AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

26th January, 2026

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization of Rural cases, severe neglect of High Unemployment petitions, unclear handling of Infrastructure cases, and no imminent risk of Visa Bulletin cut-off dates in 2026 for set-aside categories. The data underscores serious transparency and processing failures at USCIS and highlights why continued AIIA advocacy and FOIA litigation are essential to protect EB-5 investors.

We had to fight for it, but AIIA finally has more information to share about what’s happening with backlogs and processing in EB-5 Reserved categories. USCIS responded to our FOIA request for detail on I-526 and I-526E receipts, approvals, and denials by country, TEA category, and filing date through July 31, 2025. AIIA is grateful to Alexandra George of the Galati Law Firm for leading the FOIA litigation effort against USCIS in order to obtain this data.

On behalf of AIIA we have a sincere request to the public, now more than ever before, we need your support.

Before you read on to our charts and tables of the data, think about its value. And then consider supporting AIIA to continue this effort. How much do you want to know where USCIS is in processing High Unemployment petitions – which dates are getting processed and which are still pending? Or about the number and distribution of Rural I-526E approvals, so you can forecast Rural retrogression timing and risk? Or about Infrastructure, and whether enough investors are coming in to start a backlog? Or about which countries are supplying most EB-5 investors in recent months?

As you may notice, the analysis and data we have obtained has come far more delayed than we would have hoped due to USCIS’s delays. The agency almost never hands over data without a fight. As soon as the lawsuit for the data we used for this blog concluded, we had to immediately file yet another one for the next batch of data. As a nonprofit, we severely lack the funds to continue our valuable work without the support from the investor community. Obtaining this data and analyzing this costs us significant resources, and we ask that if you find our work useful and important in your decision making process, please consider becoming a member or donating to us. If you are unable to donate, you can help us by telling fellow investors and industry stakeholders to sign up for our mailing list.

Transparency for the EB-5 community should be an important prerogative for every stakeholder in the EB-5 space.

Our latest FOIA data through July 31, 2025 is especially important because it shows for the first time how USCIS was processing the I-526E inventory in 2025 – which priority dates, TEA categories, and countries were getting approvals and denials, and which were left pending. It also gives the most recent available data (previously-published reports went through June), and provides country-specific detail for Brazil, China, Columbia, India, South Korea, Mexico, Russia, Singapore, Taiwan, and Vietnam.

The data provided by USCIS to AIIA is the most complete post-RIA I-526E report to date because (1) the report provides receipts by month, which is important for showing trends, and (2) the report provides data that USCIS queried recently, in September 2025. The query date is important, because USCIS takes time to enter receipts into the database. The report that USCIS provided to AIIA states that 13,520 petitions (i.e., I-526 and I-526E) were filed in total between April 2022 and July 2025.

Priority Date on the Visa Bulletin

We know there is a lot of artificial fear on this topic and investors are often urged to make a decision based on the pressure that a “priority date” may be assigned on the visa bulletin soon. Given the fact that there are only eight months left to safely make an EB-5 investment, many investors may feel pressured to make an investment sooner based on hearsay that a priority date will be assigned to one of the set aside categories.

In our opinion, based on I-526E processing trends through July 2025, we do not believe that there will be a priority date on any of the set aside categories in 2026.

There is already an invisible backlog for India and China in both Rural and HUA categories. Infrastructure may be backlogged as well but more on that later in the article. But backlogs cannot move and cause Visa Bulletin dates until USCIS approves enough petitions.

Cut-off dates in the Visa Bulletin result when qualified visa applicants exceed available visas. The number of qualified applicants follows from the number of I-526/I-526E approvals. Have enough Rural, High Unemployment, and Infrastructure investors even been approved to take all FY2026 visas? The July 2025 FOIA data shows too few High Unemployment approvals and no Infrastructure approvals yet. This means there will likely not be a priority date on the visa bulletin for the remainder of this year for High Unemployment or Infrastructure, since there just do not seem to be enough approved petitions seeking available visas. Rural has more near-term retrogression risk based on relatively higher processing volumes, meaning more qualified applicants. But even qualified Rural applicants may be insufficient for FY2026 if many got their visas in FY2025.

Total I-526/I-526E Receipts, Approvals, and Denials for April 2022 to July 2025, by TEA

| High Unemployment Area | Rural Area | Rural Area and HUA | Infrastructure | Unreserved & Unknown | Total | |

| Receipts | 6,582 | 6,406 | 99 | 0 | 433 | 13,520 |

| Approvals | 545 | 2,819 | 29 | 0 | 49 | 3,442 |

| Denials | 13 | 62 | 1 | 0 | 37 | 113 |

| Total Adjudicated | 558 | 2,881 | 30 | 0 | 86 | 3,555 |

| % total Adjudications | 16% | 81% | 1% | 0 | 2% | 100% |

| Adjudications / Receipts | 8% | 45% | 30% | 0 | 20% | 26% |

July 2025 FOIA Data and Analysis

AIIA’s July 2025 FOIA request sought a report of all I-526 and I-526E Immigrant Petitions filed with USCIS, per month, from April 1, 2022 to July 31, 2025, further itemized by visa set aside category and by country for ten countries and the rest of the world. We also requested a report of all I-526 and I-526E approvals and denials for the same dates, countries, and categories. The following list, tables, and charts compile and analyze the data provided by USCIS. (AIIA Members may request a full copy of government responses to AIIA FOIA requests by reaching out to us through our contact form.)

Total number of I-526/I-526E petitions filed between April 1, 2022 and July 31, 2025 by TEA category and country of chargeability

| HUA | Rural | Infrastructure | Others | Total | %Total | |

| China | 2926 | 3845 | 117 | 6888 | 50.95% | |

| India | 1264 | 1636 | 88 | 2988 | 22.10% | |

| Vietnam | 271 | 105 | 19 | 395 | 2.92% | |

| South Korea | 351 | 32 | 50 | 433 | 3.20% | |

| Taiwan | 495 | 51 | 9 | 555 | 4.11% | |

| Mexico | 42 | 48 | 32 | 122 | 0.90% | |

| Brazil | 48 | 40 | 8 | 98 | 0.71% | |

| Colombia | 47 | 9 | 15 | 71 | 0.53% | |

| Russia | 45 | 23 | 3 | 71 | 0.53% | |

| Singapore | 20 | 9 | 2 | 31 | 0.23% | |

| ROW | 1073 | 608 | 189 | 1870 | 13.83% | |

| Total | 6582 | 6406 | 532 | 13520 | 100% | |

| %Total | 48.68% | 47.38% | 0% | 3.93% | 100% |

The two charts below reflect the approval and denial data of those same petitions:

I-526/I-526E petition approvals for petitions filed between April 1, 2022 and July 31, 2025 by TEA category and country of chargeability

| HUA | Rural | Infrastructure | Others | Total | %Total | |

| China | 98 | 1663 | 21 | 1782 | 51.8% | |

| India | 217 | 725 | 17 | 959 | 27.9% | |

| Vietnam | 36 | 50 | 3 | 89 | 2.6% | |

| South Korea | 52 | 14 | 2 | 68 | 2.0% | |

| Taiwan | 61 | 28 | 3 | 92 | 2.7% | |

| Mexico | 2 | 18 | 3 | 23 | 0.7% | |

| Brazil | 2 | 17 | 1 | 20 | 0.6% | |

| Colombia | 0 | 6 | 1 | 7 | 0.2% | |

| Russia | 4 | 8 | 1 | 13 | 0.4% | |

| Singapore | 6 | 3 | 1 | 10 | 0.3% | |

| ROW | 67 | 287 | 25 | 379 | 11.0% | |

| Total | 545 | 2819 | 78 | 3442 | 100% | |

| %Total | 15.8% | 81.9% | 2.3% | 100% |

I-526/I-526E petition denials for petitions filed between April 1, 2022 and July 31, 2025 by TEA category and country of chargeability

| HUA | Rural | Infrastructure | Others | Total | %Total | |

| China | 6 | 46 | 8 | 60 | 53.1% | |

| India | 1 | 5 | 8 | 14 | 12.4% | |

| Vietnam | 1 | 0 | 0 | 1 | 0.9% | |

| South Korea | 1 | 1 | 1 | 3 | 2.7% | |

| Taiwan | 1 | 0 | 0 | 1 | 0.9% | |

| Mexico | 0 | 2 | 4 | 6 | 5.3% | |

| Brazil | 0 | 1 | 0 | 1 | 0.9% | |

| Colombia | 0 | 0 | 0 | 0 | 0% | |

| Russia | 0 | 0 | 1 | 1 | 0.9% | |

| Singapore | 0 | 0 | 0 | 0 | 0% | |

| ROW | 3 | 7 | 16 | 26 | 23.0% | |

| Total | 13 | 62 | 38 | 113 | 100% | |

| %Total | 11.5% | 54.9% | 33.6% | 100% |

Demand Trend by TEA Category

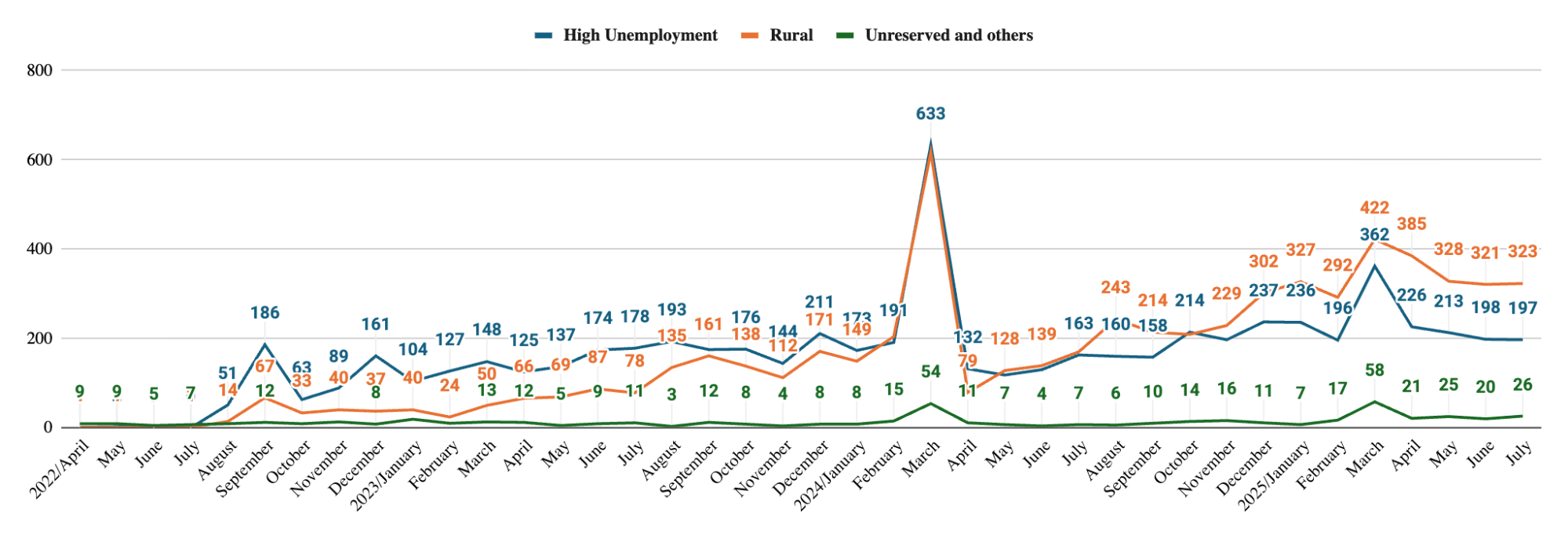

Global Post-RIA I-526/I-526E Filing Trends, by Visa Set-Aside Categories

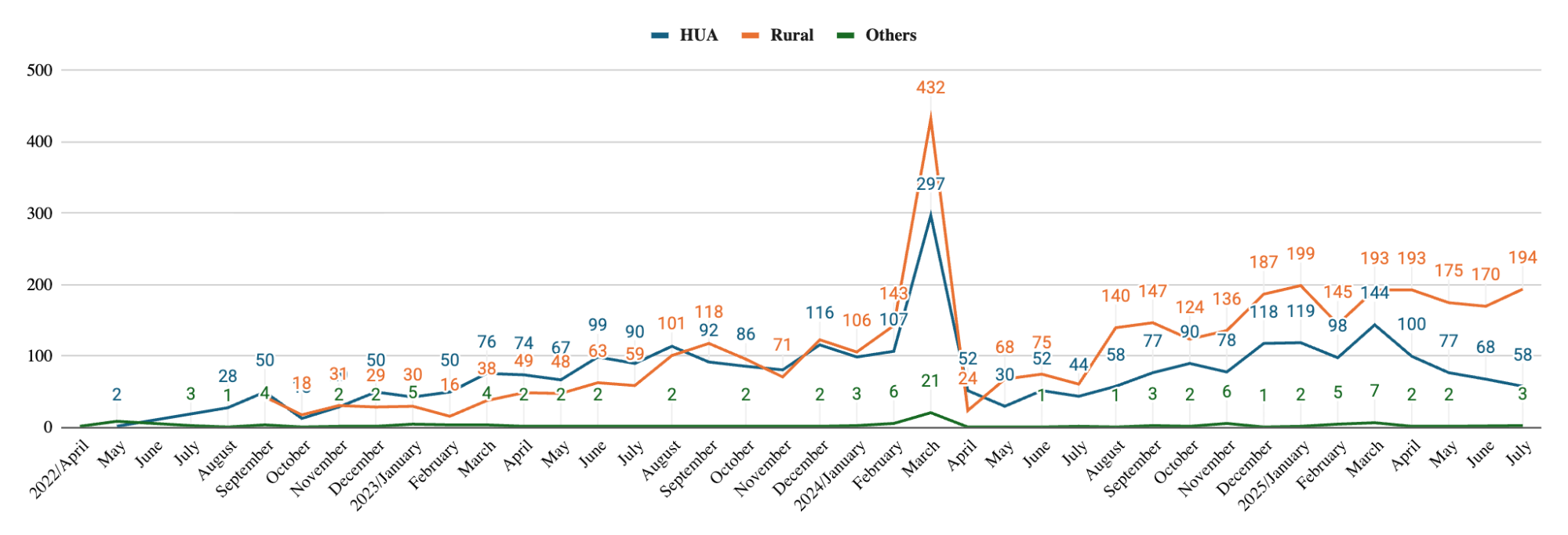

Rural vs High Unemployment I-526/I-526E Filings from Mainland China

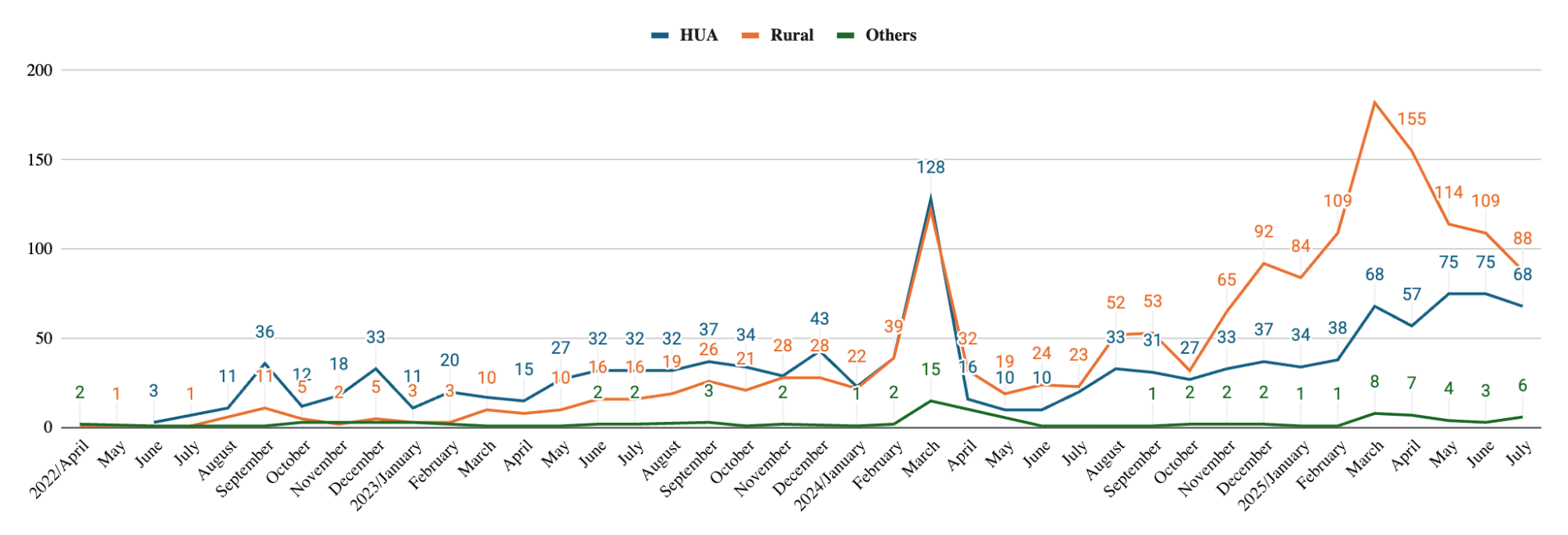

Rural vs High Unemployment I-526/I-526E Filings from India

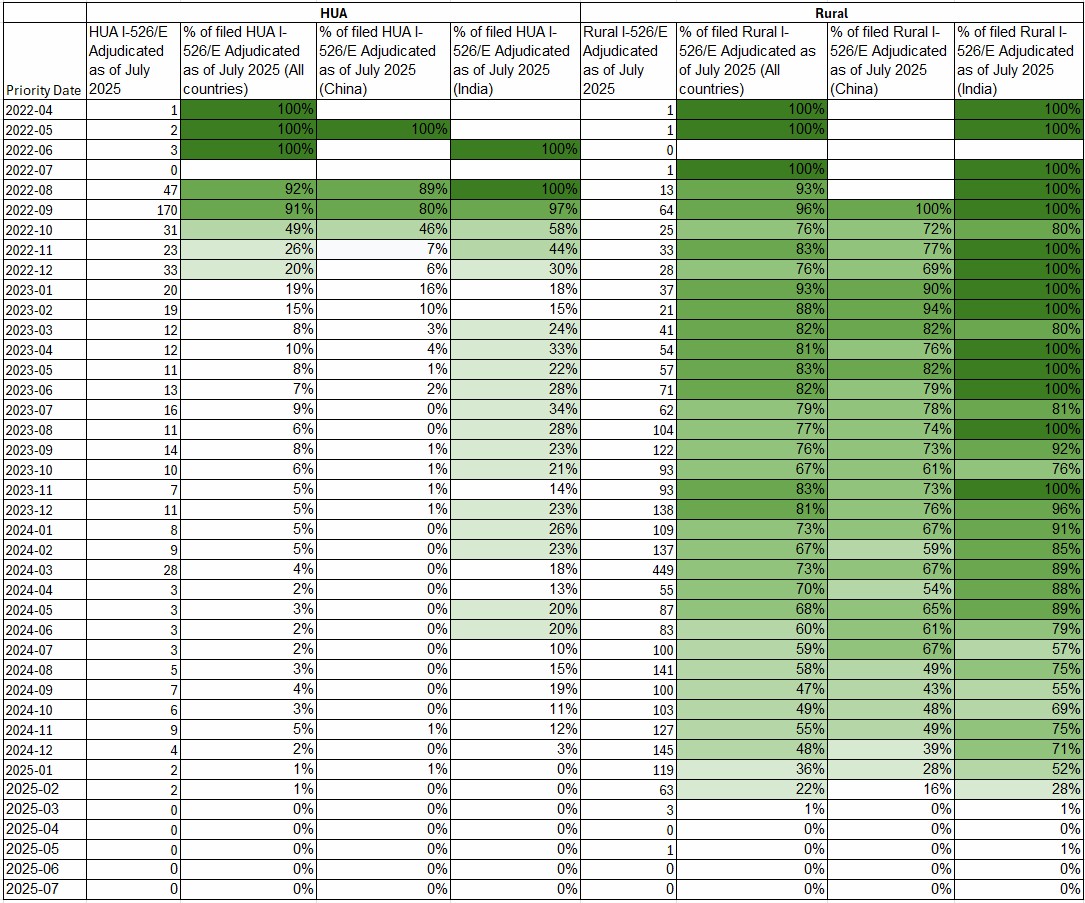

Comparing the percentage of filed I-526/E Adjudicated as of July 2025 (India, China and All countries)

Putting all this data together we can get a better understanding of how USCIS is prioritizing adjudication across the set aside categories and across countries.

What we can learn from the chart below is that there is a disparity between country based adjudications. For example, through July 2025 USCIS processed over 2x more HUA I-526E for India than China, although it had over 2x more HUA I-526E pending for China than for India. This could possibly be due to many Indian nationals located in the United States aggressively suing the agency for delayed adjudication of their petition. It could also be an active choice on behalf of the agency. Regardless, we hope to see fairer distribution by country and priority dates in the future.

We also see a Non First in First Out (FIFO) in I-526E adjudication order. The FOIA response shows adjudication activity spread over a wide range of filing dates, even as a wide range of dates remain untouched. The lack of FIFO order is particularly evident in Rural.

The chart above data visualizes Rural processing priority. Looking at the data below, we can see that by July 2025, USCIS had approved or denied most Rural I-526/I-526E filed in 2022 and 2023, a majority filed in 2024, and even a few 2025 cases. Of all I-526/I-526E adjudications up to July 2025, 81% were Rural. (This is even higher than in the January 2025 FOIA data, which showed 73% of decisions going to Rural cases.) This high Rural volume is good news for petition processing times, and also means that Rural retrogression has a chance to come sooner.

The July 2025 FOIA data shows concerning inattention to High Unemployment cases. From April 2022 to July 2025, USCIS processed a total of only 558 HUA petitions — only 9% of all HUA I-526/I-526E filed since 2022! From January 2025 to July 2025, USCIS processed only 197 HUA petitions as compared with 1,725 Rural petitions in the same period. These numbers are unacceptably-low for HUA – not even enough to create enough qualified applicants to use the quota of HUA visas. USCIS must pick up the pace of HUA approvals in the future, to avoid continuing wastage of HUA visas. The RIA set a “timely processing” goal of 120 days for investor petitions in High Unemployment. Congress should be shocked to see that a majority of HUA petitions filed in 2023 and 2024 remained untouched by USCIS in 2025. USCIS should not only focus on the “priority processing” mandate for Rural while neglecting the “timely processing” target for High Unemployment.

The Infrastructure Category

The July 2025 FOIA data shows “0” in every column for the Infrastructure category. 0 receipts, 0 approvals, and 0 denials were recorded in Infrastructure through July 31, 2025. We are not sure how to interpret this, considering reports from industry of several Infrastructure projects approved and Infrastructure I-526E filed before July 2025. Maybe there is a problem with the USCIS database recording for Infrastructure.

It’s quite possible that the infrastructure category is already accumulating a backlog given projects entering the market since July 2025 and the small allocation of visa numbers. Without tracking the number of filings and adjudications, we have no idea what the impact is.

Which brings us to our most important task – we need your support more than ever. Pursuing USCIS for this missing data and holding them accountable needs to be done and we are the only organization willing to do so.

Looking Ahead

EB-5 fundraising continued to be concentrated in two markets, with Chinese accounting for 51% and Indian for 22% of all I-526/I-526E filed since 2022. Taiwan, South Korea, and Vietnam were the next largest markets. Many other countries also supplied investors, demonstrating immigrants as economic contributors. For example, the July 2025 FOIA data shows that EB-5 investors from Brazil have recently made $76.8 million of investment in Rural and High Unemployment areas, while Russian EB-5 investors have invested $56.8 million. Both countries are on the recent 75 country visa suspension list announced just two weeks ago. Their access to EB-5 visas should not be disrupted and this is just one of the many reasons why our advocacy work must continue.

As a nonprofit organization, AIIA invests significant time and resources in acquiring, analyzing, and disseminating this data. We rely solely on donations to sustain our efforts, including funding FOIA litigation, lobbying, and daily operations. We urge anyone who values our work to enhance transparency in the EB-5 program to consider supporting us by making a donation or membership contribution. Your support is vital in ensuring that we can continue to advocate for transparency and equity in the EB-5 program, benefiting investors and industry professionals alike.

Related Posts

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

We Won The EB-5 Fee Increase Lawsuit

One Year Left to Invest in a EB-5 Regional Center Project

Stay Up To Date With AIIA

Join our newsletter to stay up to date on EB-5 updates.

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Recommended Resources

The Issue of Aging Out in EB-5

The Child Status Protection Act (CSPA) helps freeze a child’s age on EB-5 petitions, but long visa backlogs still risk...

Read More

The Sale of EB-5 Securities Offerings

EB-5 securities sales often use Regulation D (U.S. investors) and Regulation S (foreign investors) exemptions to avoid SEC registration while...

Read More

Choosing between Direct vs Regional Center EB-5 financing

Direct EB-5 suits single investors creating direct jobs; Regional Center EB-5 pools multiple investors, counting direct and indirect jobs for...

Read MoreRecent Blog Posts

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

Learn More

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

Sen. Gallego's EB-5 bill mobilizes foreign capital to build affordable housing. This collaboration has boosted AIIA's Congressional ties & credibility...

Learn More

We Won The EB-5 Fee Increase Lawsuit

AIIA successfully won its lawsuit against USCIS’s April 2024 EB-5 fee increases, with a federal judge ruling that the agency...

Learn More

One Year Left to Invest in a EB-5 Regional Center Project

AIIA warns that EB-5 Regional Center investors will lose protection after Sept. 30, 2026 unless they file I-526E petitions before...

Learn MoreGet In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.

Responses (0)