AIIA Obtains I-526E Inventory Data for Backlog Assessment

13th November, 2023

AIIA has now received a never before seen look at the I-526(E) petition inventory held at the USCIS as of April 2023. This data was obtained through a Freedom of Information Act (FOIA) request and litigated by AIIA. Now, we must continue the fight for transparency and continue to push USCIS for further information about EB-5 petition inventories and processing delays at USCIS.

Background: AIIA filed multiple Freedom of Information Act (FOIA) requests for data from USCIS which concerns the EB-5 immigrant investor community. These requests included information on staffing levels at the IPO, up-to-date inventories of pending petitions by country of chargeability and set aside visa, administrative policies on I-829 processing criteria, and implementation of the Reform and Integrity Act of 2022. AIIA initiated litigation against USCIS to compel them to respond to our various FOIA requests. We have received, and will continue to receive, hundreds of pages worth of documents including internal memos, emails and training manuals. This is our third blog in this series; read the first one here and second one here. AIIA Members are entitled to a full copy of the government’s FOIA response. If you would like to receive the complete dataset, reach out to us through our contact form.

How much demand for EB-5 set-aside visas has already accumulated? Is there any risk yet of backlogs in the TEA rural, high unemployment, or infrastructure set-aside categories, particularly for investors from China and India? After months of effort, AIIA is finally able to empower prospective investors with data relevant to these questions.

Assessing pipeline demand requires knowing how many people are entering the pipeline by filing I-526/I-526E for each set-aside category and from each high-demand country. The current Visa Bulletin shows a lack of qualified applicants at the visa stage, but the amount of future visa demand earlier in the pipeline, at USCIS, has been unknown.

USCIS does not regularly publish I-526/I-526E filing data by category or country, but AIIA has worked hard to obtain it. We requested the data in advance of the USCIS EB-5 Stakeholder Meeting in April 2023, filed a Freedom of Information Act (FOIA) request in May 2023 when USCIS failed to respond at the meeting, and followed up in July 2023 with a lawsuit filed on behalf of AIIA by the Galati Law Firm.

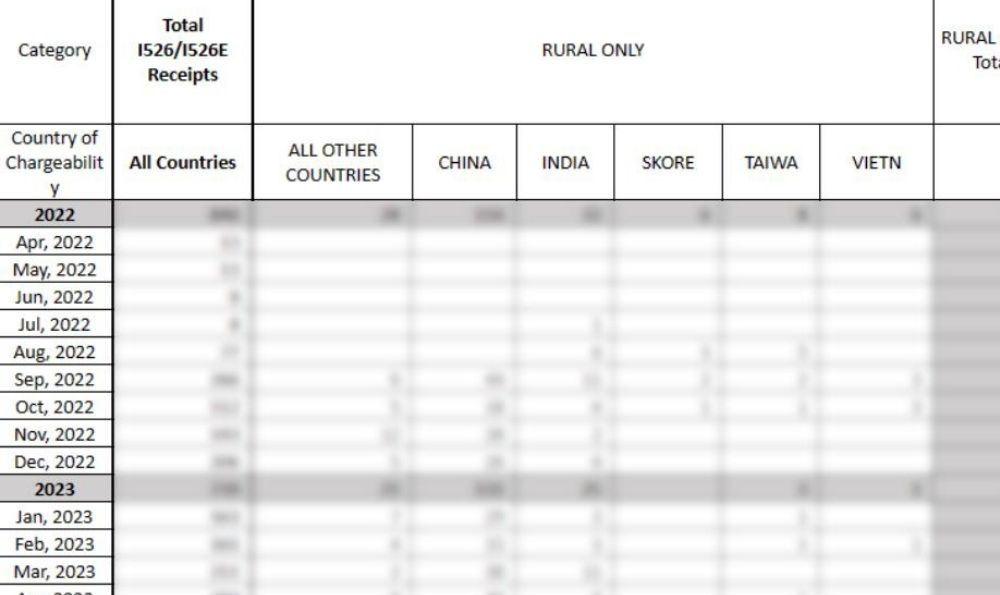

Thanks to the diligent work of attorneys Halston Chavez and Matt Galati, USCIS has now responded to AIIA’s FOIA request, providing us with a detailed report that itemizes I-526 and I-526E filings by month from April 2022 through April 2023, by TEA category, and by country of chargeability.

The full data report is available to AIIA members. This post provides highlights needed for backlog assessment, and AIIA is conducting a webinar to present a detailed analysis of the data.

Table 1. Total number of I-526/I-526E filed from April 1, 2022 to April 30, 2023, by TEA category and country of chargeability (based on FOIA request response by USCIS)

| China | India | Vietnam | Rest of World | Total | Total % | |

| Rural | 247 | 57 | 7 | 66 | 377 | 24% |

| High Unemployment | 429 | 180 | 68 | 413 | 1,090 | 69% |

| Infrastructure | 0% | |||||

| Not TEA | 23 | 15 | 3 | 72 | 113 | 7% |

| Rural and High Unemployment | 2 | 1 | 2 | 5 | 0% | |

| Total | 701 | 252 | 79 | 553 | 1,585 | 100% |

| Total % | 44% | 16% | 5% | 35% | 100% |

The data shows strongest demand from the high-unemployment set-aside category (69% of total I-526/I-526E filings) and from applicants chargeable to China (44% of I-526/I-526E filings). Applicants from India showed the second-highest demand (16% of total filings), particularly in the high unemployment category.

Surprisingly, USCIS reports a significant number of I-526/I-526Es filed outside of TEA categories, a few filings tagged for both rural and high unemployment, and no filings for the infrastructure category. With the advent of concurrent filing, petitioners from around the world have been filing their I-526E and I-485 in tandem in the new EB-5 set-aside categories, which the most senior EB-5 investors were unable to do. This means that at the visa stage, set-aside visa applicants from India and China will be competing with similar priority dates. Meanwhile, the unreserved category favors some over others, where most Indians have recent priority dates yet were able to concurrently file, compared with Chinese who were not eligible to do so at the time they applied and must undergo a separate adjustment process. Additionally, the relatively large number of “rest of the world” set-aside visa applicants will constrain the number of “otherwise unused” numbers above the 7% country cap limit that will be divided amongst China and India.

To make a visa demand forecast and backlog assessment, we take I-526/I-526E filing numbers, convert them to an estimated number of future visa applicants, and compare this number against the number of set-aside visas that will be available. The analysis shows that up to April 2023, incoming demand was still far below EB-5 visas to be available in the rural category, and on track to exceed limits for the high unemployment category.

Table 2. Comparison of Demand with Supply

| Rural | High Unemployment | |

| DEMAND | ||

| Total I-526/I-526E filed as of 4/30/2023 | 377 | 1,090 |

| Estimated pipeline visa demand as of 4/30/2023 if 1 I-526=2.5 visa demand on average | 943 | 2,725 |

| Average I-526/i-526E filed per month 9/2022 through 4/2023 | 45 | 130 |

| Estimated visa demand from monthly filings if 1 I-526 = 2.5 visa demand on average | 113 | 324 |

| SUPPLY | ||

| FY2024 visas available, including FY2023 carryover (based on FY2024 EB limit of 161,000) | 5,085 | 2,542 |

| FY2025 visas available with carryover, if assuming all new FY2024 visas were unused | 4,274 | 2,137 |

| FY2025 visas available without carryover, if assuming all FY2024 visas were used | 1,988 | 994 |

NOTE: While pipeline demand for high unemployment visas may already exceed visa supply, retrogression will not happen until these petitioners reach the visa stage. So long as USCIS’s file transfers to NVC stagger and lag, I-526Es filed in 2023 are unlikely to all become qualified visa applicants in 2024, meaning the visa bulletin will likely remain open in 2024.

The I-526/I-526E filing numbers are important primarily because they indicate, for someone entering the end of the queue, how many petitioners have an earlier position in the queue. At what date the queue reaches the visa stage is a question that depends on USCIS’s petition processing rate. The queue’s length will determine processing estimates and the visa wait times as a function of the demand/supply balance.

Assessing the backlog first requires looking at the worldwide number of I-526/I-526E filings for each category, and comparing it with worldwide supply. So long as overall demand is lower than annual supply, then the investor country of birth does not matter. When total demand exceeds supply at the visa stage, then the country cap for Chinese and Indian investors kicks in, limiting each country to 7% of available visas and any unused carryover visas. Meanwhile, the rest of the world can enjoy access to at least 86% of annual visas protected by individual country caps. The country-specific demand/supply analysis is very complex and beyond the scope of this blog post. However, AIIA has generated this analysis using the granular inventory data and processing trends at USCIS to make trend inferences.

A prospective investor needs to be able to answer the question “what is the visa demand at the time when I plan to file my I-526E?” Thanks to our FOIA success, AIIA has obtained data up to April 2023, and will continue to fight for data on incoming demand until USCIS does so by its own volition. We made the I-526E data request one of our top agenda items for discussion with the CIS Ombudsman, and may need to litigate additional FOIA requests to ensure USCIS follows through.

To support our work remediating the information gap between USCIS and its stakeholders, consider signing up for our email list, becoming a member, or making a donation to our organization. All donations are put towards our advocacy campaign, which strives to resolve the issues plaguing USCIS and the EB-5 investor community at their source. We appreciate all our supporters and the work they do to ensure we can continue advocating for equity and transparency in the EB-5 program for all investors.

Leave your comments

Responses (1)

Related Posts

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

We Won The EB-5 Fee Increase Lawsuit

One Year Left to Invest in a EB-5 Regional Center Project

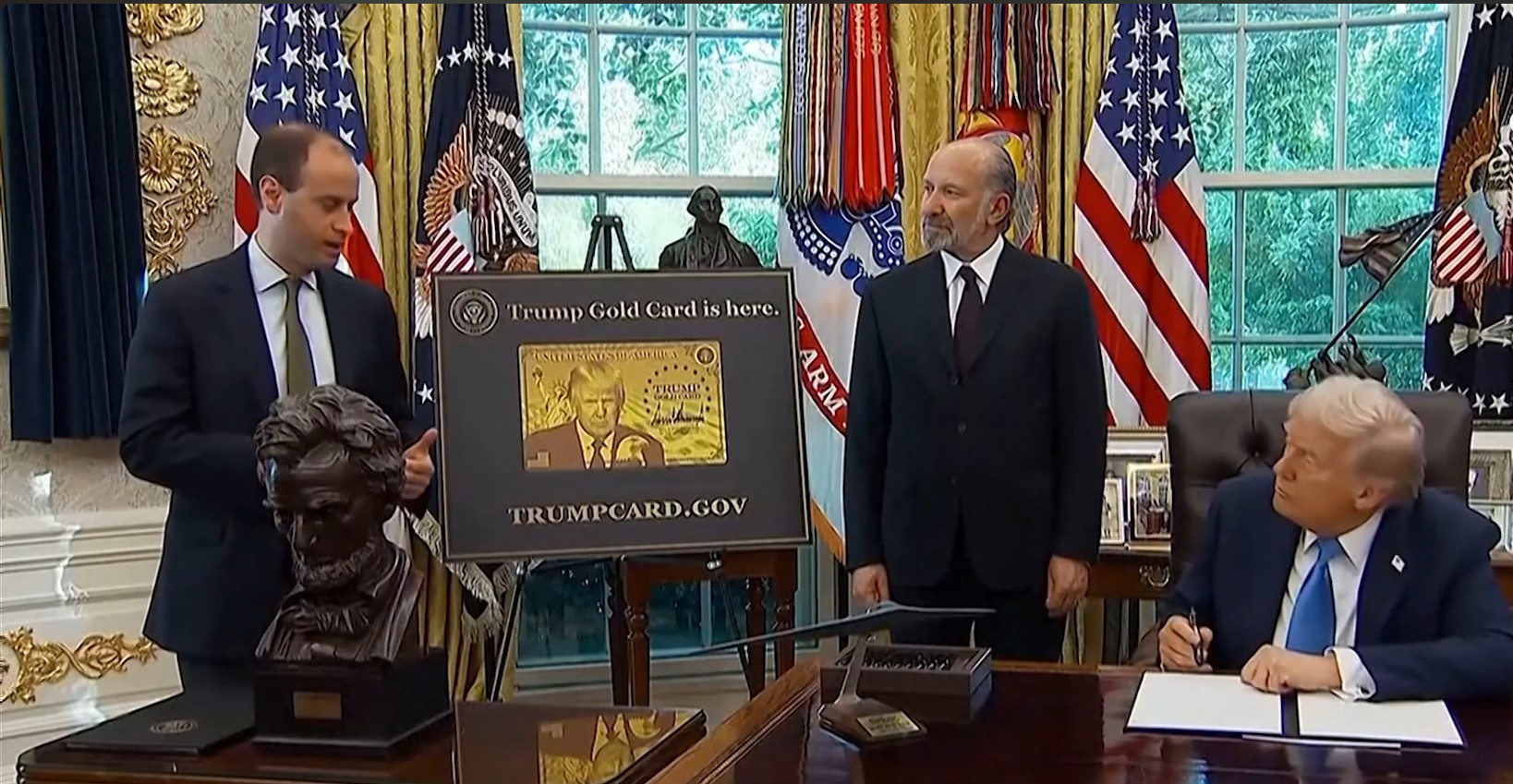

Trump Gold Card: A New Green Card Pathway Competing with EB-5

Stay Up To Date With AIIA

Join our newsletter to stay up to date on EB-5 updates.

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Recommended Resources

The Issue of Aging Out in EB-5

The Child Status Protection Act (CSPA) helps freeze a child’s age on EB-5 petitions, but long visa backlogs still risk...

Read More

The Sale of EB-5 Securities Offerings

EB-5 securities sales often use Regulation D (U.S. investors) and Regulation S (foreign investors) exemptions to avoid SEC registration while...

Read More

Choosing between Direct vs Regional Center EB-5 financing

Direct EB-5 suits single investors creating direct jobs; Regional Center EB-5 pools multiple investors, counting direct and indirect jobs for...

Read MoreRecent Blog Posts

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

Sen. Gallego's EB-5 bill mobilizes foreign capital to build affordable housing. This collaboration has boosted AIIA's Congressional ties & credibility...

Learn More

We Won The EB-5 Fee Increase Lawsuit

AIIA successfully won its lawsuit against USCIS’s April 2024 EB-5 fee increases, with a federal judge ruling that the agency...

Learn More

One Year Left to Invest in a EB-5 Regional Center Project

AIIA warns that EB-5 Regional Center investors will lose protection after Sept. 30, 2026 unless they file I-526E petitions before...

Learn More

Trump Gold Card: A New Green Card Pathway Competing with EB-5

Trump’s new $1M “Gold Card” visa plan competes directly with EB-5 and raises serious legal concerns, as it lacks statutory...

Learn MoreGet In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.

Excellent work!