美国投资移民协会(AIIA)获得的美国公民与移民服务局(USCIS)FOIA数据显示,RIA后的EB-5需求远远超过年度签证限额--高失业率地区约为10倍,农村地区约为4倍,这就造成了漫长的潜在等待时间,尤其是对中国和印度而言。我们请求您考虑捐款,以维持 FOIA 诉讼和投资者透明度的宣传。.

Background: As part of our mission to advocate for EB-5 investors, AIIA regularly files Freedom of Information Act (FOIA) requests for information from USCIS on topics that affect the EB-5 immigrant investor community. Because USCIS does not provide timely response to FOIA requests, AIIA regularly litigates against them to compel the agency to respond. In response to our recent lawsuit, USCIS has provided us with the filing, approval, and denial data for post-RIA investors as of January 2025. This is a crucial set of data for immigrant investors to determine the wait times to receive their green cards. We ask that you consider 捐助 to help us continue to pursue these efforts. AIIA Members may request a full copy of government responses to AIIA FOIA requests by reaching out to us through our 联系表. .AIIA 感谢 Alexandra George of the Galati Law Firm 为获得这些数据,他领导了针对移民局的信息自由法案诉讼工作。.

(来自中国的读者们可以通过以下链接访问AIIA微信公众号上发表的本文翻译: https://mp.weixin.qq.com/s/sByvBRo5uKSdhuN9GJ2t8Q)

We have previously reported the official data we received from USCIS by filing multiple lawsuits against the agency. This includes detailed data on I-526 and I-526E receipts from 2023 年 4 月, 2023 年 11 月 和 July 2024. USCIS has now provided AIIA with a report through January 31, 2025, with data queried by the USCIS Office of Performance and Quality in February 2025. The updated data contains the distribution of I-526 and I-526E receipts by TEA category and country of chargeability, which is crucial for understanding visa backlogs and estimating waiting times in the reserved visa categories.

The data provided by USCIS to AIIA is the most complete post-RIA I-526E report to date because (1) the report provides receipts by month, which is important for showing trends, and (2) the report provides data that USCIS queried recently, in February 2025. The query date is important, because USCIS takes time to enter receipts into the database. The report that USCIS provided to AIIA states that 9,878 petitions (i.e., I-526 and I-526E) were filed in total between April 2022 and January 2025.

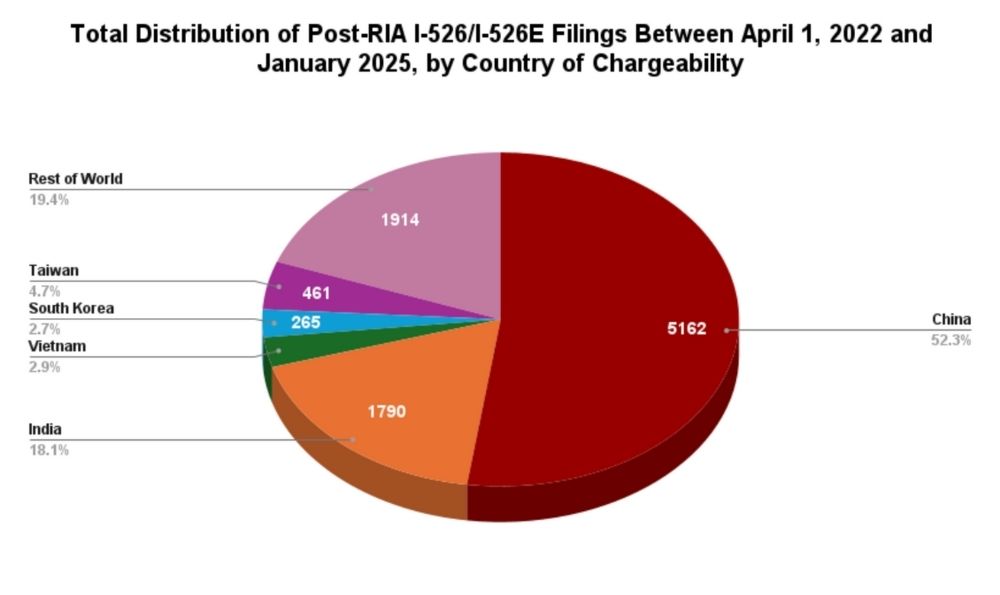

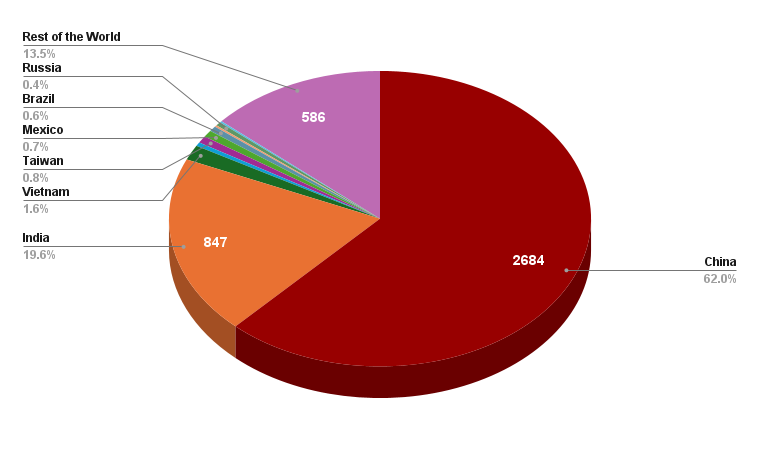

Total number of I-526/I-526E petitions filed between April 1, 2022 and January 31, 2025 by TEA category and country of chargeability (latest statistics as per USCIS data queried February 2025 in response to AIIA FOIA request)

| 中国 | 印度 | 世界其他地区 | 总计 | % 共计 | |

| 农村地区 | 2,684 | 847 | 798 | 4,329 | 44% |

| 高失业率 | 2,380 | 883 | 1,928 | 5,191 | 53% |

| 基础设施 | 0% | ||||

| 其他 | 98 | 60 | 200 | 358 | 4% |

| 总计 | 5,162 | 1,790 | 2,926 | 9,878 | 100% |

| % 共计 | 52% | 18% | 30% | 100% |

By the end of January 2025, a total of 5,191 investors had filed I-526/I-526E petitions in the high unemployment (HUA) set-aside category, and 4,329 investors had filed petitions in the rural category. These figures entail a demand of approximately 10,400 HUA visas and 8,700 rural visas (taking into account the estimated number of derivative petitions by dependents , such as wives and children, and denial rates). The figures far outstrip the statutory annual visa availability of 1,000 high unemployment set-aside visas and 2,000 rural set-aside visas.

按 TEA 类别划分的需求趋势

Global Post-RIA I-526/I-526E Filing Trends, by Visa Set-Aside Categories

The above chart shows that rural petitions have steadily narrowed the gap with HUA petitions since our previous update in July 2024.

各国需求趋势

Global Post-RIA I-526/I-526E Filing Trend, by Country of Changeability for HUA category

Global Post-RIA I-526/I-526E Filing Trend, by Country of Changeability for Rural category

The petition trends across countries have started to stabilize after the turbulence of March 2024 caused by the fee increase, with Mainland China and India resuming their respective normative petition volumes in more recent months. The petitions filed by all other countries have remained robust post-March 2024 as well.

中国农村与 HUA

来自中国大陆的农村与高失业率 I-526/I-526E 申请

印度农村与 HUA

来自印度的农村与高失业率 I-526/I-526E 申请

EB-5 热门市场需求比较

Distribution of I-526E Filings for the Rural Category (April 2022 to January 2025)

Distribution of I-526E Filings for the High Unemployment Category (April 2022 to January 2025)

The proportions of petitions coming from both Mainland China and India across both the Rural and the High Unemployment categories have remained stable since the last FOIA data release.

What does this data mean for the invisible visa backlog?

As of January 2025, there was demand for 10 times as many High Unemployment visas and 4 times as many Rural visas, compared to their respective annual visa supply numbers.

| 高失业率 | 农村地区 | |

| Actual investor I-526 / I-526E filed 2022 to Jan 2025 | 5,191 | 4,329 |

| Estimated average visa demand per I-526/I-526E filed | 2 | 2 |

| Estimated pipeline visa demand as of Jan 2025 | 10,382 | 8,658 |

| Base Annual Visa Supply | 1,000 | 2,000 |

| Worldwide pipeline demand / Base Annual Visa Supply | 10.4 x | 4.3 x |

If visas were issued first-in-first-out (FIFO) with no country limit, it would mean about a 10-year wait time for high unemployment and 4-year wait time Rural for investors with priority dates after January 2025. Since there are country limits on visa allocation, actual visa wait times could be much less for new investors from the Rest of the World and much greater for new investors from Mainland China and India.

Take the example of an Indian investor today considering a TEA investment. Should he expect to wait 5 to 10 years or more for a visa, considering the number of rural and high unemployment investors already queued up? The answer would be “Yes,” if TEA investors could only get TEA visas. However, a TEA investor may also choose after I-526E approval to be allocated an Unreserved visa. The Unreserved category also has backlogs, but the Unreserved pre-RIA backlog for India-born petitioners may be cleared within 5 years – making it possibly the soonest-available visa for India-born investors in 2025 regardless of whether they choose to invest in a rural or high unemployment TEA. If the China pre-RIA Unreserved backlog may possibly be cleared in about 8 years, then the Unreserved category may also be a fallback for China-born TEA investors. The backlog situation and visa wait times for China and India TEA investors can also be improved if many Rest of World TEA investors elect to take Unreserved visas following I-526E approval. Otherwise, if TEA investors from China and India were actually limited by TEA category and country caps, then wait times would be astronomical, given that pipeline visa demand from China and India far exceeds 7% of rural and high unemployment visas.

In Summary

The major highlights we can see from this dataset are that 1) Demand for EB-5 visas has increased since April 2024, within every TEA category and every country group; 2) Demand for Rural TEA visas has consistently outpaced demand for high unemployment; and 3) China continued to show the strongest demand growth. By studying the monthly visa issuance data and the fact that only 3% of the visas for the year have been issued, it is very likely that the visa bulletin will remain current for the rest of the year. We can make this prediction with some confidence given the fact that only 351 HUA and 1,126 rural petitions have been approved as of January 2025. This topic will be explored further in a future blog post.

作为一个非营利组织,AIIA 投入了大量的时间和资源来获取、分析和传播这些数据。我们完全依靠捐赠来维持我们的工作,包括资助 FOIA 诉讼、游说和日常运营。我们呼吁任何重视我们提高 EB-5 计划透明度工作的人考虑通过以下方式支持我们 捐款 或 会费. .您的支持对于确保我们能够继续倡导 EB-5 计划的透明度和公平性至关重要,从而使投资者和行业专业人士都能从中受益。.

了解 AIIA 的最新动态

加入我们的时事通讯,了解 EB-5 的最新动态。.

一旦订阅,即表示您同意我们的隐私政策,并同意接收本公司的更新信息。

推荐资源

最近的博客文章

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

了解更多

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

了解更多

联系我们

如果您有任何问题、咨询或合作建议,请随时联系我们。

答复 (0)