Last updated: Dec 01, 2022

The EB-5 visa program is an immigration by investment program that allows prospective immigrants to invest into an eligible EB-5 project for a specific period of time in order to obtain permanent residency in the United States. Investors can either make an investment in a qualifying business (or start their own qualifying business), or invest in a larger project that is raising capital via an offering to a pool of investors and is sponsored by a designated Regional Center.

Regional Center projects and investments can be both attractive and complicated for those not versed in the program. This page covers the basics of EB-5 Regional Center projects including how project offerings function, conditions for investment, investment structure, how to conduct proper due diligence, and other pertinent considerations.

Choosing a Regional Center Project

To access immigration benefits offered through the EB-5 program, investors must be able to prove to the U.S. Citizenship and Immigration Services (USCIS) that their funds have been invested and properly spent in a project that has created and maintained for a required period of time at least ten new full-time jobs for U.S. citizens or LPRs. As the governing body of the program, the USCIS’s primary role is to assess and confirm whether a project and offering meet the program’s requirements and whether an investor qualifies for benefits but not to confer judgment on the value or risk of the investment. For all Regional Center projects, the USCIS reviews and approves a business plan and project documentation but this approval does not constitute proper due diligence from an investment standpoint. As subscription to an RC offering is a passive investment in the lion’s share of cases, most investors will have limited partners’ rights at the most and no role in managing their project post-subscription. This passiveness on one hand is welcomed by the majority of EB-5 investors who do not want to manage any business but on the other hand leaves them with little recourse if the project fails or stalls. Therefore, it is in the best interest of investors' interest to vet their project as extensively as possible to ensure plausibility that it would (1) comply with key EB-5 requirements, and (2) return their funds at the end of the investment period.

To conduct proper project due diligence, many investors choose to work with intermediaries local to their home countries who speak their language and have the experience and knowledge of selecting projects or work with U.S. based FINRA licensed EB-5 investment specialists.

Investment in any private offering is highly risky and illiquid and hence available only to accredited investors as defined under the U.S. Securities Laws. Prospective investors should be prepared to see that the project subscription documents (Private Placement Memorandum, Subscription Agreement and Operating Agreement (in case of a Limited Liability Company) or Partnership Agreement (in case of a Limited Partnership) will contain a section dedicated to disclosure of risks associated with the offering. This is a crucial part of any EB-5 deal required by EB-5 and SEC regulations. Hence, no matter how well the project was marketed to you or even how conservative its structure is, beware that the list of risks will usually be overly extensive and an investor will have to agree and acknowledge to all the fine print disclosures, disclaimers and waivers, challenging the investor’s potential legal recourse in the event that the investment is not refunded.

Project Structure

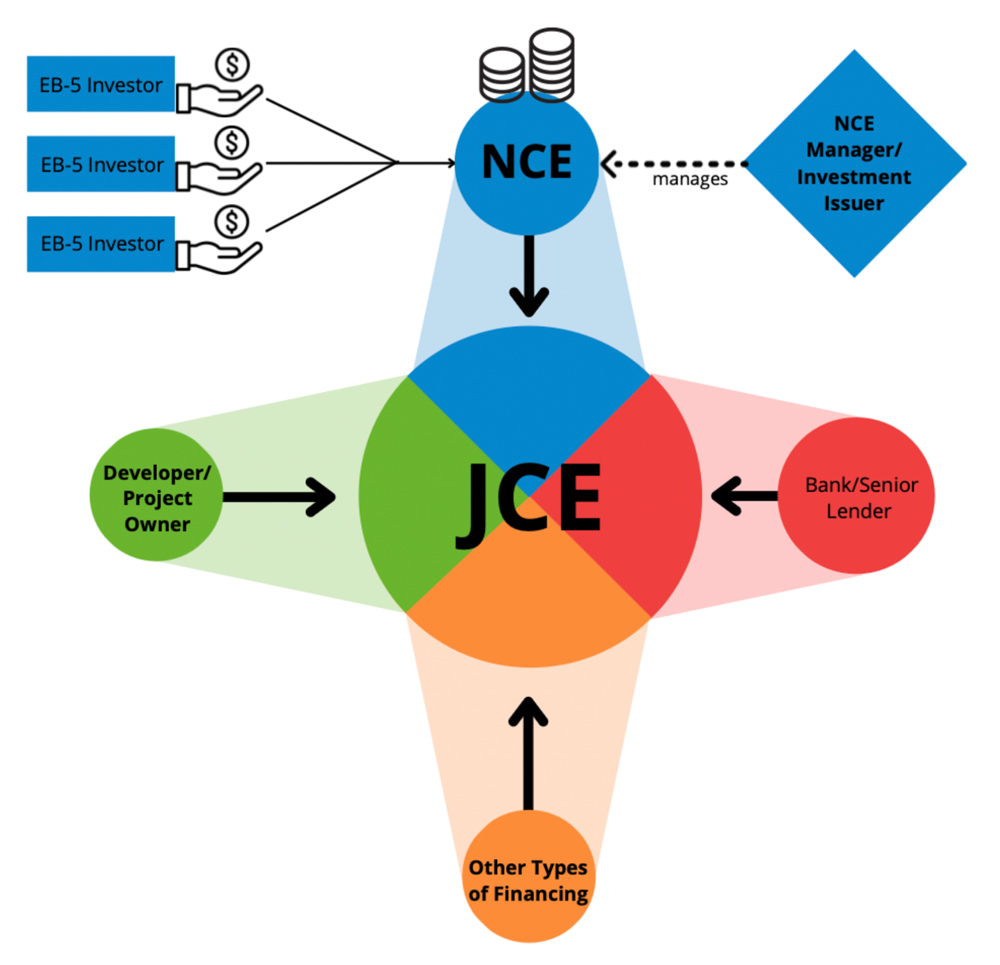

Regional Center projects are structured in layers and involve multiple entities, including the Regional Center, the developer and the entities that facilitate the investment and distribution of EB-5 funds.

New Commercial Enterprise (NCE)

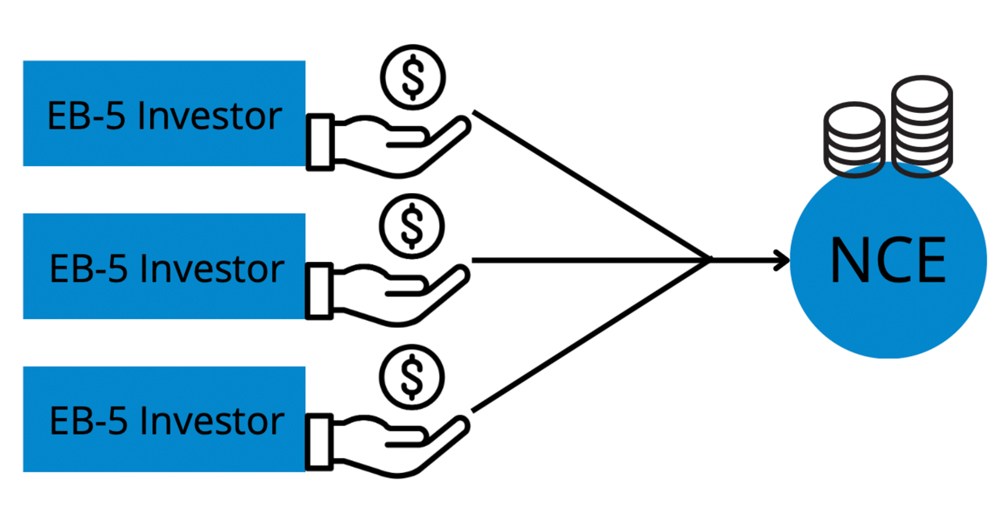

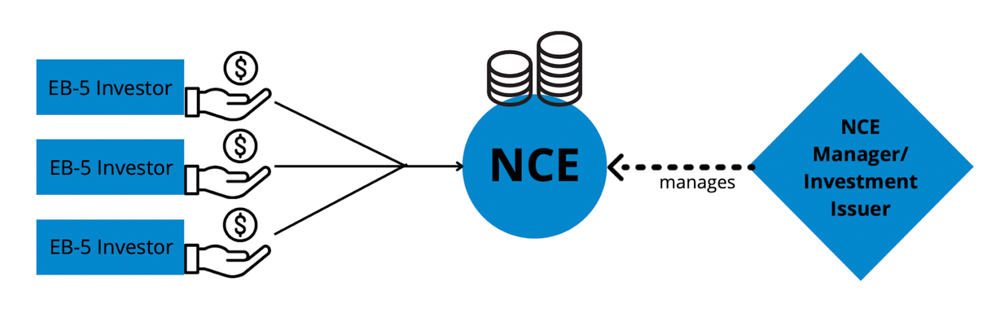

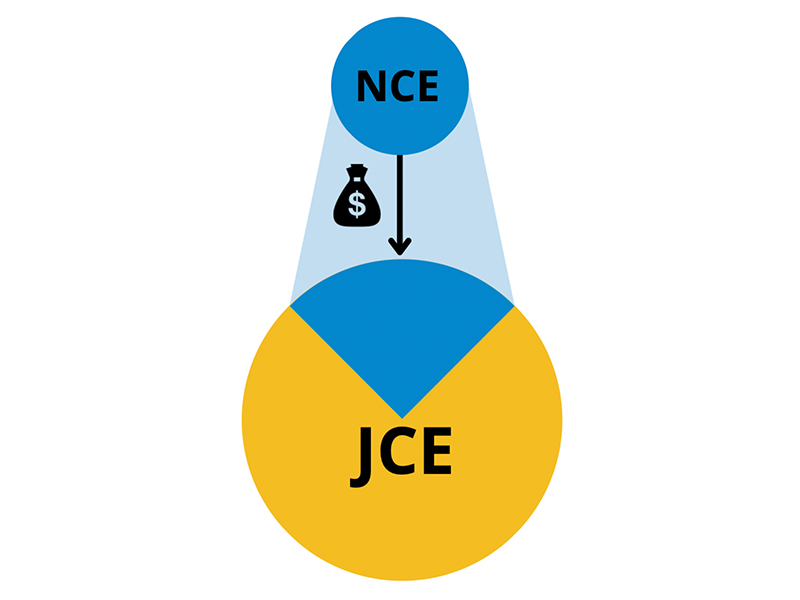

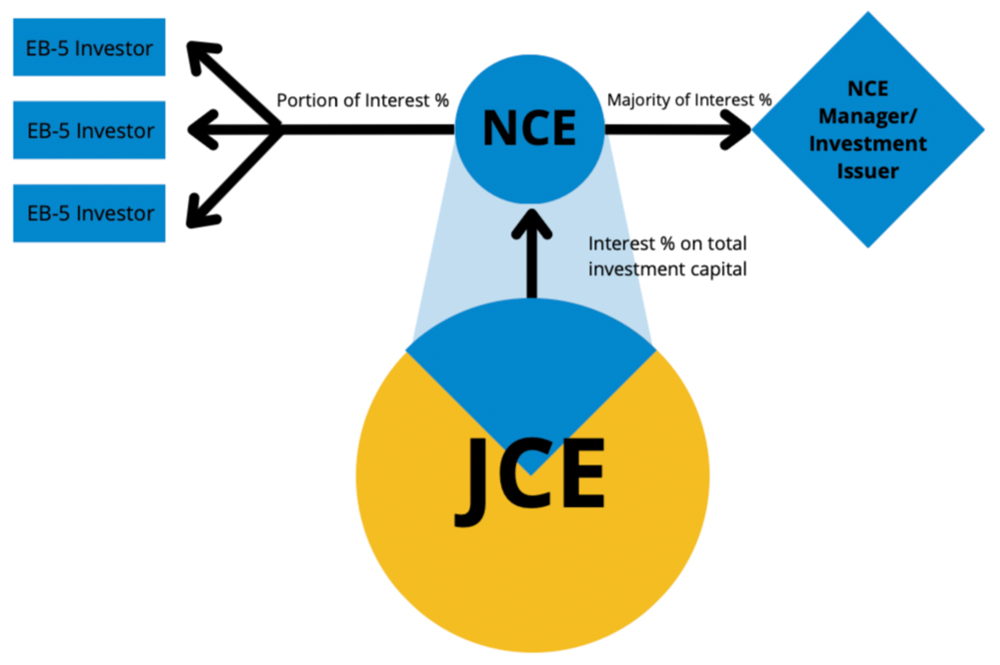

For the purpose of raising an EB-5 investment for a specific project, the project sponsor establishes a New Commercial Enterprise (NCE). The NCE functions almost like a special purpose entity. Its main function is to pool funds from multiple investors (whose numbers could range from a handful to a few hundred) and then either invest or loan those funds to the Job Creating Entity (JCE) to develop the project and create jobs.

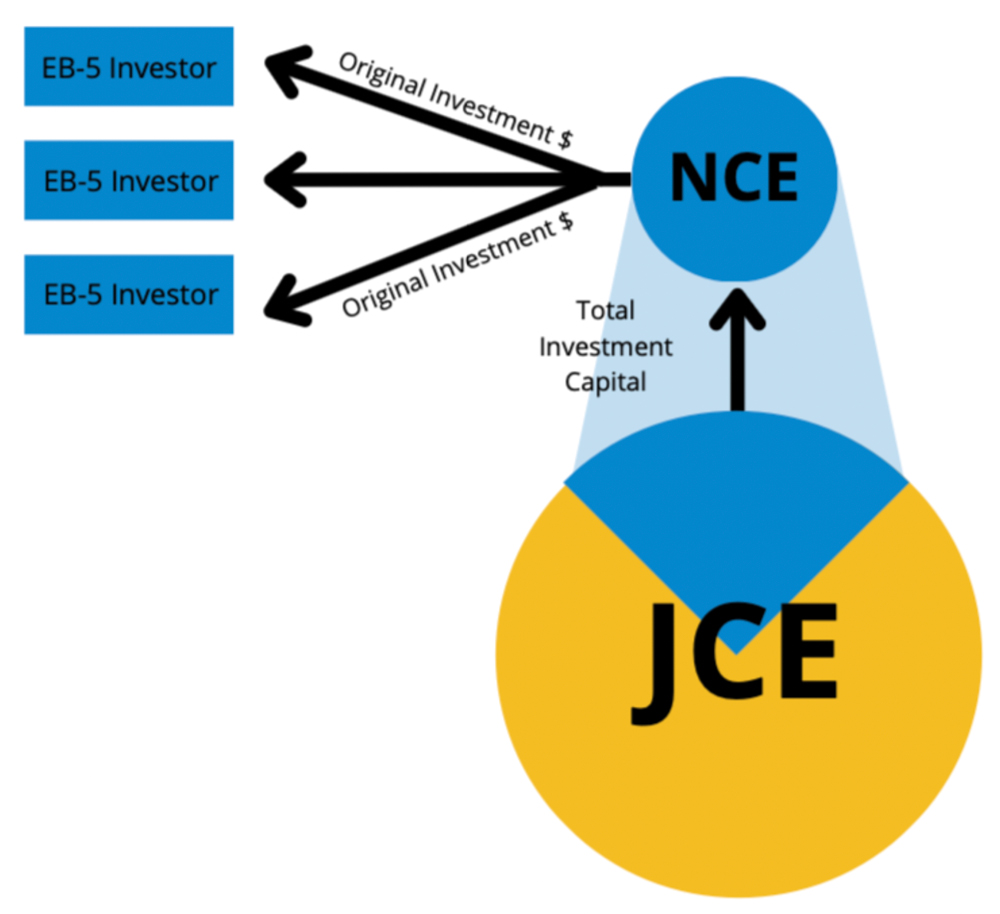

When an investor contributes capital to an NCE, they are purchasing an equity (ownership) share in that entity. Usually, NCEs are formed as LLCs or LPs. Ownership interests are split equally among EB-5 investors. At the end of the investment period, the NCE is either paid back with the loan it issued to the JCE (“loan model”) or is paid out distributions from the sale or refinancing of the project (“equity model”). When the NCE is paid back, it in turn pays back the capital contributed by investing members during the dissolution process.

In many cases, and depending on the offering, investors will also be promised a return on investment. Returns are either current, and paid out quarterly or annually, or accrued, and paid out at exit. Thus, when the project pays back the NCE, EB-5 investors are paid back their original investment in addition to the value of the preferred returns they received over the life of their investment. Returns are not guaranteed. In conservatively structured projects, returns are generally low.

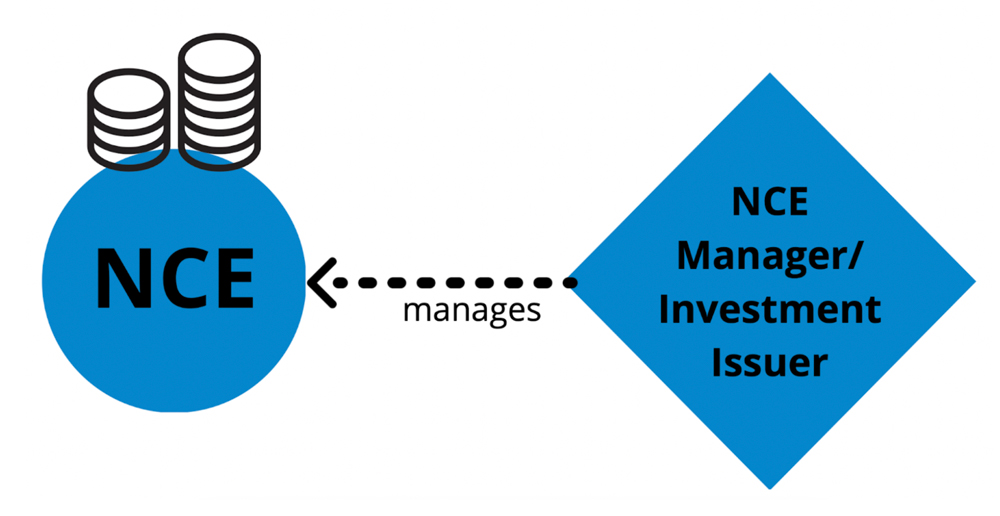

NCE Manager

The NCE is the entity created to take the funds of multiple investors and pool them into one project. Every NCE has a Manager (typically a Managing Member or General Partner) who directs the activities of the NCE and conducts all business with investors and project developers. The NCE Manager’s duties include the following:

- Oversee transfer of funds to and from NCE

- Handle administrative duties and securities laws compliance

- Formulate all project and subscription documents for investors and authorities

- Enter into agreements with developer

- Monitor and share information about project progress

- Oversee all business conducted by the NCE including control construction loan draws and debt servicing by borrower

- Eventually manage repayment to investors for their initial investment

In most cases, the Regional Center (or an affiliate of the Regional Center) serves as the NCE Manager.

Legally, the NCE Manager has to protect the interests of all investors in the NCE. However, investors should be aware that managers often have to balance investor interest with the financial interests of the NCE and management corporations which can often conflict. Therefore, it is in the investor’s interest to closely review all offering documents to identify potential conflicts of interests and ensure that investor’s rights include rights to monitor the investments as well as the activities of the NCE Manager.

Job Creating Entity (JCE)

A Job Creating Entity (JCE) is typically the developer or its affiliated entity that is developing or operating the project that receives EB-5 funds in the form of loan or equity and creates the requisite jobs. In a Regional Center project, the NCE and the JCE are distinct and separate entities. Whereas the NCE is capitalized by equity contribution from the EB-5 investors, the JCE is capitalized by an investment (equity model) or loan (loan model) from the NCE and is the entity directly engaged in project development.

The NCE’s capital contribution to the JCE can be structured in the following ways:

- Senior Debt

- Subordinated Debt

- Preferred Equity

- Common or Pari Passu (“equivalent to”) equity

Job Creation

Regional Center projects are allowed to count indirect and induced job creation in addition to direct job creation (in contrast, Direct EB-5 projects can only count direct job creation). They utilize an economic model as the common method of calculating future job creation by a project.

Direct, Indirect, and Induced Jobs

- Direct jobs are jobs that are created through either construction or operating activity. These are actual jobs and positions employed by the JCE or by its contractors in the long term construction of the project. While Regional Centers can count other types of jobs, at least 10% of jobs out of 10 jobs per investor required to qualify for EB-5 must be direct jobs.

- Indirect jobs refer to jobs created in adjacent industries as a result of the project’s expenditures. For example, a construction budget includes spending on materials (steel, lumber, etc.) and services (architecture and design, transportation, etc.). This spending, in turn, contributes to job creation in these industries. For example, the more work a transportation or production company gets, the more staff it requires. While these jobs are not directly related to the project, they are indirectly created thanks to the money spent by the project.

- Induced jobs are jobs that are created as a result of the spending of the JCE’s employees on goods and services - such as groceries, healthcare, entertainment, etc. - which are sustained by the circulation of capital in the local economy. In other words, because of the project, there are more people employed in the local economy and those people are using their wages to buy goods from other businesses in the economy, and as a result, those businesses are hiring more workers. This downstream job creation is induced by the development of the project.

The classic example of direct, indirect, and induced is in the development of a hotel. The construction and operations of the hotel creates direct jobs (construction workers and hotel employees); indirect jobs (suppliers), and induced jobs (the new cooks hired by the neighboring cafe, for example, which is now seeing a steady stream of lunch traffic from the hotel’s employees).

Sources of Capital, aka ‘Capital Stack’

Regional Center projects are rarely funded by a single capital source. Most have a mix of financing sources, which can include equity from the developer, equity from private investors, EB-5 debt or equity, senior lending, tax credits, grants, and more. Collectively, the sources are often referred to as the “capital stack” where “stack” is an appropriate metaphor because each source may come with its own collateral, return terms, and repayment priority. The positioning in the capital stack defines repayment priority for invested parties.

The sections below detail the most common sources comprising a project’s capital stack.

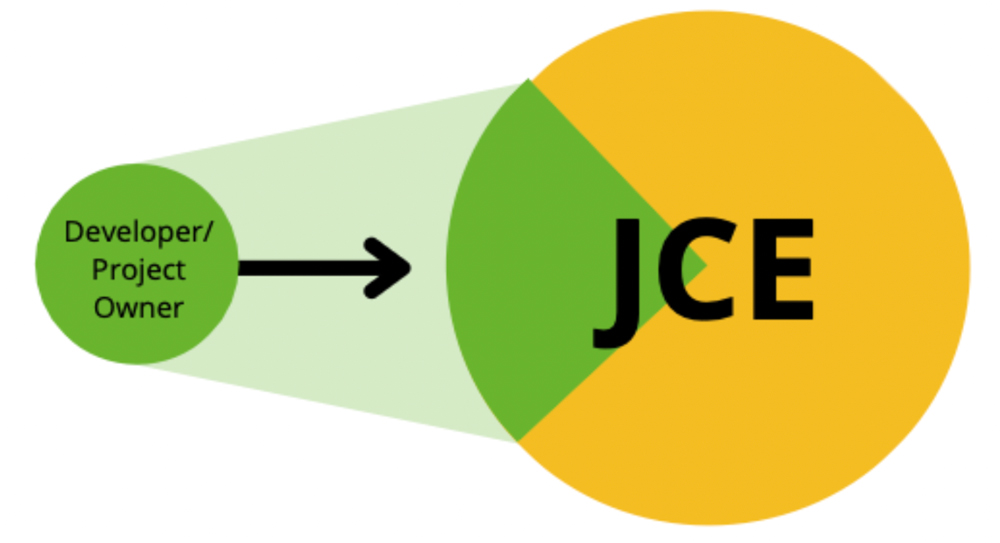

Developer/Project Owner

The developer is the individual or organization that directly manages project construction and operations. Developers can constitute individuals or corporations, either independent from or directly tied to the NCE manager. If the NCE manager is affiliated with developer it must be disclosed in a project’s offering documents.

The developer usually holds common equity in a JCE and in many cases will contribute cash equity or the value of land or other assets for the Project. The Developer or project owner is also responsible for planning the project, measuring project feasibility, acquiring the necessary licenses and permits, and raising the other financing required for the project from a variety of sources, including equity capital from other shareholders, loans from banks, and EB-5 funds. Funds raised are deployed for project development, pursuant to the business plan and terms outlined in the Private Placement Memorandum. Developers with common equity stock are always in the lowest priority of all creditors in the capital stack.

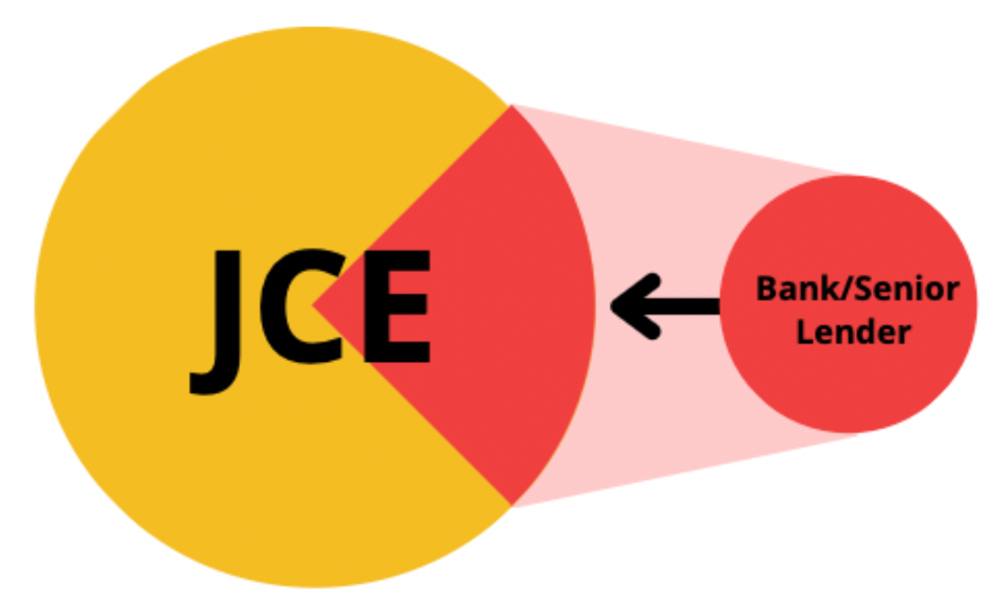

Bank or Senior Lender

Financing from banks or lenders account for some portion of the sources of capital in many EB-5 projects. When a bank issues a loan for an EB-5 project, it is typically positioned in the senior, or first priority, position in the capital stack. When a bank holds a senior loan in a project, it will secure the loan with a mortgage or deed of trust with the developer, meaning that if the loan is not repaid, the property will be foreclosed by the bank.

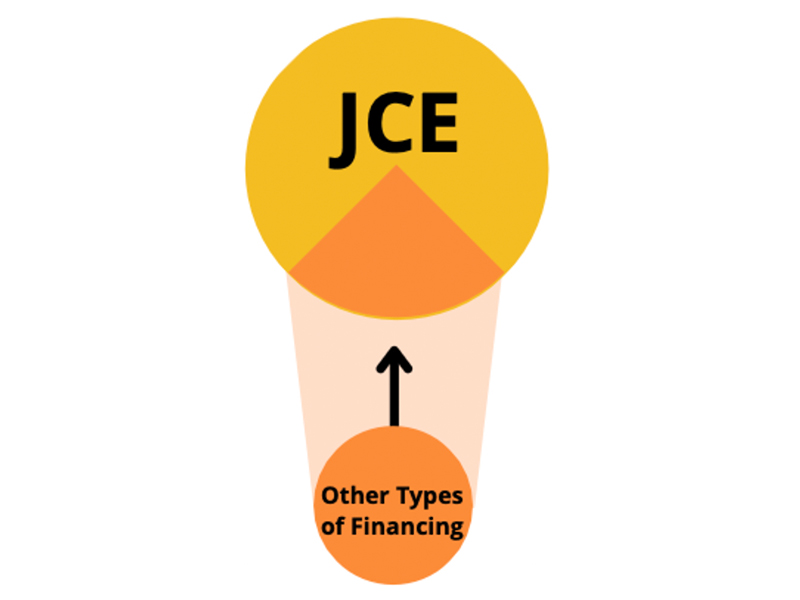

Other types of financing

Developers and Banks constitute a large portion of financing in most EB-5 projects, but there are various other sources of funds. Private equity investors, other lenders, and in certain cases even local governments can provide funding to a JCE.

Summary of Project Structure and Capitalization

This image summarizes the various sources of funds that can contribute to an EB-5 project and how EB-5 investors fit into the larger project ecosystem.

Financing & Repayment in an EB-5 project

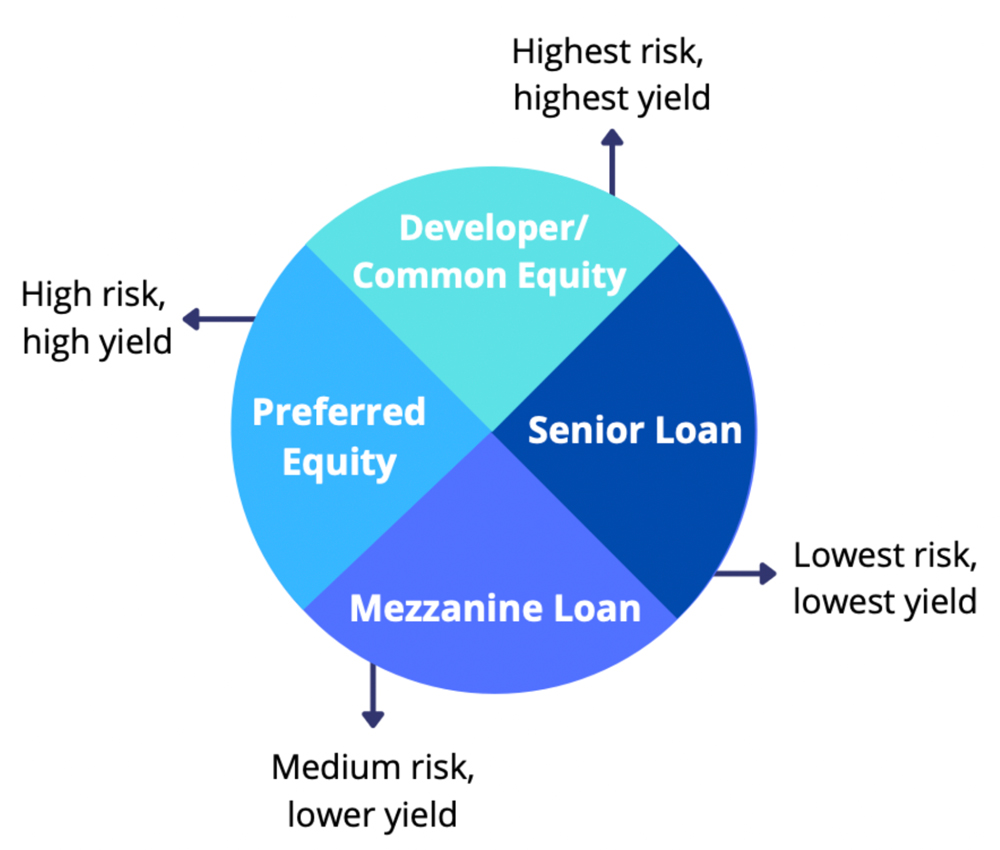

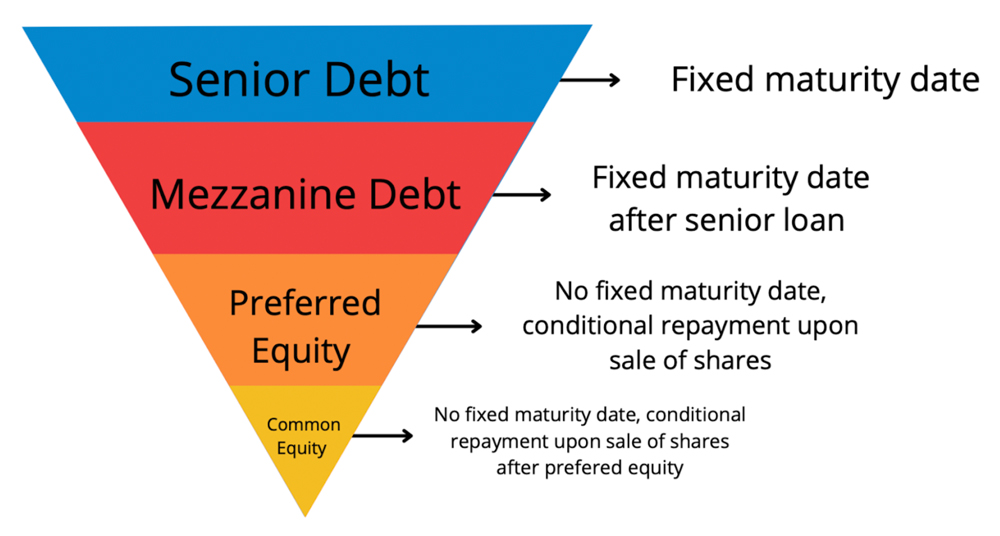

Understanding the funding structure of an EB-5 project is crucial to assessing investment risk. The capital stack acts as a visual representation of the share of funding provided by each investing party and allows us to understand repayment priority. While there are many shades and variations of each stack, a generic capital stack typically consists of 4 sources of funding (numbered in repayment priority order):

- Senior Debt

- Mezzanine Debt

- Preferred Equity

- Developer/Common Equity

The sources are “stacked” on top of each other to fund a project. Here’s an easy way to visualize it:

Priority Positions in Capital Stack

The first party to be repaid in a capital stack has something called a “senior position”, meaning that their loan to the project has the highest priority for repayment. No other parties will be repaid before the senior lender. Senior loans are always repaid first and are often secured by project assets which can be liquidated if the project is unable to pay interest or repay senior position to lenders. This position is usually occupied by institutional lenders but in rare cases can be occupied by the EB-5 lender. When a senior loan is not current or not repaid and a property is foreclosed, the senior lender will extract their original loan amount from the liquidated funds and pass on any remaining funds to the mezzanine lender or to the next position below the senior lender.

Within the repayment hierarchy, the next in line to senior lenders holds a “mezzanine position”. Members of this rank will only be repaid after the senior lender has been paid back in full. This position is also called mezzanine debt, mezzanine loan, or subordinated debt/loan. Following that, Preferred Equity is the third position in the repayment hierarchy and will be repaid after all loans from senior and mezzanine positions have already been repaid. Because this position does not hold debt in the project, preferred equity investors receive profits made by the project, sometimes even before the project is completed. This also means financial return is dependent on the project returning a profit unlike a loan where interest is earned regardless of project completion or performance. In preferred equity position, there is no finite “maturity date”, meaning that investors in this position are not required to be repaid by a certain time. Insecurity from lack of maturity date is what makes preferred equity much riskier than senior or mezzanine debt. Additionally, if a project goes into bankruptcy and liquidation, the preferred equity stands third in line claiming the liquidation value, behind senior and mezzanine loans and other priority creditors. In these cases, the senior lender decides a project's liquidation value which can be catastrophic for equity investors who may not be repaid with the remaining liquidation funds.

Common equity position has the highest return on investment due to the high risk factor. All profit derived from interest on a common equity investment is split between an investor and their associated NCE manager. Because this position is last in the repayment hierarchy, it holds the largest risk for no repayment at all.

Repayment

As the project progresses the JCE will make interest payments to the NCE. These interest payments are usually split between the NCE manager and the EB-5 investors where majority of the interest goes to the NCE manager. This is how investment issuers make most of their profit.

Investors are eligible for repayment once their sustainment period has completed. However, even after an investor reaches this stage, investors may have to wait far longer periods of time until their NCE is repaid by the JCE. Investors must keep in mind that petition approval is not required in order for them to be repaid. Once the NCE has been repaid, all eligible investors should expect to have their original investment amount returned to them less any deductions provided by the project documents. Investors who are ineligible for repayment may have to have their funds reinvested or redeployed.

Investors must be clear on their project’s “exit strategies” which is a common moniker for repayment and investor divestment from a project. For debt investments (such as senior and mezzanine positions), the exit strategy pertains to repayment of the investor’s loan plus a small amount of interest. For equity investments, exit strategies are far more nuanced and require the investor to have their share of ownership in the NCE redeemed in order to fully divest themselves from ownership in the project.

Investment repayment comes from the pockets of project developers, meaning that if a project is stalled, foreclosed, or generally unprofitable, repayment may not be an option for some investors. Investors oftentimes struggle to receive full repayment and are discouraged at the small amount of interest accrued on their loans to the NCE. While selecting projects with higher interest and the potential for larger financial returns may seem favorable, these projects often come with higher risks both for the return on investment and the immigration process. Additionally, regardless of the amount of interest promised to investors, an NCE manager will take a major cut of the interest payment received from the project. For that reason, the real return on investment is the Green Card given to investors and their families at the culmination of the EB-5 process. However, if you are an investor and believe you have been defrauded or are seeking repayment related support on your EB-5 investment, we recommend visiting our investment support page.

Due Diligence: Considerations in Choosing an EB-5 Project

When choosing an EB-5 project, an investor should weigh the benefits and risks of individual offerings and projects. Research into these risks is called Due Diligence. Investors should question everything when conducting project due diligence, including all parties involved in the process. Issuers, developers, agents, and other parties have commonly used investor ignorance to defraud an investor of large retainer fees or the investment as a whole. As a rule of thumb, investors should remember that if someone cannot commit a verbal promise to paper, whatever the party is saying is most likely untrue. Physical documentation of any relevant communication that occurs is an investor’s BEST protection against fraud. Going into a project based on statements on an issuer’s website for example, or based on an issuer’s previous success rates and self reported I-526 approvals is NOT due diligence. Investors should consult all project offering documents to make sure these offerings are listed in the contractual fine print, otherwise they are not guaranteed. When reviewing offering documents investors must be aware that most likely no changes to offering documents will be allowed and the only method to effect any such modifications is by execution of side-letters with the issuer and upon their agreement.

While conducting due diligence, investors should keep in mind that auditing a project to determine risk is best accomplished with the help of an investment specialist since the best due diligence is conducted by going through paper trails and analysis of all parties involved in the project. An investment specialist can help investors check the past performance of an RC, their track record of capital repayment, and pending litigation against an RC or the principals of a sponsored EB-5 project. Oftentimes, an investment specialist can also visit a project to conduct an audit for investors living far away.

Furthermore, due diligence does not necessarily require having the project in an investor's vicinity or having family members or friends visit the project site. Taking advice from a non-accredited person such as a friend, family member, or online forum is another way investors commonly conduct due diligence. Yet, this advice must ALWAYS be backed up by advice from immigration and investment specialists or from accredited resources such as the USCIS website.

Private Placement Memorandums

The Private Placement Memorandum (PPM) is an important component of private securities offering for EB-5 projects. Under the U.S. securities laws, private offerings in most EB-5 deals are exempt from registration with the SEC. The PPM acts as an offering prospectus prepared by securities and immigration counsel of the Investment Issuer. Investors are encouraged to use the PPM along with other Subscription Documents as a primary source for all the information and disclosures relevant to the investment and offering terms, including:

- Project description and its objectives

- Funding and Financial terms and conditions, including loan terms and maturity

- Repayment Conditions

- Redeployment

- Project management operations

- Arbitration Clauses

- Issue details

Put simply, the PPM should include a detailed account of where investor’s funds will be invested in the project, what share of the NCE belongs to the investor, what protections the NCE offers an investor in the case of a project gone awry, and information about the capital stack discussed above. The investor should carefully consider the details of a PPM and Subscription Documents with an EB-5 Private Placement consultant or intermediary before investing in a project.

Repayment for Denied Petitions

Some PPMs offer a “I-526 Denial Guarantee” in which the investor is granted a refund on their investment in the case that their I-526E is denied by the USCIS. However, the terms and conditions of this repayment guarantee must be carefully studied as this repayment clause does not typically include scenarios such as a denial of I-526E due to invalid source of funds. These guarantees can range from paying back merely the investment amount to paying back both the investment amount and the administrative fees associated with the investment.

Redeployment

One important aspect of any EB-5 project is the issuer’s right to “redeploy” investments after the invested capital is repaid back to the NCE. An issuer may choose to “redeploy” these funds into a new project, sometimes without the consent of the investor. Additionally, some issuers will issue exploitative PPMs allowing the issuer to redeploy investors' returns if a project is repaid before an investor is eligible for repayment.

Redeployment can sometimes yield positive results as well, for example, investors can technically still receive dividends from the NCE with redeployment funds. However, the discretion allowed to issuers with redeployment permits them to choose any commercial enterprise regardless of the risk it may pose to investors. Some issuers have even been known to use investor’s interest to repay debts and loans. As the potential for redeployment abuse is greater than many investors realize when they enter into an EB-5 project, it makes reviewing a PPM and other offering documents even more important.

Acronyms

CGC- Conditional Green Card

JCE- Job Creation Entity

LLC- Limited Liability Company

NCE- New Commercial Enterprise

NVC- National Visa Center

PPM- Private Placement Memorandum

RC- Regional Center

TEA- Targeted Employment Area

USCIS- United States Citizenship and Immigration Services