Written by Isabella Getgey

Background: Last year, AIIA filed a Freedom of Information Act (FOIA) request for data from USCIS on various topics that concern immigrant investors. These included information on staffing levels at the IPO, up-to-date inventories of pending petitions by country of chargeability, administrative policies on I-829 processing criteria, and implementation of the Reform and Integrity Act of 2022. AIIA initiated litigation against USCIS to compel them to respond to our FOIA requests. We have received, and will continue to receive hundreds of pages worth of documents including internal memos, emails and training manuals. This is our second blog in this series and you can read the first one here. AIIA Members are entitled to a full copy of the government’s FOIA response. If you would like to receive the full copy, reach out to us through our contact form.

In our most recent review of USCIS’s response, we examined communications within USCIS just before the Reform and Integrity Act (RIA) was passed in March 2022. Included in these communications was a request for the number of I-526, I-924, and I-829 petitions in the backlog and the nationalities of these petitioners broken down by number for the top 5 countries in each category. A response from the Immigrant Investor Program Office (IPO) at USCIS on March 7, 2022 reveals the following data:

I-526 pending with USCIS around Feb-Mar 2022

| Country | Regional Center | Direct |

| China | 4576 | 247 |

| India | 1718 | 457 |

| South Korea | 1010 | (part of ROW) |

| Vietnam | 973 | 55 |

| Taiwan | 579 | (part of ROW) |

| Mexico | (part of ROW) | 55 |

| Canada | (part of ROW) | 27 |

| Rest of the World (ROW) | 3120 | 386 |

| Total | 11976 | 1227 |

I-829 pending with USCIS around Feb-Mar 2022

| Country | Regional Center | Stand Alone |

|---|---|---|

| China | 5748 | 592 |

| India | 730 | 132 |

| South Korea | 516 | 31 |

| Vietnam | 614 | (part of ROW) |

| Taiwan | 428 | 46 |

| Venezuela | (part of ROW) | 32 |

| Rest of the World (ROW) | 2138 | 333 |

| Total | 10399 | 1166 |

These never-before-seen statistics provide a picture of how large the pending I-526 petition backlog has become, especially among large volume countries such as China, India, Vietnam, and South Korea. This information helps to calculate the EB-5 backlog as of March 2022 – a critical date, because the law changed in March 2022. EB-5 investors with priority dates up to March 2022 are now in a queue for “unreserved” visas (68% of the EB-5 total), while investors after March 2022 will probably join the new queues for “reserved” visas (remaining 32% of EB-5 visas).

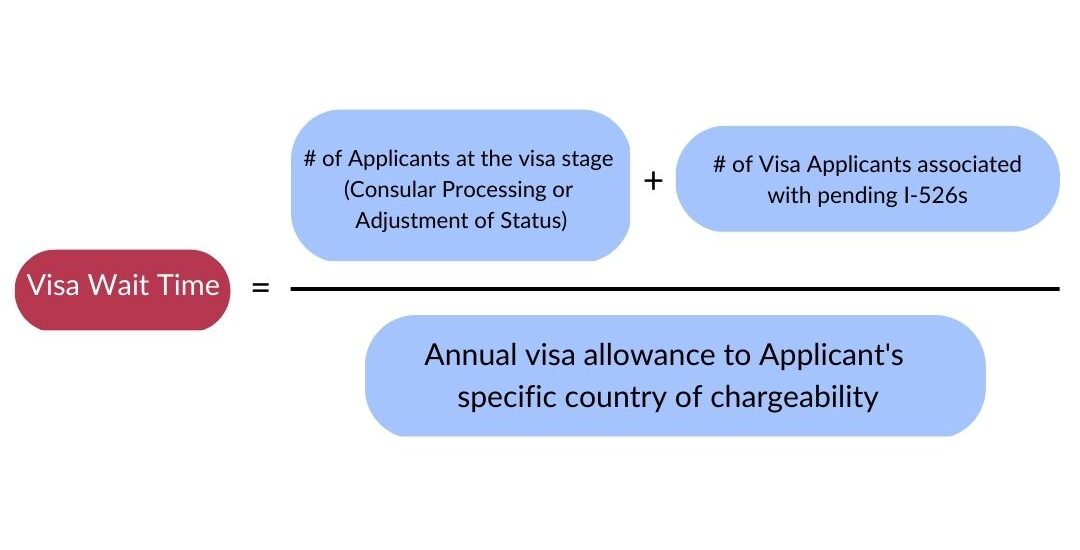

USCIS does not publicly report country-specific I-526 data, and it’s critical for estimating visa availability and wait times. The visa wait time for EB-5 investors from China, Vietnam, and India can be estimated using a formula like this for each country.

Per-country pending I-526 data helps fill a missing piece in this formula. AIIA is computing the data we have been able to obtain for each of these variables for priority dates up to March 2022, and compiling a detailed chart on the wait time estimations for pre-RIA investors from China, India, and Vietnam. AIIA is looking to release this in the near future. However this is a tricky and time consuming process. With the limited resources and time that our staff and board continue to devote to such initiatives, we ask you, the EB-5 stakeholders, to support us any way that you can with our efforts.

Estimations are complicated by unknowns and variables. For example, even knowing pending I-526 from various times, we need to estimate future denial rates and family per I-526. Visa-stage demand is an estimate pieced together from reports of approved I-526 without visas available, applicants registered at the National Visa Center, and hints from Visa Bulletin movement and other sources. And each priority date needs its own calculation, because people who invested at different times have different positions in the backlog and thus different wait time outlooks.

The supply of unreserved visas is also in question. From AIIA’s FOIA response, we reviewed communications from USCIS staff discussing that many unused EB-5 visa numbers from the FY-2022 were slated to roll over into FY-2023 for applicants to claim. But we do not see those numbers in the annual numerical limits report. Only 14,000 visas were allotted for the 2023 fiscal year, which does not include the 6,384 unclaimed “reserved category” visas from 2022. In fact, that report states explicitly, “The employment chart does not include numbers carried over from the previous fiscal year in the EB-5 category.” We await clarification as to when the government will carry over unused reserve EB-5 visa numbers as required by RIA (or whether it will continue to follow the directive that assigns all unused EB-5 visas to EB-1/EB-2 and then to family-based categories in the following year).

It is evident that the I-526 and I-829 backlog totals up to 22,000+ petitions that are awaiting processing by the agency, a total which amounts to millions in adjudication costs, and millions in filing fees that were collected without adjudication. As noted in our previous blog post, USCIS supposedly does not receive sufficient funding to continue to sustain operations and will quickly run out of agency funding. Their current fee proposal proposes to dramatically raise EB-5 fees, but only plans fees to cover the cost of adjudicating new petitions, not to address the backlog or to reduce processing times. This situation is alarming for investors with pending petitions.

Our organization is still receiving responses to our FOIA requests. We expect to receive more of these documents in the near future and will release further summaries of our findings that will be useful to all within the EB-5 community. These requests and the information which we glean from USCIS’s responses allow us to continue tailoring our advocacy efforts and better use our resources to remedy issues investors have faced for years.

Members who wish to receive further information on the FOIA response and associated data, please reach out to us through our contact form. We will continue to receive incremental updates to our original FOIA requests in the months to come, and will promptly update our AIIA community with more useful information.

Leave a Reply