One Year Left to Invest in a EB-5 Regional Center Project

30th September, 2025

AIIA warns that EB-5 Regional Center investors will lose protection after Sept. 30, 2026 unless they file I-526E petitions before that date, as the program may lapse again in 2027 amid the administration’s push for the competing $1M “Gold Card” scheme. AIIA—creator of EB-5 grandfathering—urges investors and issuers to act now and continues advocating for extended protections if Congress fails to reauthorize the program.

The American Immigrant Investor Alliance (AIIA) has always sought to protect investors amid statutory changes to the EB-5 immigrant investor program. One of our biggest achievements has been the principle of “grandfathering” enshrined in the EB-5 Reform and Integrity Act (RIA) of 2022.

AIIA was founded in 2021 in response to Congress’s failure to reauthorize the EB-5 Regional Center Program in a timely manner. When authorization lapsed, tens of thousands of EB-5 investors were thrust into legal and financial jeopardy. Neither could they proceed with the immigration process, nor could they withdraw their funds from regional centers without risking a loss of immigration pathways. Investors were totally unprotected, and suffered from great anxiety as well as financial stress as their date of eligibility for repayment was further pushed back. AIIA resolved to prevent this from ever happening again.

The RIA, which reauthorized the EB-5 Regional Center Program for five years until Sept. 30, 2027, included a provision that protects investors should the program fail to be reauthorized after that date. Specifically, any investor who files a I-526E petition before Sept. 30, 2026 will be permitted to continue the immigration process regardless of whether the program sunsets. This provision, which “grandfathers” EB-5 regional center investors, was championed by AIIA and may not have likely been included by Congress without our advocacy efforts. AIIA is the father of “grandfathering” in EB-5.

Unfortunately, grandfathering only protects investors whose I-526E petitions are filed on or before Sept. 30, 2026. Any investor who files a petition after that date will be unprotected without congressional action, i.e., if the program’s authorization expires, investors who filed their petitions after Sept. 30, 2026 will be frozen until the program is reauthorized by Congress, again.

Until January 20, 2025, AIIA was fairly confident that the EB-5 program would be reauthorized by Congress in 2027. However, recent actions and statements by the incumbent presidential administration have led to concerns that the program will not be reauthorized. Specifically, the Secretary of Commerce, Howard Lutnick, has spoken very critically of the EB-5 program in favor of a proposed “Gold Card” scheme for investment-based immigration.

Investors must prepare for the possibility that the Regional Center program will lapse on Sept. 30, 2027 just as it did in 2021. For these reasons, AIIA strongly urges all prospective EB-5 investors to file I-526E petitions on or before Sept. 30, 2026, to be protected by the“grandfathering” provision in the RIA.

The Regional Center Program is Temporary

Unlike direct EB-5 investments, which were permanently authorized by the Immigration Act of 1990, the EB-5 Regional Center program has always been temporary. Congress created the Regional Center Program in 1993 and has periodically reauthorized it after intervals of several years, each time including a “sunset” or expiry date.

Initially, EB-5 investors were expected to not only invest but also take an active role in managing projects to achieve job creation. When this proved unattractive, the Regional Center Program was conceived, initially as a pilot program, to spur interest in EB-5. The Regional Center Program allows investors to pool their funds to invest in larger projects, without active management required, while still meeting the 10 full-time-job creation requirements.

Additionally, Members of Congress have often raised concerns about fraud and abuse in the Regional Center Program, which led to disputes that prevented the program’s timely reauthorization in 2021. The perceived need for congressional oversight means that the program will likely not be permanently authorized in the near future.

What Happened Back In 2021

EB-5 investors previously faced a lapse in program authorization that halted adjudication of immigration benefits, and many pre-RIA investors may remember this like it was yesterday.

The date was June 30, 2021, when the EB-5 Regional Center Program’s authorization to exist by Congress expired.

Attempts to pass a reauthorization bill by U.S. Sen. Chuck Grassley (R-Iowa) failed due to divisions within the EB-5 industry. Additionally, urban developers — who have frequently used EB-5 capital to finance their construction projects — were opposed to Grassley’s reauthorization bill due to its commonsense integrity reforms that sought to address gerrymandering of high-unemployment areas and corruption in the industry.

When authorization for the Regional Center Program lapsed, U.S. Citizenship and Immigration Services (USCIS) stopped processing all I-526E petitions. This meant that investors not only couldn’t file new petitions, but also that any processing of pending petitions was frozen. Citing a lack of congressional authorization, USCIS refused to act on any I-526 petitions. Pending petitioners’ interviews with USCIS, for instance, were cancelled. The agency even refused to respond to any substantive inquiries about the status of a petition, stating only that new congressional authorization was necessary for any activity to occur.

For investors whose I-526 petitions were approved but who had not yet received Conditional Lawful Permanent Resident (LPR) status, USCIS stopped processing their Form I-485 applications for adjustment of status. Neither did the U.S. Department of State accept any applications from EB-5 investors for immigrant visas through the consular process. EB-5 investors with approved petitions were unable to receive LPR status at all. Only those investors who had already received Conditional LPR status and I-551 LPR cards (i.e., “green cards”) were able to maintain their status. Conditional LPRs were also eligible to file Form I-829 to remove conditions on their status.

Three months after the lapse of the program, USCIS stated in an FAQ on October 4, 2021 that if no legislation was passed by Dec. 31, 2021, USCIS would reevaluate its policy to continue holding these cases in abeyance. In other words, USCIS was threatening mass denial of these EB-5 petitions.

To say the very least, this situation was terrible for EB-5 investors with pending petitions or those with approved petitions seeking LPR status. While their immigration process was stalled, almost all were reluctant to withdraw their investment capital from regional centers, as they feared losing their place in the visa queue and all the time and other fees. As a result, they were deprived of access to both immigration benefits and their own funds, which in many cases represented the life savings of the EB-5 investors’ family. It was a dire situation for all investors during these eight months.

AIIA’s Response and ‘Grandfathering’

Whether or not the Regional Center Program was reauthorized in 2021, AIIA had one principal objective: the protection of existing investors. From the moment the program lapsed, we began our advocacy for legislation that included “grandfathering” provisions to ensure existing investors with pending I-526 petitions could continue the immigration process.

AIIA, along with Robert C. Divine, a partner with Baker Donelson PC and formerly the Chief Counsel and Acting Director of USCIS, drafted the first version of the Foreign Investor Fairness and Protection Act (FIFPA) that embodied these objectives. The bill was the first legislative language to provide “grandfathering” for EB-5 investors.

While the FIFPA was never enacted into law, AIIA’s intention with the text was to signal to the EB-5 community the terms of negotiations regarding reauthorization. AIIA, representing the pro-investor position in the debate, established a condition for supporting any reauthorization bill, and was able to negotiate for the “grandfathering” clause in the final bill.

To make this happen, AIIA solicited the services of our lobbying partner, Morrison Public Affairs Group, which was instrumental in introducing AIIA and our arguments to the U.S. Senators and Representatives, whom we sought to enlist as allies in the effort to protect investors. Our activities included meeting with elected representatives as well as sending demand letters to their offices, as we worked to galvanize support.

‘Grandfathering’ Expires a Year Before Program Does

In the end, when the RIA was enacted as a component of the Consolidated Appropriations Act of 2022, the AIIA-championed “grandfathering” provision was included. The provision represents a major victory for EB-5 investors who filed or will file their immigration petitions prior to September 30, 2026 and will now be protected regardless of whether the program lapses.

AIIA’s objective was–and remains–to enact a permanent grandfathering clause that protects all EB-5 investors in the future if the program isn’t reauthorized. However, the existing grandfathering provision came with a poison pill: namely, that such protection would expire one year prior to the program’s authorization period, which ends on September 30, 2027. The expiration of the grandfathering provision is a big blow to investor interests; there will be no protection for those who make investments after September 30, 2026 in the event of a program lapse.

AIIA remains perplexed as to why this expiry was put in the RIA in the first place.

What Should Investors and Investment Issuers Do?

AIIA advises all prospective EB-5 investors to file I-526E petitions in advance of September 30, 2026. Any petition filed after this date cannot statutorily benefit from grandfathering and, thus, investors will be unprotected if the EB-5 Regional Center Program lapses in 2027.

Investment issuers should seek to complete fundraising rounds well before September 30, 2026, so that investors have the requisite time to file an I-526E petition with USCIS before the grandfathering provision expires. It is imperative that all EB-5 stakeholders clearly advise their investors that any filings made after September 30, 2026 are not protected by the grandfathering provision.

Will the Regional Center Program be Reauthorized?

AIIA cannot guarantee that the EB-5 Regional Center Program will be reauthorized before its scheduled expiry date on September 30, 2027. The current political environment provides no clarity or assurance about the EB-5 program’s fate.

Statements and actions of the current presidential administration, offer clues as to how the EB-5 program may be affected.

The new ‘Gold Card’ program for employment-based immigration under EB-1 and EB-2 status, for the price of a $1 million payment to the U.S. government, is a direct competitor to the EB-5 program. Currently, general category EB-5 investments require a minimum of $1.05 million while investments in Targeted Employment Areas (TEAs) — i.e., rural, high unemployment, and infrastructure — must be $800,000. In both cases, the investment must create or preserve a minimum of 10 full-time jobs for U.S. workers. A ‘Gold Card’ payment, by contrast, does not require any job creation or sustainment period.

The price of a Gold Card, and promise of expeditious immigration, means that immigrant investors who would normally pursue the EB-5 program may elect to buy a ‘Gold Card.’ It should be noted that, unlike a ‘Gold Card’ donation, an EB-5 investor may be returned their capital after the investment matures, and even realize a small financial return. A Gold Card payment, by contrast, means giving money to the U.S. government that will never be returned.

The timing of the Gold Card program’s announcement is significant, as the EB-5 Regional Center program will have to be reauthorized by Congress in 2027. Instead of directly investing in the United States to create jobs through the private sector, the Trump administration appears to desire that investment-based immigration benefit the U.S. Treasury directly, which would help raise revenue for government spending. During a press briefing announcing the rollout of the Gold Card, Secretary Lutnick explicitly said, “In less than a month, the other visa Green Card categories are likely to be suspended, and this will be the model that people can come into the country,”. This statement gives clear indication that the administration and Republican supporters of the Gold Card program in Congress may seek to substitute the current EB-5 program with the Gold Card program, codified at the same place in the statute [i.e., INA Section 203(b)(5); 8 U.S.C. § 1153(b)(5)].

Should the EB-5 program lapse, again, or should the Trump administration seek to replace the program in entirety, AIIA will continue to lobby Congress for protection of all existing immigrant investor petitions. As a pro-investor organization, our desire is to preserve a pathway to U.S. permanent residency for immigrant investors. There is also no doubt that any substitution of the current EB-5 program for the Gold Card program will hurt EB-5 regional centers the most, which rely on EB-5 demand to finance development projects and receive fees for their service.

Our priority in all advocacy efforts is to extend AIIA’s “grandfathering” provisions, currently in the statute, to cover all investors beyond September 30, 2026. This goal is crucial to ensuring that existing EB-5 investors are protected and fulfils our organization’s central mission. To support that mission against future adverse action, we encourage you to donate to AIIA or join our membership program today.

Leave your comments

Responses (1)

Related Posts

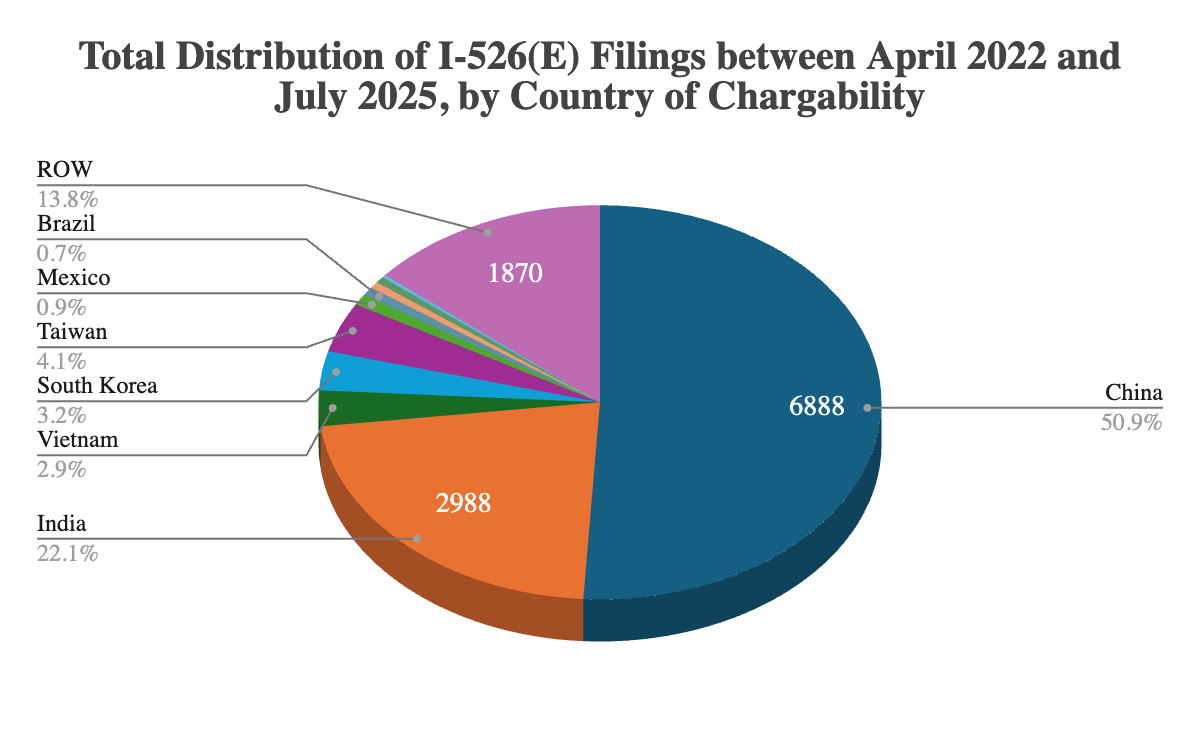

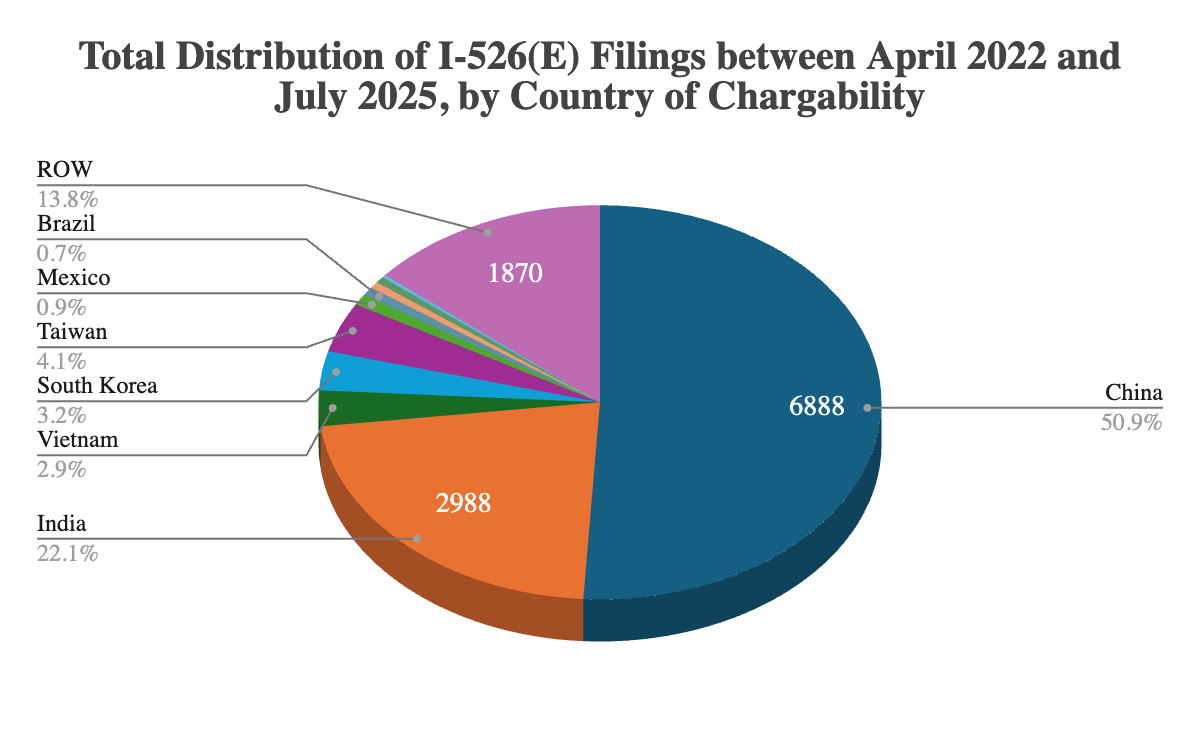

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

We Won The EB-5 Fee Increase Lawsuit

Stay Up To Date With AIIA

Join our newsletter to stay up to date on EB-5 updates.

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Recommended Resources

The Sale of EB-5 Securities Offerings

EB-5 securities sales often use Regulation D (U.S. investors) and Regulation S (foreign investors) exemptions to avoid SEC registration while...

Read More

Choosing between Direct vs Regional Center EB-5 financing

Direct EB-5 suits single investors creating direct jobs; Regional Center EB-5 pools multiple investors, counting direct and indirect jobs for...

Read More

Is EB-5 Regional Center financing right for my project?

EB-5 regional center financing fits large projects creating many jobs, preferably in TEAs, with sufficient funds and investor appeal, but...

Read MoreRecent Blog Posts

AIIA FOIA Series: Updated I-526E Inventory Statistics for July 2025

AIIA obtained new FOIA data through July 31, 2025 revealing how USCIS is actually processing EB-5 petitions, showing heavy prioritization...

Learn More

AIIA Submits Comments on USCIS NPRM on Updated EB-5 Fee Rule

AIIA submitted comments on USCIS’s October 2025 EB-5 fee NPRM supporting revised, lawful fee levels but urging refunds for overpaid...

Learn More

We Congratulate Senator Gallego for New Legislation that Leverages the EB-5 Program to Build Affordable Housing

Sen. Gallego's EB-5 bill mobilizes foreign capital to build affordable housing. This collaboration has boosted AIIA's Congressional ties & credibility...

Learn More

We Won The EB-5 Fee Increase Lawsuit

AIIA successfully won its lawsuit against USCIS’s April 2024 EB-5 fee increases, with a federal judge ruling that the agency...

Learn MoreGet In Touch With Us

If you have any questions, inquiries, or collaboration proposals, please don’t hesitate to reach out to us.

Oh, the EB-5 rollercoaster! One minute youre dancing around the grandfathering clause, the next USCIS is telling you to stand still like a statue. Its like trying to invest without a program – utterly confusing! But hey, at least AIIA is like that friend who reminds you to file your taxes early, saying, File before Sept. 30, or youre toast! while the future of the program remains as uncertain as a politicians promise. Keep your I-526E petitions ready, folks, and maybe bring a snack for the long wait!