AIIA 提供了详细的数据分析,说明新的 FOIA 数据对后 RIA 投资者意味着什么,请阅读我们的博客和我们在 Youtube 上讨论这些数据的网络研讨会,了解更多信息。.

背景介绍

As part of our mission to advocate for EB-5 investors, AIIA has filed multiple Freedom of Information Act (FOIA) requests for information from USCIS on topics that impact the EB-5 immigrant investor community. These have included:

- Information on staffing levels at the IPO, which affects the speed of processing EB-5 petitions

- Data for I-526/I-526E receipts by country and set-aside category, which is crucial for estimating the waiting times for incoming investors

- Administrative policies on I-829 processing criteria in order to assist investors in successfully getting their petitions approved and

- Implementation of the EB-5 Reform and Integrity Act of 2022.

由于美国公民与移民服务局(USCIS)通常不会及时回应信息自由法案(FOIA)的要求,美国信息与移民服务局(AIIA)还对美国公民与移民服务局(USCIS)提起诉讼,以迫使该机构做出回应。我们已经收到并将继续收到价值数百页的文件,包括内部备忘录、电子邮件和培训手册。. AIIA 会员可以索取政府对 AIIA FOIA 申请的回复的完整副本。如果您想获得完整的数据集,请通过我们的 联系表.

Find this article too complex? Want even further specifics and predictions? Watch this webinar we did with some of the top EB-5 experts to further analyze the raw data and put forth possible wait time predictions on the different countries and visa categories.

AIIA was previously able to obtain data through April 2023 (reported here), and has now received a report through the end of 2023. The updated data contains the distribution of I-526 and I-526E receipts by TEA category and country of chargeability, which is crucial for understanding visa backlog and waiting time estimation in the new reserved visa categories. In this blog, we have analyzed the data to assess 1) economic impact of EB-5 in the post RIA world, 2) the trend in filings and 3) what the visa backlog/potential wait times could look like for investors.

In summary, the latest data indicates a moderate growth in demand for the Rural TEA category, but still below the needed level to absorb the near-term annual visa supply, including visas carried over from the previous year. Conversely, demand for visas in Urban High Unemployment TEAs remained high and is on track to surpass annual availability.

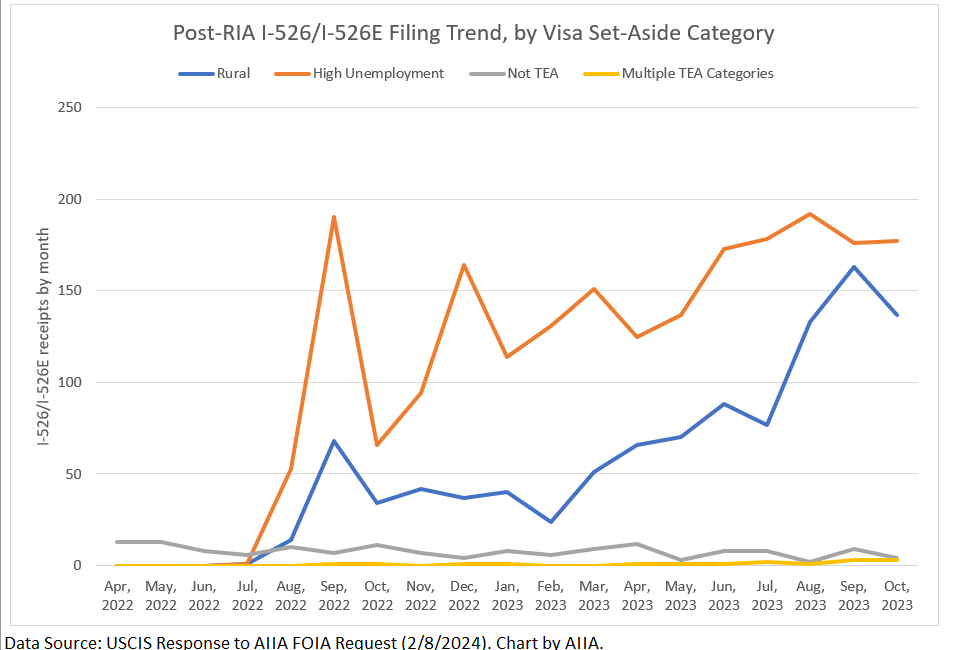

按 TEA 类别划分的需求趋势

Compared to the data we have previously received, this new batch of data clearly shows a surge in the number of petitions in the rural category. The number of rural I-526E petitions saw a significant jump afterJuly 2023 and is now close to the high unemployment category in terms of monthly applications (see chart 1). While the ratio of total rural I-526Es compared to total high unemployment I-526Es have been steadily rising from April’s 1:3 to around 1:2 as of today, it should still be noted that the demand and supply of rural and high unemployment categories is still lopsided, considering that the ratio of rural to high unemployment visa supply is 2:1.

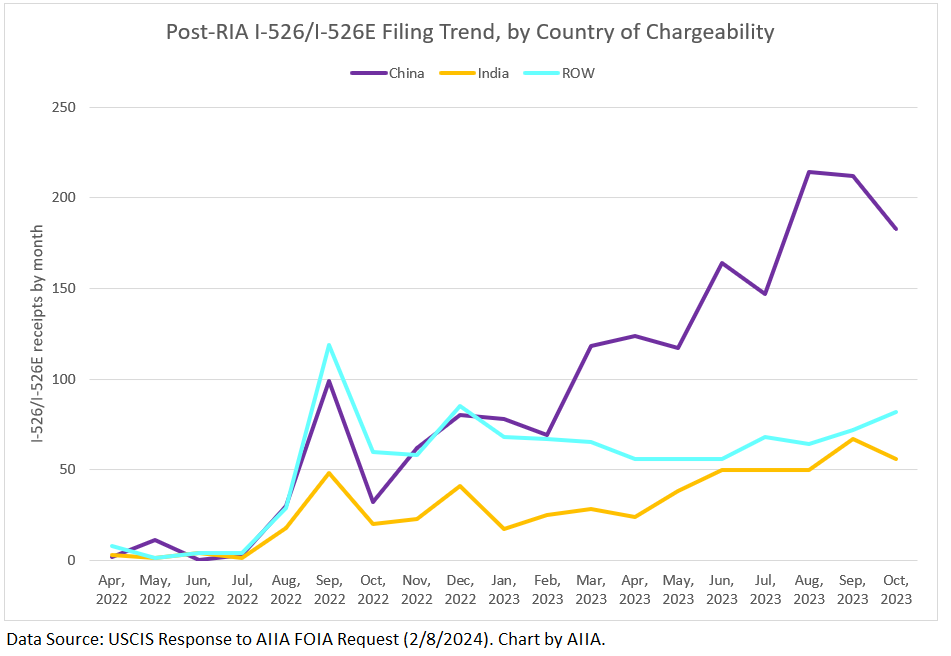

各国需求趋势

The data also shows demand from China increased, while that from India and other countries remained steady.

The table below shows the total number of I-526 and I-526E petitions filed after the enactment of RIA, including petitions for reserved visa categories. The key point to note is the high demand from the Rest of the World in the high unemployment category. This opens the potential for a visa backlog for the ROW investors and is also likely to affect the visa availability beyond the 7% country cap for investors from China and India.

Total number of I-526/I-526E filed from April 1, 2022 to November 2023, by TEA category and country of chargeability (latest stats as per our FOIA data)

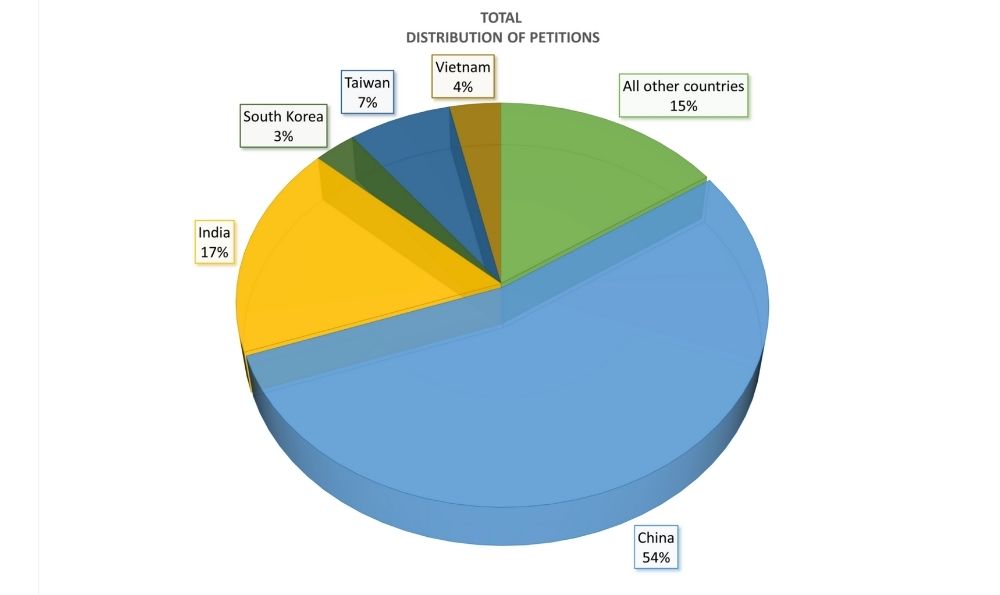

| 中国 | 印度 | 台湾 | 世界其他地区 | 总计 | % 共计 | |

| 农村地区 | 767 | 174 | 18 | 134 | 1,093 | 32% |

| 高失业率 | 976 | 375 | 209 | 625 | 2,185 | 63% |

| 基础设施 | 0% | |||||

| Multiple TEA Categories | 7 | 3 | 5 | 16 | 0.5% | |

| Not TEA | 26 | 21 | 6 | 97 | 150 | 4% |

| 总计 | 1,776 | 573 | 233 | 861 | 3,444 | 100% |

| % 共计 | 52% | 17% | 7% | 25% | 100% |

The pending inventory of I-526 and I-526E petitions represents an “invisible backlog” that is not reflected in the visa bulletin because they have not yet reached the visa stage. This backlog indicates the growing pipeline of people who will eventually apply for visas.

AIIA is doing its best to bring the invisible backlog out into the open. With this information, prospective investors can assess what they are getting into, pending applicants can see where they are in line, and responsible EB-5 investment issuers can protect their investors by advocating for visa relief. We believe the industry needs to band together and support any and all policies that make the inevitable backlog-induced wait times more tolerable.

While measures such as concurrent filing and decoupling sustainment of investment from the immigration timeline have helped mitigate concerns, visa relief remains crucial. The current visa numbers are insufficient to accommodate the investments made under the EB-5 program, highlighting the need for legislative action.

Congressional representatives should be delighted to hear that foreign EB-5 investors have already committed over $874 million into rural areas and $1.7 billion into distressed urban areas since the RIA was passed. A huge economic benefit attracted by the promise of a visa incentive! Congress should also realize that the current law under RIA only provides sufficient annual visas to actually deliver about $640 million in rural EB-5 investment and $320 million in high unemployment EB-5 investment annually.

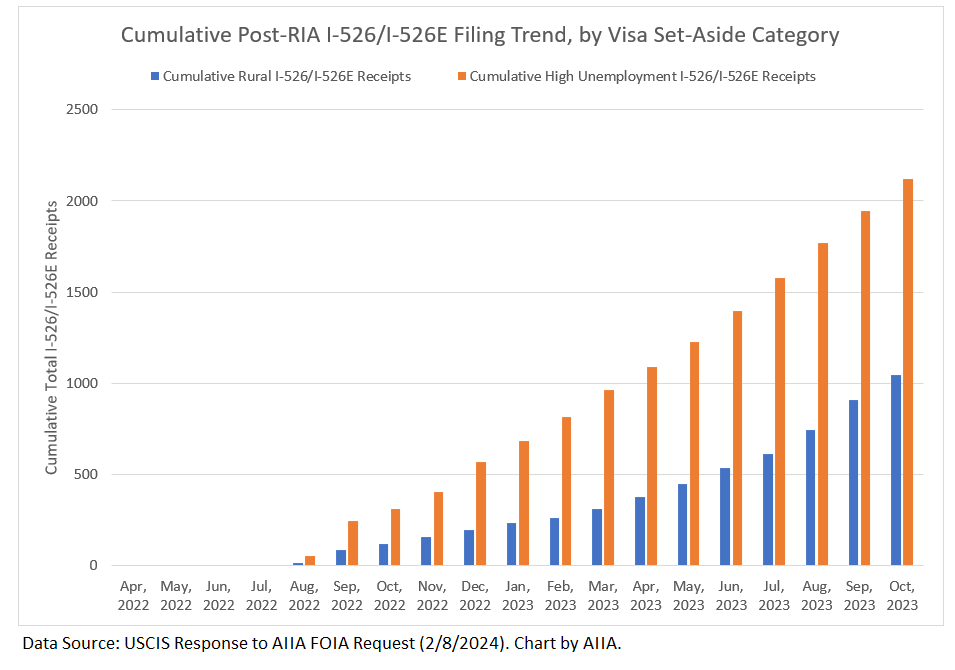

Comparing Demand with Supply

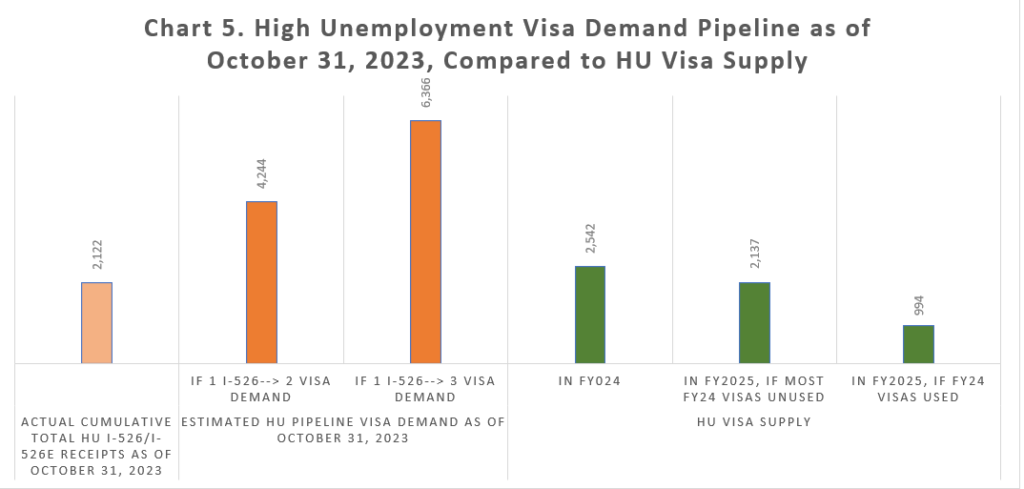

Based on the information we have, we can compare the demand pipeline with supply of visas and see whether a backlog is likely. To make the comparison, we first take the known number of I-526/I-526E receipts (each representing one investor) and convert that into an estimated number of future visa applicants (which includes investors plus spouses and children, less attrition from denials). We then compare pipeline visa applicants per category with visa supply per category in coming years. The demand/supply comparison shows that by the end of October 2023, cumulative pipeline visa demand significantly exceeded annual high unemployment visa availability, even in a year with extra carryover visas. Meanwhile, the rural demand pipeline appeared still below near-term visa supply, but high enough to absorb all available visas in a normal year.

Rural:

High Unemployment:

Please note:

*Actual cumulative I-526 and I-526E receipts from USCIS Response to AIIA FOIA Request (2/8/2024).

*Visa demand estimates multiply I-526/I-526E receipts by 2 or 3 (estimate considering addition of family and attrition from denials)

*Visa supply numbers are actual for FY2024; this supply can only be used as I-526s get approved in time.

*The first estimate for FY2025 assumes maximum possible carryover if FY24 visas unused; the second shows supply without carryover.

如果今天投资,等待签证的时间有多长?

Wait times result when visa demand exceeds limited annual visa supply. Estimating specific wait times starts with facts, including how many investors have already joined the queue for visas, how many visas will be available, and how visas get allocated by country and category. Then the estimate has to add assumptions on top of the facts, including assumptions about family sizes, future denial rates, and future I-526/I-526E processing speed, volumes, and priority. People with different agendas will use different assumptions and reach different conclusions. But it is critical for every estimate to at least start from facts. As an organization, AIIA will not tell you the one and only way to interpret the data, but we want to empower you with data to interpret for yourself. As we did with the April 2023 FOIA response, we also plan to host a webinar with industry experts explaining how they make wait-time estimates based on available information.

Individual wait time estimates are complex and open to difference of opinion, but the big picture is simple: demand > supply = wait times. By that metric, the high unemployment category was clearly already headed toward a significant backlog and visa wait times as of November 2023, the end of last year, while the rural category appeared to have some cushion but is approaching the backlog rapidly. Individual analysis should drill down more deeply and include the country factor. The backlog risk is especially a concern for applicants from China and India, considering that these countries have shown strong demand but are limited to 7% of available visas plus what is leftover from the rest of the world.

最终想法

投资者和专业人士依靠准确的数据为其客户做出有关移民和投资的明智决策。了解签证处理和签发时间表以及排队等候的投资者人数对 EB-5 计划至关重要,尤其是考虑到移民政策的不确定性。然而,美国公民与移民服务局(USCIS)并没有持续提供这些信息,这促使美国投资移民协会(AIIA)代表 EB-5 社区提出《信息自由法》申请。.

As a nonprofit organization, AIIA invests significant time and resources in acquiring, analyzing, and disseminating this data. We rely solely on donations to sustain our efforts, including funding FOIA litigation, lobbying, and daily operations. We urge anyone who values our work to enhance transparency in the EB-5 program to consider supporting us by making a donation or membership contribution. Your support is vital in ensuring that we can continue to advocate for transparency and equity in the EB-5 program, benefiting investors and industry professionals alike.

了解 AIIA 的最新动态

加入我们的时事通讯,了解 EB-5 的最新动态。.

一旦订阅,即表示您同意我们的隐私政策,并同意接收本公司的更新信息。

推荐资源

最近的博客文章

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

了解更多

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

了解更多

联系我们

如果您有任何问题、咨询或合作建议,请随时联系我们。

答复 (0)