Trump Gold Card: A New Green Card Pathway Competing with EB-5

20th September, 2025

Trump’s new $1M “Gold Card” visa plan competes directly with EB-5 and raises serious legal concerns, as it lacks statutory authority and reinterprets EB-1/EB-2 categories in ways likely to be blocked in court; unlike EB-5, Gold Card funds go straight to the U.S. Treasury, signaling a shift toward government revenue over job-creating private investment and raising risks for EB-5’s 2027 reauthorization.

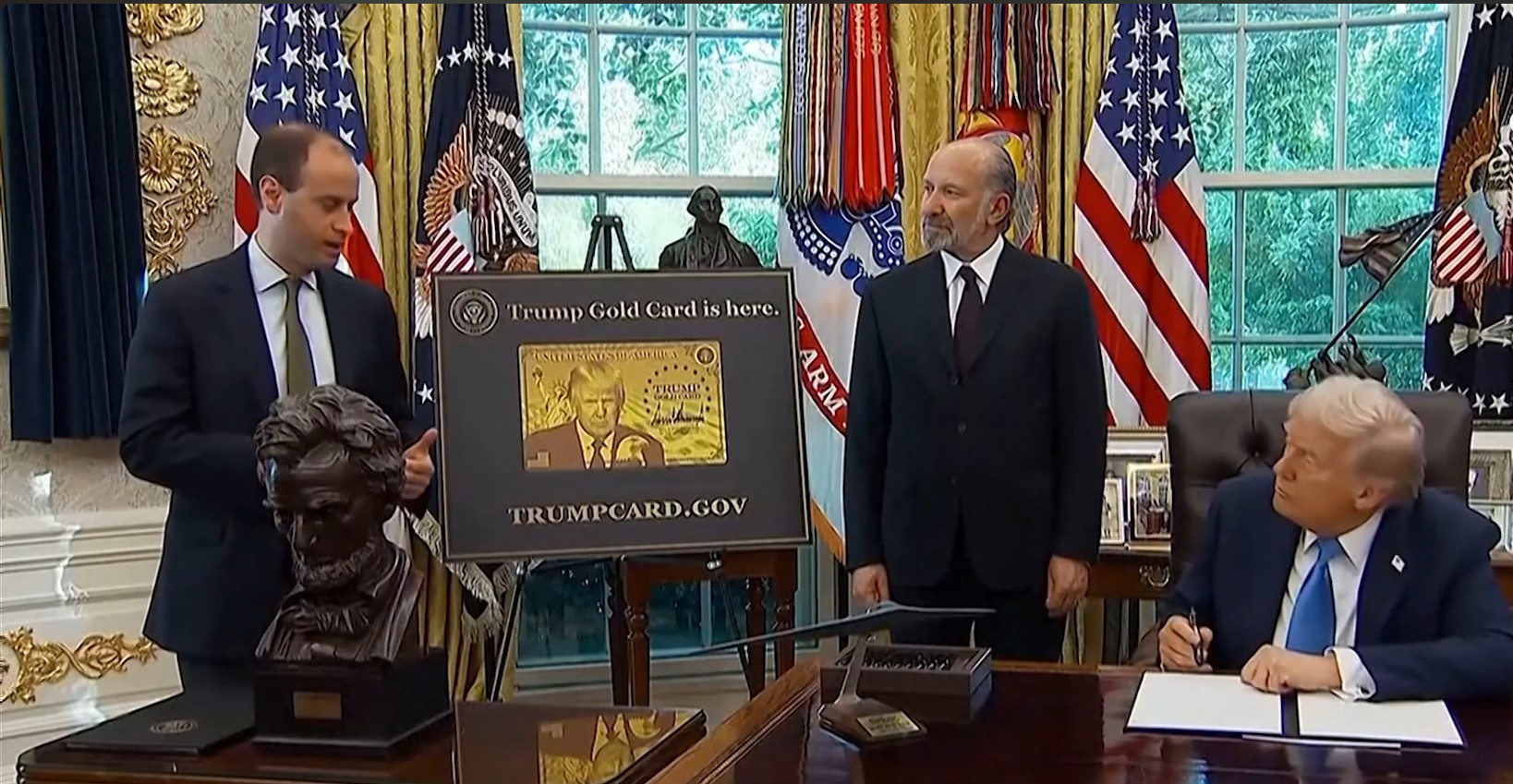

On September 19, President Donald Trump signed an executive order to create a “Gold Card” visa program to allow for “expedited immigration for aliens who make significant financial gifts to the United States.”

The American Immigrant Investor Alliance (AIIA) represents job-creating foreign national investors who seek to immigrate to the United States, with each investor creating or preserving at least 10 full-time jobs for U.S. workers. While we welcome the president’s continued interest in legal immigration, we are troubled that his order to lower the gold card amount from $5 million to $1 million puts this program in direct competition with a longstanding program that currently works and has immigrants already in line – EB-5 immigration by investment program. We support the creation of additional programs that allow more immigration to the United States, provided that the EB-5 program and immigrant investors are unharmed and able to continue their legal path to permanent residence.

In February, the senior leaders of Trump’s administration — particularly the Secretary of Commerce, Howard Lutnick — had announced their intention to replace U.S. Citizenship and Immigration Services (USCIS)’s EB-5 Immigrant Investor Program with the Gold Card program. Those previous statements along with the questionable legal basis of this executive order calls into question the potential long-term sustainability and future reauthorization of the current job-creating immigrant investor program.

The Gold Card Program

The Executive Order signed today, as well as the Gold Card website that was concurrently activated, offer more details on the proposal. Under the proposed terms, foreign nationals will be able to purchase a “Trump Gold Card” (bearing the President’s name, signature, and likeness) issued by the U.S. Government for a price of $1 million. Alternatively, corporations can pay $2 million for a transferable “Trump Corporate Gold Card” that can be used to sponsor one foreign national to work in the United States. Upon receipt of the gift, the Gold Card will be issued in “record time,” according to the Trumpcard.gov website, and grant the holders Lawful Permanent Resident status in the EB-1 and EB-2 classifications.

Another for-pay green card pathway, known as the “Trump Platinum Card,” has been announced but has not been finalized, and its details may be released subsequently.

Previously, the President had said that “thousands” of applicants wanted to purchase Gold Cards at the cost of $5 million per card. The Executive Order, with its lower price of $1 million, is significantly different from earlier announcements.

The Executive Order mandates that funds collected from the Gold Card Program will be deposited into the U.S. Treasury to “promote American commerce and industry.” This is unlike the EB-5 program, where investor funds are directly used to create or preserve 10 full-time jobs for U.S. workers, without government involvement in the investment process, and with the expectation that the investor will see a return of capital and a small return on the investment, upon successful completion of the project.

To enable the Gold Card program to begin, without any legislation, the Executive Order requires the Secretaries of Commerce, State and Homeland Security to establish application processes and set fees in addition to the costs of the cards.

The Executive Order specifically references the EB-5 program, in Section (3)(f), by directing officials to “[c]onsider expanding the Gold Card program to visa applicants under 8 U.S.C. 1153(b)(5)” which is the statutory basis for the EB-5 program and outlines its essential features. While the Executive Order does not on its face directly affect the EB-5 program, it is unclear and therefore concerning what any future impact might be.

Our Position

Above all else, AIIA supports the EB-5 Immigrant Investor Program, which has a demonstrated record of directly creating millions of jobs through investments across the United States. The principle of granting Lawful Permanent Resident (LPR) status to investors who directly create jobs is fundamental to the program, and highly beneficial to the national interest.

Supplementary programs to improve the U.S. government’s budget deficit and/or raise revenue for public spending are not necessarily prejudicial to the EB-5 program.

The Gold Card’s $1 million price point positions it competitively against EB-5’s current investment requirements of $800,000 for Targeted Employment Areas (TEA) and $1.05 million for non-TEA investments, making this pricing strategy accessible to the same immigrant pool that would consider EB-5 rather than limiting it to ultra-high-net-worth individuals with $5 million to spend. This strategic positioning becomes particularly significant given that the EB-5 Regional Center Program faces reauthorization in 2027, and the Trump administration may prefer immigrants directing their money to the US Treasury Department rather than investing in private commercial enterprises. Unlike EB-5 investments which flow into private projects and may be recoverable, the Gold Card represents a direct “gift” to the Commerce Department that generates immediate revenue for the Treasury. Commerce Secretary Howard Lutnick has claimed the program could raise over $100 billion for the Treasury, which would be used for “cutting taxes and paying off debt”.

This fundamental shift from private investment with potential returns to direct government revenue generation reflects the administration’s preference for capturing immigrant capital directly for federal use rather than channeling it through regional centers and private developers, potentially positioning the Gold Card as a replacement for EB-5 should Congress choose not to extend the program beyond its 2027 expiration.

AIIA remains ready to work with policymakers and develop supplementary immigration-by-investment program proposals to be established by Congress.

What Will Happen Next

The Gold Card program will be challenged in court and, as a result, may not be successfully implemented by the Trump administration.

The biggest legal concern that AIIA holds is that the Gold Card program lacks any statutory authorization. Instead, it seeks to creatively re-interpret the text of the Immigration and Nationality Act to suit the Trump Administration’s policy objectives. This type of administrative action has been heavily discouraged by federal courts previously, which have emphasized that fidelity to the will of Congress — expressed through the text of enacted legislation — is critical for any action relying on that legislation to survive scrutiny.

The proposal to classify Gold Card recipients as EB-1 and EB-2 LPRs is, in AIIA’s view, arbitrary and capricious as well as contrary to law. We assess that, should the program be implemented, it will probably be challenged and injunctively suspended due to its arbitrary and capricious reading of the INA, as Congress never intended for EB-1 and EB-2 to be used this way.

Additionally, if the program were implemented, it would not allow the recipients of the Gold Card to immigrate any faster, as applicants in those categories will still be subject to visa queues, which are governed by Dates for Filings and Final Action Date charts in the Visa Bulletin.The EB-1 classification already has cutoff dates for applicants from India and China. The EB-2 classification already has visa queues for all countries.

As always, our work would not be possible without the support of the EB-5 investor community and industry stakeholders that put their investors before profits. Please consider donating to AIIA or joining our membership program so we can continue to fight for the rights of immigrant investors.

Leave your comments

Responses (1)

Related Posts

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

We Won The EB-5 Fee Increase Lawsuit

Stay Up To Date With AIIA

Join our newsletter to stay up to date on EB-5 updates.

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Recommended Resources

The Sale of EB-5 Securities Offerings

EB-5 securities sales often use Regulation D (U.S. investors) and Regulation S (foreign investors) exemptions to avoid SEC registration while...

Read More

Choosing between Direct vs Regional Center EB-5 financing

Direct EB-5 suits single investors creating direct jobs; Regional Center EB-5 pools multiple investors, counting direct and indirect jobs for...

Read More

Is EB-5 Regional Center financing right for my project?

EB-5 regional center financing fits large projects creating many jobs, preferably in TEAs, with sufficient funds and investor appeal, but...

Read MoreRecent Blog Posts

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

Learn More

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

Learn More

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

Sen. Gallego's EB-5 bill mobilizes foreign capital to build affordable housing. This collaboration has boosted AIIA's Congressional ties & credibility...

Learn More

We Won The EB-5 Fee Increase Lawsuit

AIIA successfully won its lawsuit against USCIS’s April 2024 EB-5 fee increases, with a federal judge ruling that the agency...

Learn MoreGet In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.

读完这篇文章,我深感困惑。政府通过行政命令推出黄金卡项目,试图绕过国会立法,这本身就令人担忧。用一百万美元购买身份,这难道不是对移民投资计划的扭曲吗?虽然听起来能筹集大量资金,但这种直接向政府捐赠换取绿卡的方式,与EB-5通过投资创造就业的初衷大相径庭。更让人忧虑的是,这个项目缺乏法律依据,一旦遭遇法律挑战,结果未知。如果真能实施,会不会成为EB-5的变相替代品,进一步加剧移民政策的混乱?政府似乎急于通过移民资本填补财政缺口,却忽视了立法的严肃性和移民政策的根本目标。