastructure all require different analyses. This includes projects which are not yet finished developing or raising capital–they must provide an EIR based on the information known to the regional center at the time. Amendments are required for models that are revised or switched after the regional center proposal is submitted, therefore all business plans will be reviewed and approved by the RC team before the regional center project is submitted to USCIS.

Poor economic analyses will put your investors at risk of a petition denial and could even risk the RC’s I-956 approval. Ensure that all data being put inside an econometric analysis is up to date and the source material will be readily available to adjudicators at USCIS.

Business plans

The main purposes of a business plan are:

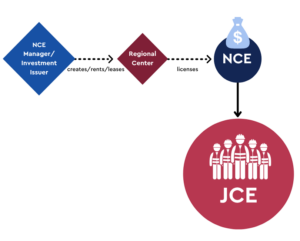

- to justify the formation of an NCE;

- to validate the business and its prospects for success, and;

- to validate the need for job creation (and/ or the inputs used by the economist to calculate job creation).

- Demonstrate market analysis

- Describe the target market of an investment issuer

- Present all permits obtained for the project

- Show all expenditures anticipated for construction materials, marketing, etc.

It also serves as a guideline for independent regulators and investors to see the overall business strategy, including how the investment funds were spent.

Although the inclusion of so many details may seem trivial at the beginning of the process, it is important to note that including variables like a marketing plan can have a profound impact on how your deal can be structured and what positions in the capital stack can be offered to investors. At the end of the day, the business plan should be so extensive and detailed that USCIS should be able to draw conclusions about the job and revenue creation potential themselves.

Once a business plan has been approved by USCIS, it cannot be changed unless an addendum is submitted by the regional center identifying any “material changes”.

Business plans also need to establish an established roadmap by laying out all possible details about a project. It helps prevent changes to your approved regional center petition or project proposal down the line. It also ensures that contingency plans have already been developed if job creation or repayment is threatened by the time an investor reaches the I-829 stage.

Business plan writers operate like the consultant for all members of your team, and the entire offering and structure of the project will be laid out in entirety in their report. A business plan can be hundreds of pages long. Therefore it is crucial that your business plan writer is very familiar and up to date with the most recent trends and changes to EB-5 laws and adequately demonstrates the project’s compliance with USCIS and SEC regulations. Even the smallest errors can cause delays for both the regional center and investor later in the process. Therefore, it is highly encouraged to do the bulk of diligence during the business plan writing stage.

| Executive summary and mission statement |

|

| EB-5 RC program outline |

|

| Initial Project/JCE |

|

| Overview of all companies and people involved | |

| Marketing Plan for Investor Solicitation |

|

| NCE management, administration and operation |

|

| Legal and risk planning |

|

| Economic Impact Analysis and Job Creation Study |

|

| NCE manager financial outline |

|

| Miscellaneous |

|

This list is non-exhaustive and is only an abridged example of what a business plan may include. One should consult with your business plan writer to know exactly what is necessary to demonstrate.

Business plans are dictated by an overruling court case which defined a lasting precedent known as “Matter of Ho” after the plaintiff in the case. Matter of Ho stipulates that a comprehensive business plan has, at minimum,

- a business description

- the products and services associated with the business

- the businesses’ objective

Ideally the plan should also include:

- a market analysis, names

- strengths and weaknesses of their competitors

- a description of the target market

- a comparison with their competitors products/services

- all permits and licenses

- contracts for supply of material

- marketing strategy

- organizational structure with the staff’s experience

- the businesses staffing requirements and hiring plan

Private Placement Memorandum

The offer structure you decide on with your securities attorney will ultimately be formalized in a document known as a Private Placement Memorandum (PPM) which will be offered to investors prior to sending their investment. It must include all details about the offering:

- period of the loan

- partnership agreements

- management personnel

- investor exit strategies

- redeployment provisions

- investor rights

- and more.

The corporate entities involved in the capital stack should be laid out specifically in this document, with information about where in the “capital stack” each party occupies. PPMs should be easy to read for an average person who is not involved in the everyday operations of the regional center. Both investors and USCIS will scrutinize this document to determine the project’s details, legitimacy, and legal compliance, yet neither will have the experience and knowledge of your team. Be sure to be clear and direct in this document to avoid issues with your investors’ immigration processes.

Multiphase projects and bridge loans

Some EB-5 projects have multiple phases in which different batches of investors will fund specific parts of the EB-5 project’s construction. For larger construction projects, this allows developers to break up a large amount of foreign investment into more easily repaid pieces. Multi phase projects are allowed with each phase being a separate trench with its own business plan, I-956F etc.

Each phase may be quite different in size based on the number of jobs each one creates. As a result of the varying sizes, the time it takes to process incoming investments will vary accordingly. Investors grouped into each phase would ideally file their I-526Es in a block, corresponding to the investment requirements of each phase.

Bridge financing is used by developers to “overlap” the periods between a phase 1 project and a phase 2 project. In some risky EB-5 deals, phase 2 financing is used to pay out phase 1 investors. USCIS finds this process viable and legal only if the econometric analysis makes excruciatingly clear that bridge financing will ultimately be repaid by EB-5 funds in a “reasonable amount of time” (albeit arbitrary). Bridge financing is an area with much uncertainty and it must be approached cautiously and on advice from counsel.

Guaranteeing returns or assets in exchange for investment

It is important to note that an investment cannot have guaranteed returns or be given in exchange for some type of asset (i.e. an apartment or condo unit). Not only do these types of deals disqualify investors from receiving any form of visa, but they also put the regional center at risk for termination, as demonstrated by the termination of Lake Buena Vista regional center. USCIS’s policy manual defines a guaranteed return as “the right to eventual ownership or use of a particular asset in consideration of the investor’s contribution of capital into the new commercial enterprise…” The asset’s value is counted against the total investment amount, meaning that if an investor receives usage rights in a condo in return for a $800,000 investment in the same condo, the value of the condo unit will be deducted from the investment amount, instantly disqualifying the investor.

Some investors are unaware of this, and will opt into agreements which look safe to the untrained eye. Attorney Michael Harris states, “utilizing part or all of your EB-5 capital contribution as a means of securing a future benefit of real estate in the name of the EB-5 investor may likely be a violation of USCIS long-standing precedent decisions and current policy. Any benefit, including what may be deemed to be an intangible benefit such as usage rights, perhaps even a preferable time frame to finalize a real estate closing, may endanger an EB-5 investment.” It is critical to ensure that this type of business is not conducted under the EB-5 program for the benefit of your regional center and your investors.

面向开发商、企业主和政府

更多资源

找不到合适的资源

请使用此工具找到最适合您需要的 EB-5 资源。

联系我们

如果您有任何问题、咨询或合作建议,请随时联系我们。