AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

26th December, 2025

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid 2024 fees, codification of RIA processing timelines, transparency around the new technology fee, investor-protective implementation of new Form I-527, tiered fees to preserve market choice, and technical fixes for derivative investors.

On October 23, 2025 USCIS released a Notice of Proposed Rulemaking (NPRM) on its proposed updates to EB-5 fee rule following AIIA’s recent legal victory over the agency regarding its previous unlawful petition fee increase back in 2024.

On December 21, AIIA submitted formal comments in response to USCIS’s NPRM. While AIIA supports several aspects of the proposal, we also raised critical questions and recommendations aimed at protecting EB-5 investors and ensuring the agency delivers on its statutory commitments.

What does the NPRM cover

The NPRM would substantially overhaul the fee structure for the EB-5 program. Some of the most significant changes include:

- Adjusting all EB-5 immigration benefit request fees, including I-526s, I-829s, and I-956s, based on the results of a statutorily required fee study conducted under the EB-5 Reform and Integrity Act (RIA). The newly proposed fees are lower than the previously implemented unlawful fee increase but higher than the old rule applicable prior to April 2024.

- Codifying statutory requirements and elements of the RIA directly into the fee regulations, with the goal of aligning the fee schedule with the program’s mandates.

- Proposing a new “EB-5 technology fee” to support modernization of systems and processes used to adjudicate EB-5 filings.

- Introducing a new form (Form I-527) for amendments to legacy I-526 petitions, filling a procedural gap for certain pre-RIA investors impacted by regional center termination or debarment, which would carry its own fee.

- Updating fee provisions related to the EB-5 Integrity Fund and associated penalties, including proposed inflation adjustments to Integrity Fund fees for regional centers and timelines for payment obligations.

Why this proposed rulemaking is important

The proposed fee rules not only determine how much investors and stakeholders must pay, but they also signal how strong USCIS’s commitments on service delivery, transparency, and accountability truly are. For EB-5 investors, who already face long adjudication backlogs and heightened integrity requirements under the RIA, the NPRM (and the final rule that shall be based on it) will directly affect:

- Whether higher fees translate into faster and more predictable adjudications;

- Whether investors who overpaid under the now-stayed 2024 fee rule will automatically receive refunds;

- How investor-protection mechanisms under the RIA, particularly Section 203(b)(5)(M) (also commonly known as the Good Faith Investor’s protection), are implemented in practice; and

- Whether fee design choices preserve meaningful investment options for EB-5 petitioners rather than pushing the market toward regional center consolidation and fewer choices.

As such, the NPRM will determine whether the EB-5 program operates as Congress intended—or whether investors will bear higher administrative costs without corresponding improvements.

AIIA’s comment and response

In AIIA’s formal response to the NPRM, we structured our comments around six core issues we have identified in USCIS’s proposal. Each reflects a balance between supporting effective program administration and ensuring meaningful protections for the EB-5 community.

- Support for revised EB-5 fee levels and refunds for fees paid under the stayed 2024 fee rule: AIIA expressed support for the proposed EB-5 fee levels, noting that they are lower than those imposed under the 2024 fee rule and would hopefully be sufficient to result in higher quality and more timely adjudications. At the same time, AIIA emphasized that many investors overpaid under the now-stayed 2024 fee rule and asked USCIS to clearly explain how and when refunds will be issued to affected petitioners.

- Codification of the RIA’s processing time goals: AIIA urged USCIS to codify the RIA’s statutory processing time goals in the final regulations. Because the NPRM proposes fees intended to achieve those goals, AIIA argued that the agency should formally commit to them in regulation, consistent with long-standing precedent in other immigration benefit contexts. Codification would provide transparency, accountability, and measurable benchmarks for investors paying higher fees.

- Transparency and milestones for the proposed EB-5 technology fee: While AIIA strongly supports investment in technology modernization, we raised concerns that the proposed technology fee lacks a public implementation plan. AIIA demanded USCIS to publish a clear roadmap with defined milestones, timelines, and performance benchmarks to ensure that fee revenue results in measurable processing improvements and avoids past modernization failures.

- Support and clarifications needed for the new Form I-527: AIIA supports the creation of Form I-527 to standardize amendments for certain pre-RIA investors affected by regional center termination or NCE/JCE debarment. However, AIIA stressed that the form must function as an investor-protection mechanism, not a penalty. AIIA proposed safeguards including priority date retention, scope-limited review, reasonable flexibility where court proceedings delay redeployment, electronic case linkage, and clear guidance on when the form is required and how Good Faith Investor protections should be applied.

- Tiered fee structures for regional centers to preserve investor choice: AIIA cautioned that flat EB-5 project and regional center fees disproportionately burden smaller projects and encourage market consolidation, reducing meaningful options for investors. Drawing on existing USCIS precedent, AIIA recommended a tiered fee structure (particularly for Form I-956F) based on total project cost as a practical and administrable proxy for adjudicative workload and complexity.

- Technical corrections related to derivative filings: Finally, AIIA urged USCIS to address technical issues affecting derivatives EB-5 petitioners, including aligning Form I-829 filing deadlines with the expiration of the derivative’s conditional status rather than the principal investor’s, and clarifying what substitute evidence may be accepted when the principal investor is deceased, divorced, removed, or otherwise unable to cooperate.

At the end of the day, AIIA’s comment underscores a central principle: if USCIS is asking EB-5 investors to pay more, it must also provide clearer rules, stronger investor protections, and measurable improvements in processing and performance. As always, our work would not be possible without the support of the EB-5 investor community and industry stakeholders that put their investors before profits. Please consider donating to AIIA or joining our membership program so we can continue to fight for the rights of immigrant investors.

Related Posts

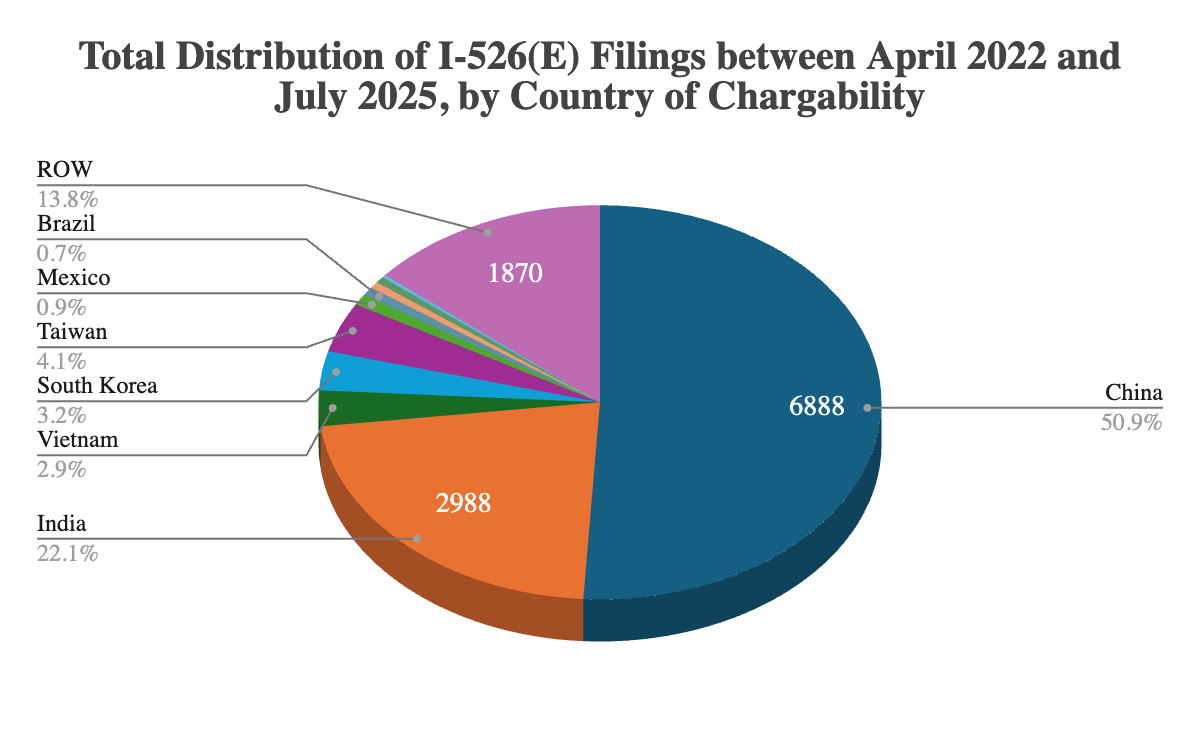

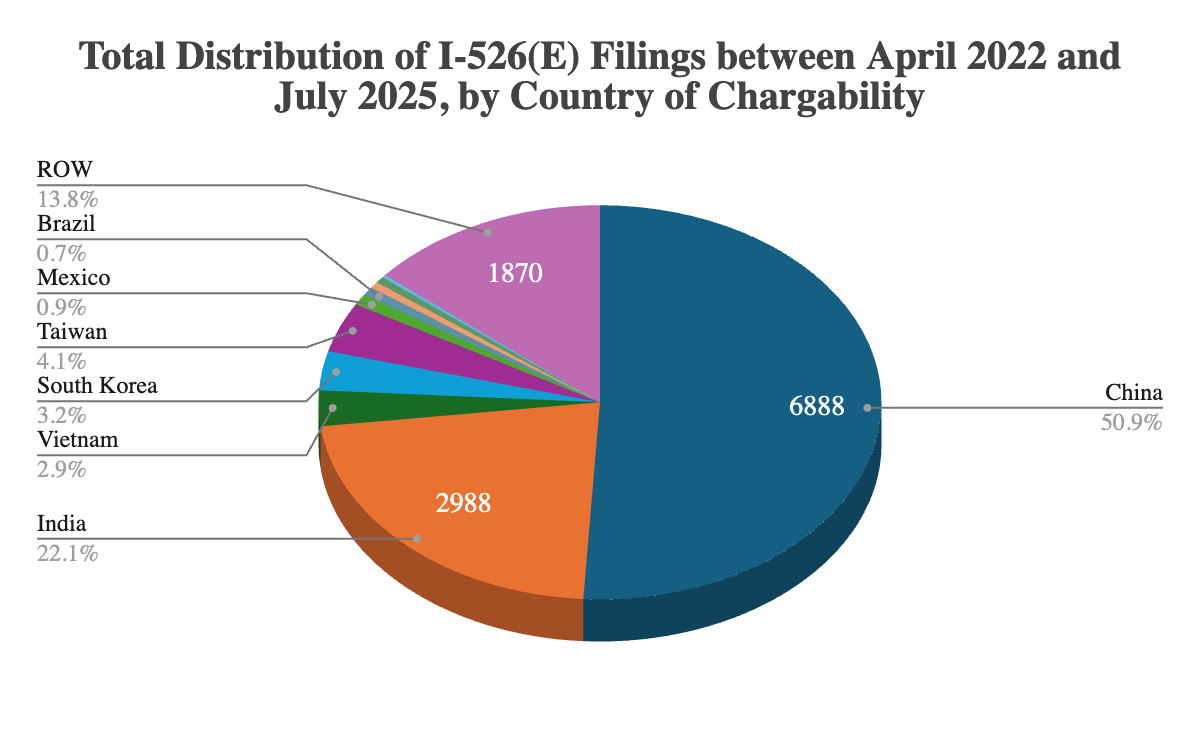

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

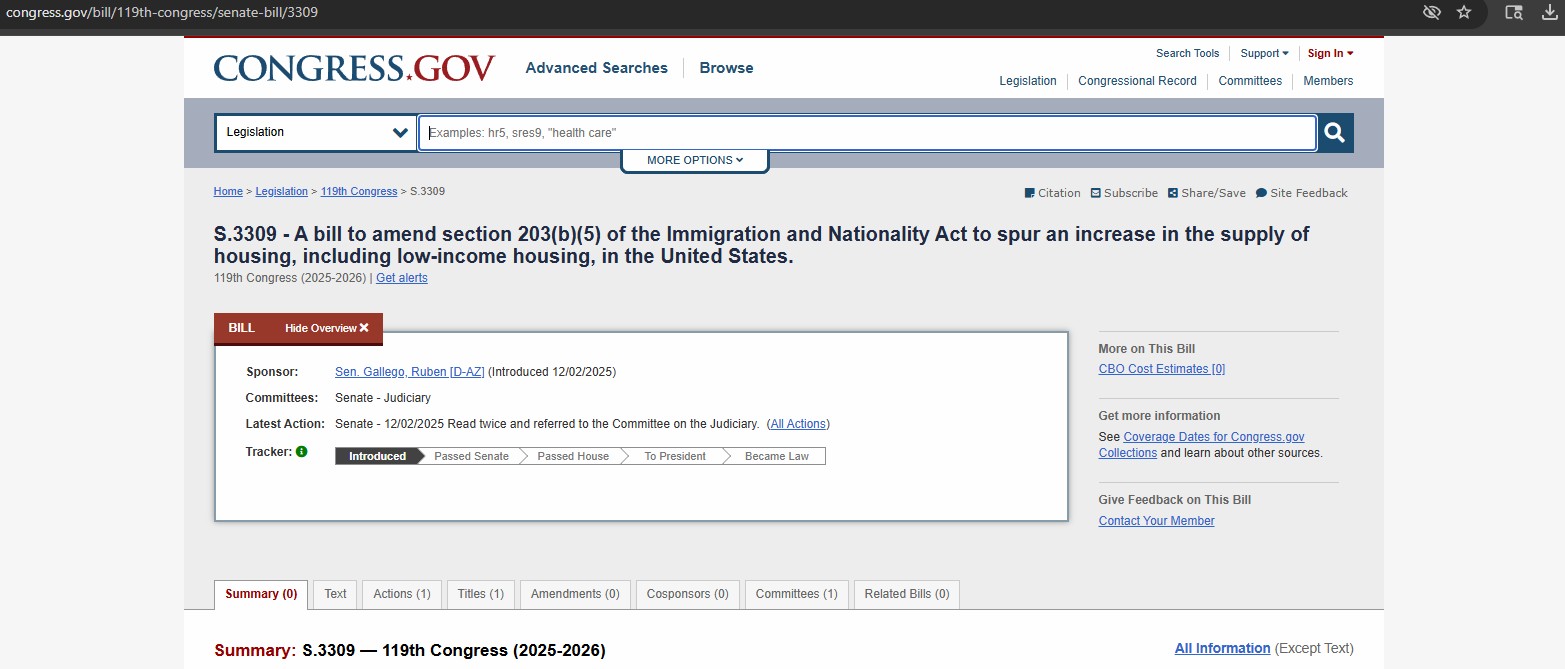

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

We Won The EB-5 Fee Increase Lawsuit

One Year Left to Invest in a EB-5 Regional Center Project

Stay Up To Date With AIIA

Join our newsletter to stay up to date on EB-5 updates.

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Recommended Resources

The Issue of Aging Out in EB-5

The Child Status Protection Act (CSPA) helps freeze a child’s age on EB-5 petitions, but long visa backlogs still risk...

Read More

The Sale of EB-5 Securities Offerings

EB-5 securities sales often use Regulation D (U.S. investors) and Regulation S (foreign investors) exemptions to avoid SEC registration while...

Read More

Choosing between Direct vs Regional Center EB-5 financing

Direct EB-5 suits single investors creating direct jobs; Regional Center EB-5 pools multiple investors, counting direct and indirect jobs for...

Read MoreRecent Blog Posts

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

Learn More

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

Sen. Gallego's EB-5 bill mobilizes foreign capital to build affordable housing. This collaboration has boosted AIIA's Congressional ties & credibility...

Learn More

We Won The EB-5 Fee Increase Lawsuit

AIIA successfully won its lawsuit against USCIS’s April 2024 EB-5 fee increases, with a federal judge ruling that the agency...

Learn More

One Year Left to Invest in a EB-5 Regional Center Project

AIIA warns that EB-5 Regional Center investors will lose protection after Sept. 30, 2026 unless they file I-526E petitions before...

Learn MoreGet In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.

Responses (0)