The American Immigrant Investor Alliance has filed its third complaint against U.S. Citizenship and Immigration Services for failing to respond to a Freedom of Information Act request. The agency has so far received four FOIA requests from AIIA, none of which the agency has responded to without litigation. This complaint was again filed on behalf of AIIA by the Galati Law Firm, whom we thank for their consistent and diligent work for the EB-5 community. USCIS’s response to our FOIA request will be distributed to AIIA members as soon as it is delivered to our office, and we encourage all interested stakeholders to join our cause.

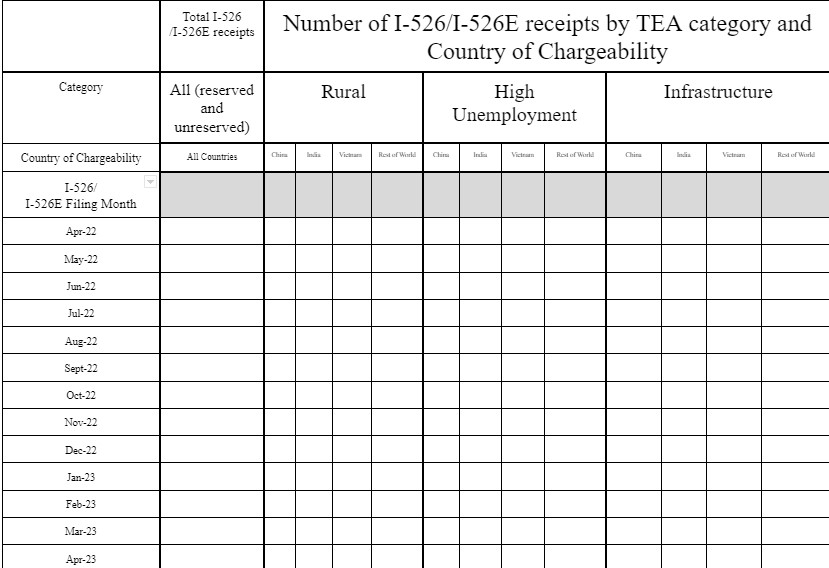

Our most recent FOIA filed with USCIS asks for the specific inventory of petitions which have accumulated at the Immigrant Investor Program Office (“IPO”) since the passage of the EB-5 Reform and Integrity Act. We are also requesting that data be broken down by country of origin.

At an April 2023 USCIS event, the I-526 Division Chief at IPO, Kevin Muck, insisted that an investor could understand the potential visa backlogs in the set aside categories simply by referencing the Visa Bulletin, which currently shows all categories as current. Following Muck’s ignorant response to these questions, we took action to find out how many petitions have been filed in each set aside category, broken down by country of chargeability.

As many backlogged petitioners know, the visa bulletin is not an accurate reflection of IPO’s petition inventory. Many EB-5 applicants filed petitions when the visa bulletin was current, only for the visa bulletin to retrogress after their initial filing. Knowing the actual inventory of pending petitions gives investors a better picture of how long it may take to get an EB-5 visa before they invest. The stakes are even higher in the set aside categories because such few visas are issued to each country in these categories, making it crucial for investors to know petition inventories before they commit their funds to a visa category with an invisible backlog.

For example, the July 2023 Visa Bulletin has a final action date of September 8, 2015 for Chinese applicants in the EB-5 Unreserved category. This means Chinese EB-5 applicants who invested and filed I-526 before September 2015 are the only petitioners currently eligible for an EB-5 visa to be issued to them. All applicants with priority dates after September 2015 will not be eligible for a visa until all petitions filed before September 2015 have been adjudicated, if USCIS’ alleged first in first out processing is to be believed.

The inventory of the Chinese unreserved category could have been publicized and thus potentially avoidable back in 2015, if USCIS had published country-specific I-526(E) receipt data. However, without such reporting, Chinese EB-5 investors in 2015 entered a queue of unknown length, received priority dates of unknown value from USCIS, and are still waiting eight years later to claim the visas which incentivized their investment. A similar situation has arisen for Indian EB-5 investors who invested in late 2019 without realizing the potential backlogs accruing in the Indian unreserved category.

As if the wait times for visa issuance were not bad enough, another threat makes an “invisible backlog” more dire for EB-5 investors. Visa backlogs trap EB-5 investors in a cycle of redeployment, where their pending visa issuance prohibits them from being repaid their investment until after their conditional residency ends or forgo their EB-5 immigration entirely. As invisible backlogs loom and wait times for visa issuance continue to skyrocket, investors will be forced to redeploy their funds into other projects with no say over the terms of the new investment and risk losing their entire investment all together.

We are on the verge of history repeating itself at USCIS. Inventory data is extremely critical for transparency between USCIS and the immigrant investor population they are intentionally misleading. Lack of transparency by the USCIS about incoming EB-5 demand has already facilitated devastating backlogs in the Unreserved visa category. Therefore, USCIS should take the necessary steps to avoid the same issue in the new set aside categories.

We are taking action to prevent further backlogs

After the USCIS engagement session, we immediately moved to obtain data pertaining to any “invisible” backlogs accruing in the set aside categories. On May 16, 2023, we filed our fourth FOIA request with USCIS, seeking a report of Forms I-526 and I-526E filings filed before April 30, 2023, itemized by EB-5 visa category and country of chargeability.

We waited over 40 business days for their response and did not receive it. We believe USCIS and its officers in particular are acting in bad faith, not only by ignoring the FOIA request and failing to respond within the statutory timeframe, but also by offering an investor visa incentive while making it impossible for the investor or any other stakeholder to estimate visa availability at the time of investment. This is a recipe for dashed expectations and family separation. We, the EB-5 investors, deserve better from the agency that we fund through filing fees approaching $5,000 a petition.

AIIA plans to publicize USCIS’s response to our FOIA for AIIA members. To be in the know about USCIS’s response and to support our work remediating the information gap between USCIS and its stakeholders, consider signing up for our email list, becoming a member, or making a donation to our organization. All donations are put towards our advocacy campaign, which strives to resolve the issues plaguing USCIS and the EB-5 program at their source. We appreciate all our supporters and the work they do to ensure we can continue advocating for equity and transparency in the EB-5 program for all investors.

Hi there,

I appreciate your work. When you say ‘ break down by country’, you are only showing china,India and Vietnam. Everyone else is in the ‘rest of the world’ pile. I think it would be great they also ha e the same info.

Hello, I really appreciate all the hard work you do on behalf of numerous affected EB-5 investors who are in limbo because of USCIS misleading policies.I am in same boat, as an investor from Russia, with i526 pending since dec2020.Wonder, why USCIS is “intentionally misleading investors”… What is really behind all if this

Hi, Really appreciate your hard work. This will help all the EB5 investors.