美国投资移民协会强烈反对由 IIUSA 和区域中心提起的 IIUSA 诉 Blinken 的诉讼,该诉讼旨在阻止将未使用的预留 EB-5 签证转入无保留类别,认为这将损害面临大量积压的 RIA 前投资者。虽然 IIUSA 声称这一行动将有助于预留类投资者,但 AIIA 却声称,这将减少已在等待的预留类投资者的可用签证,从而损害预留类投资者的利益。.

AIIA has always defended EB-5 immigrant investors against attempts by regional centers (RCs) to unlawfully and unfairly rewrite the program’s rules. Most recently IIUSA filed a suit against The Department of Homeland Security (DHS) concerning the definition of the “sustainment period” for post-RIA investments. There, IIUSA’s egregious lawsuit defies the clear statutory text and seeks to misuse the judiciary to overturn laws passed by Congress that were intended to allow investors to timely receive their funds back. AIIA has vigorously opposed the EB-5 industry’s anti-investor legal positions.

IIUSA and a group of RCs have filed a new lawsuit: IIUSA v Blinken. Although framed as a lawsuit to benefit investors, IIUSA wants to prevent the reallocation of unused EB-5 visas. If successful, the lawsuit will benefit regional centers, could significantly hurt pre-RIA investors without much help to post-RIA investors. On balance, the lawsuit has far more downside than upside for investors.

The full complaint that was filed in court can be 从此处下载.

Read below for a summary of the lawsuit, why RCs have filed this lawsuit, the potential harm it does to investors and our analysis of the legalities of this case.

The Lawsuit

IIUSA and RCs (“Plaintiffs”) filed a civil action in the U.S. District Court for the Eastern District of Wisconsin on August 6, 2024 with no formal public statement from the organization or any other regional centers involved in the case.

Plaintiffs are asking the District Court to hold unlawful and set aside a decision by the U.S. Department of State to implement the EB-5 Reform and Integrity Act (RIA) by carrying over unused reserved visas. The RIA specifies that unused set-aside EB-5 visas, at the end of the succeeding fiscal year (FY), are transferred (i.e., ‘carried over’) into the unreserved EB-5 category.

IIUSA believes that the RIA’s text requires set-aside visas to remain within the EB-5 program, even if unused, after “carrying over” into the unreserved category. They claim that the Department of State’s interpretation of the RIA on these grounds is wrong. IIUSA contends that post-RIA, unused set-aside visas should never be rolled up into other categories.

IIUSA admonishes U.S. Citizenship and Immigration Services (USCIS) for its slow processing of EB-5 immigrant petitions (i.e., I-526E) for post-RIA investors. It claims that USCIS’ inaction is the reason for set-aside EB-5 visas ‘rolling’ into the unreserved category. It also claims that the current prioritization of other EB-5 petitions (i.e., for unreserved pre-RIA investors) is unlawful in that Congress sought to prioritize certain post-RIA set-aside visa categories (e.g., for rural).

Plaintiffs argue that USCIS and DOS have made several mistakes that have contributed to the delays and inefficiencies in the EB-5 program. These mistakes include issuing incorrect receipt notices, rejecting petitions for missing receipt notices, failing to implement a pre-paid return envelope system, failing to provide electronic copies of receipt notices and mis-allocating unreserved visas by granting set-aside investors green cards in the unreserved category.

To these ends, IIUSA is requesting the the court to:

- Overturn the Department of State’s interpretation of the RIA as permitting “rollover” into other employment-based or family-based immigration categories.

- Prevent unreserved EB-5 visas from “rolling up” into the EB-1 and family-based categories.

- Prevent set-aside EB-5 visas (for petitions filed post-RIA in FY 2023) from moving into the unreserved EB-5 category if underutilized in the fiscal year.

Why IIUSA Filed This Lawsuit

IIUSA has crafted a lawsuit that appears beneficial to EB-5 investors but, in reality, harms pre-RIA investors who are awaiting for their priority dates to become current. The RC’s motivation is unlikely to be any concern for investors, but the commercial priorities of regional center investors.

Most RCs, which focus on set-aside EB-5 visas, are profitable only if they can convince prospective immigrant investors to invest funds through their investment offerings.

When a visa category is oversubscribed by natives of a certain country, a backlog ensues until the priority date becomes “current” on the Department of State’s visa bulletin.

Prospective investors are unlikely to participate in regional centers’ programs if the EB-5 category in question is backlogged. If so, it’s expected that regional centers will see a decline in revenue.

Hence, the regional center plaintiffs (and their umbrella group, IIUSA) are concerned that (1) oversubscription will soon occur in set-aside categories due to excess demand for set-aside immigrant visas and (2) USCIS’s inefficiency in the processing of EB-5 immigrant visa petitions will result in moving or rolling over set-aside visas away from the set-aside category and into the unreserved category. They are trying to keep as many visas in the newly formed set-aside category as possible.

As the complaint reads, “by not using the visas that are available now for the [set-aside] investors and their family members that have applied now, Defendants are setting up a future visa backlog…the result will be a large number of visa applicants competing for a small number of visas.” IIUSA refers, of course, only to set-aside visas, through which their RCs currently make money.

IIUSA’s objective of keeping as many set-aside visas available to its RCs as possible, would be too self-serving if articulated on its own in a lawsuit and there would likely be no legal cause of action for a federal court to intervene. IIUSA’s argument is primarily driven by policy concerns, not legal concerns. Hence, IIUSA has couched their effort in a broader attack on USCIS’s inefficiency and the “rolling up” of unreserved visas to EB-1. As we will explain below, these problems are of far less concern than their proposed freeze on the rolling over of set-aside visas.

The Harm to Investors

Should the Plaintiffs’ claims be accepted and the proposed injunctions granted, pre-RIA investors in the unreserved category would be greatly harmed.

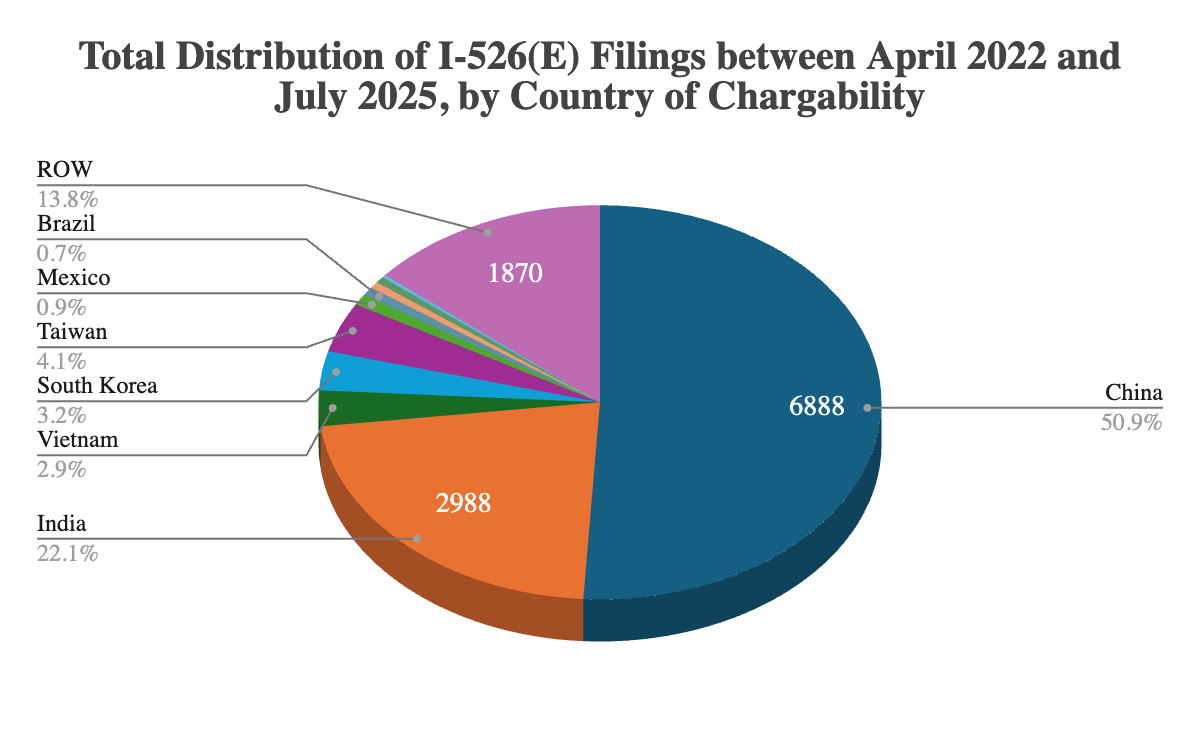

Mainland China and India-born pre-RIA investors in the unreserved category currently have Visa Bulletin backlogs, to 12/2015 and 12/2020, respectively. During this time, these investors have been unable to begin their period of Conditional Lawful Permanent Residency (CLPR) as their priority dates are not yet current (earlier than the current cut-off date in the monthly Visa Bulletin). Some have waited for nearly a decade to begin CLPR status, which also marks the “official” start of their investment sustainment period. During this time, their investments have often been redeployed on unfavorable terms and without their consent. It’s a terrible situation for which AIIA was, in part, founded to combat.

All these harms would continue if the RCs win this case. There remains a high backlog of pre-RIA investor petitions that USCIS has yet to process. Clearing this backlog, so that pre-RIA investors can finally receive their immigrant visas and LPR status, is a top priority for AIIA. It requires as many visas as possible to be made available in the unreserved category for USCIS and, thereafter, the Department of State, to allocate to pre-RIA investors and their families. Hence, the rolling over of visas into the unreserved category every year must continue to ensure pre-RIA investors get their LPR status in a timely manner. This would also be beneficial to make way for post RIA applications as the pre RIA petitions would clear up by the time USCIS is able to process most of the post RIA applications. Thereby allowing effective utilization of visas to pre-RIA investors and their families.

Right now, amid its inefficiencies, USCIS has apparently prioritized the processing of unreserved pre-RIA I-526 petitions—a very fair decision, given how long these petitioners have waited compared to more recent petitioners. The rate of allocation of unreserved category visas is much higher than set-aside category visa allocations, which means that the latter category is often underutilized. More set-aside visas, hence, are being rolled over into the unreserved category, which USCIS is using fully to clear the existing backlog. IIUSA acknowledges this fact in its complaint, writing that. “Defendant USCIS appears to be processing legacy I-526 petitions at nearly 10 times the rate it is processing I-526E petitions.”

Separately, it must be observed that this admission negates IIUSA’s claim that the rolling over of unreserved EB-5 visas to EB-1 is a current problem. This type of rollover is minuscule because the government claims to have allocated all unreserved EB-5 visas this year. Unreserved investors are not threatened by the loss of visas to EB-1, but rather are greatly threatened by the absence of rollover visas from the set-aside categories to the unreserved categories.

IIUSA’s effort to prevent the rollover of set-aside visas will be unhelpful unless USCIS’s adjudication times are improved (an unlikely outcome in any scenario). Keeping 4,200 more visas in the set-aside category is likely to be useless, because the adjudication pace of post RIA petitions and the pace of issuance of visas looks unlikely to produce sufficient applicants to even absorb next year’s regular allocation.

If accepted it would could potentially result in a ROW (rest-of-the world) cut-off date for the unreserved category in 2025 or 2026, as well as hurt China and India’s backlogs causing investors from those countries to lose access to 4,238 rollover visas from the set-aside categories in FY 2025.

The validity of IIUSA’s legal standings

The crux of IIUSA’s case is that the RIA does not permit set-aside visa rollover into the unreserved category because of the RIA’s mandate that set-aside EB-5 petitions should receive “priority” in adjudication. They presume this recent statutory language in the RIA takes precedence over previous laws that mandate the rolling over of unused visas across categories.

IIUSA’s position runs afoul of the plain language of the RIA.. An extract of Section 102 of the RIA addresses how visas are allocated and carried over (boldface emphasis added) by providing, in relevant part:

“(B) DESIGNATIONS AND RESERVED VISAS.—

(i) RESERVED VISAS.—

(I) IN GENERAL.—Of the visas made available under this paragraph in each fiscal year—

(aa) 20 percent shall be reserved for qualified immigrants who invest in a rural area;

(bb) 10 percent shall be reserved for qualified immigrants who invest in an area designated by the Secretary of Homeland Security under clause (ii) as a high unemployment area; and

(cc) 2 percent shall be reserved for qualified immigrants who invest in infrastructure projects.

(II) UNUSED VISAS.—

(aa) CARRYOVER.—At the end of each fiscal year, any unused visas reserved for qualified immigrants investing in each of the categories described in items (aa) through (cc) of subclause (I) shall remain available within the same category for the immediately succeeding fiscal year.

(bb) GENERAL AVAILABILITY.—Visas described in items (aa) through (cc) of subclause (I) that are not issued by the end of the succeeding fiscal year referred to in item (aa) shall be made available to qualified immigrants described under subparagraph (A).”

As the extract clearly evinces, the RIA both contemplates and explicitly authorizes the roll over of unused set-aside visas to the unreserved category (who are described in subparagraph (A) of the RIA, section 102. The language is unambiguous.

EB-5 regional centers cannot legitimately use the judiciary to overturn a law passed by Congress for the principal purpose of changing policies for its own benefit. IIUSA can only legitimately argue that USCIS has improperly interpreted a law passed by Congress, or that the law itself is unconstitutional. The role of the judiciary is not to change public policies, but merely to adjudicate disputes about the meaning and validity of laws.

We trust that the Court will uphold the plain language of the RIA and strike down IIUSA’s attempt to manipulate the statute for the benefit of Regional Centers. There is no need for rule-making where, as here, the language is plain and IIUSA’s attempt to create a gap in the RIA falls flat and reeks of desperation.

Interestingly, this complaint contradicts the earlier lawsuit filed by IIUSA concerning the investment sustainment period as it admits that the RIA did change the rules for sustainment for post-RIA. See line 62 and 93 from the complaint –

- The RIA now defines the investment period as “at least two years.” For Legacy Investors, this “sustainment period” is the two years of conditional residence- which does not begin until an investor becomes a conditional resident.

- Pursuant to the RIA’s new definition of the sustainment period, an investor may be entitled to a return of capital long before he or she gets a green card or files an I-829 petition

It will be interesting to watch IIUSA’s counsel reconcile their inconsistent interpretations of the RIA.

Conclusion and AIIA Action

In sum, IIUSA advances a legal argument that is contrary to the demands of the plain language of the statutory text. Plaintiffs are trying to use the judiciary to change public policy for non-legal reasons, a practice that is both unlawful and heavily disfavored by judges. The rollover of set-aside visas that sustain RC profitability may hurt regional center’s financial interests, but they have no recourse other than persuading Congress to change the law, which itself is unlikely to happen. The EB-5 regional center industry is not a victim of bad laws or bad administrative practices, but of market forces and the high demand for a limited supply of visas. It must accept the outcome even as its self-interest is hurt.

IIUSA’s policy claim that set-aside visas must remain in the set-aside category (i.e., not rolled over) to avoid backlogs is pointless. Unless IIUSA can change USCIS processing times for petition adjudication, preventing the rollover of visas in successive fiscal years will have no effect on availability to post RIA investors. IIUSA is also seeking to prioritize the adjudication of set-aside visas with this lawsuit, but it is unlikely to succeed (given that the slow pace of adjudication is due to bureaucratic inefficiencies, which cannot be changed by judicial pronouncements).

Worse, if IIUSA’s claims were to succeed, they would severely hurt investors from the unreserved category, especially those before the RIA was enacted. AIIA stands with all EB-5 investors and is opposed to IIUSA’s lawsuit in its current state. We believe that pre-RIA investors must benefit from set-aside visa rollovers so they can obtain LPR status as soon as possible.

There is one redeeming claim in this lawsuit. IIUSA argues that EB-5 visas carried over from the Reserved categories should never be “rolled up” from Unreserved to other employment-based immigration categories (e.g., EB-1, EB-2, et. cetera). All immigrant investors benefit when as many EB-5 visas are available as possible and that is something we as an organization can get behind. In the future, should USCIS become more inefficient at processing EB-5 immigrant petitions, preserving visas in the EB-5 category will be crucial to ensuring investors can immigrate in a timely manner.

AIIA will continue to monitor the case. We may choose to intervene and/or file an amicus brief, as deemed necessary. Such decisions will be based on the advice of legal counsel.

Our work would not be possible without the support of people like you. Please consider 向 AIIA 捐款 或 加入我们的会员计划 这样我们就能继续为投资移民争取权利。.

了解 AIIA 的最新动态

加入我们的时事通讯,了解 EB-5 的最新动态。.

一旦订阅,即表示您同意我们的隐私政策,并同意接收本公司的更新信息。

推荐资源

最近的博客文章

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

了解更多

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

了解更多

联系我们

如果您有任何问题、咨询或合作建议,请随时联系我们。

答复 (0)