Background: AIIA filed multiple Freedom of Information Act (FOIA) requests for data from USCIS on various topics that concern the EB-5 immigrant investor community. These included information on staffing levels at the IPO, up-to-date inventories of pending petitions by country of chargeability and set aside visa, administrative policies on I-829 processing criteria, and implementation of the Reform and Integrity Act of 2022. AIIA initiated litigation against USCIS to compel them to respond to our FOIA requests. We have received, and will continue to receive hundreds of pages worth of documents including internal memos, emails and training manuals. This is our third blog in this series and you can read the first one here and second one here. AIIA Members are entitled to a full copy of the government’s FOIA response. If you would like to receive the complete dataset, reach out to us through our contact form.

How much demand for EB-5 set-aside visas has already accumulated? Is there any risk yet of backlogs in the TEA rural, high unemployment, or infrastructure set-aside categories, particularly for investors from China and India? After months of effort, AIIA is finally able to empower prospective investors with data relevant to these questions.

Assessing pipeline demand requires knowing how many people are entering the pipeline by filing I-526/I-526E for each set-aside category and from each high-demand country. The current Visa Bulletin shows a lack of qualified applicants at the visa stage, but the amount of future visa demand earlier in the pipeline, at USCIS, has been unknown.

USCIS does not regularly publish I-526/I-526E filing data by category or country, but AIIA has worked hard to obtain it. We requested the data in advance of the USCIS EB-5 Stakeholder Meeting in April 2023, filed a Freedom of Information Act (FOIA) request in May 2023 when USCIS failed to respond at the meeting, and followed up in July 2023 with a lawsuit filed on behalf of AIIA by the Galati Law Firm.

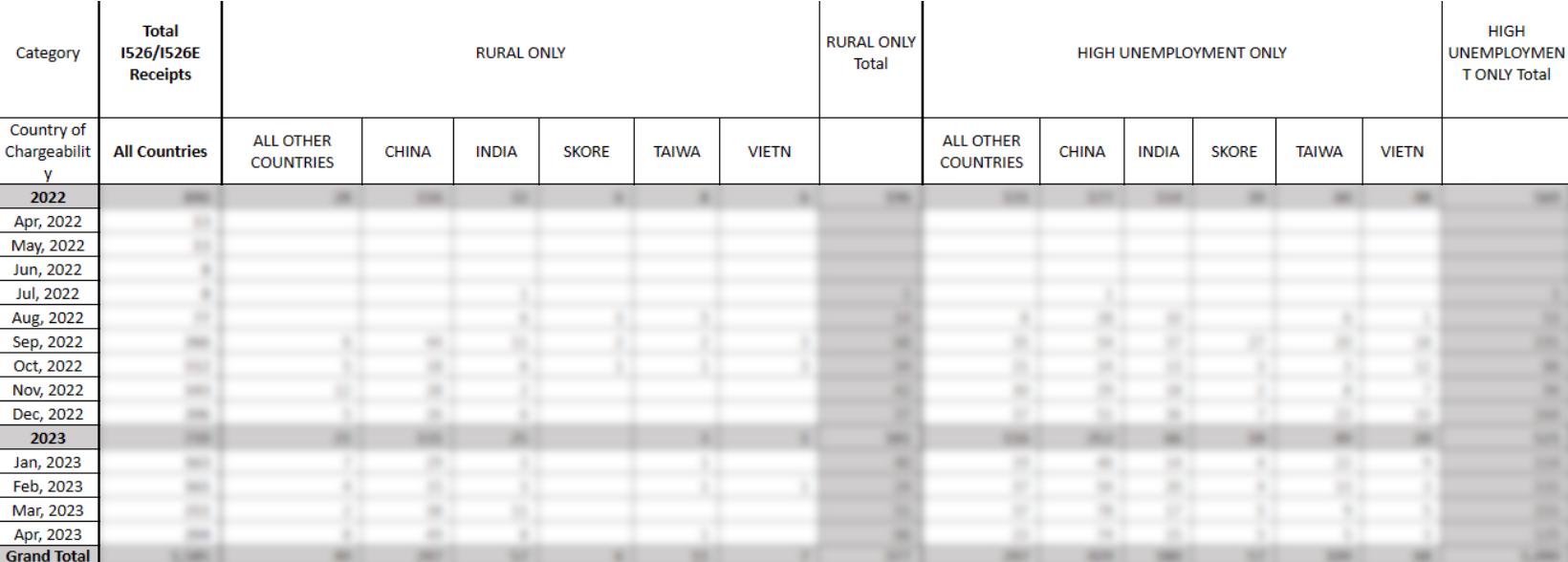

Thanks to the diligent work of the Galati Law Firm, USCIS has now responded to AIIA’s FOIA request, providing us with a detailed report that itemizes I-526 and I-526E filings by month from April 2022 through April 2023, by TEA category, and by country of chargeability.

The full data report is available to AIIA members. This post provides highlights needed for backlog assessment, and AIIA has conducted a webinar to present a detailed analysis of the data.

Table 1. Total number of I-526/I-526E filed from April 1, 2022 to April 30, 2023, by TEA category and country of chargeability (based on FOIA request response by USCIS)

| China | India | Vietnam | Rest of World | Total | Total% | |

| Rural | 247 | 57 | 7 | 66 | 377 | 24% |

| High Unemployment | 429 | 180 | 68 | 413 | 1090 | 69% |

| Infrastructure | 0% | |||||

| Not TEA | 23 | 15 | 3 | 72 | 113 | 7% |

| Rural and High Unemployment | 2 | 1 | 2 | 5 | 0% | |

| Total | 701 | 252 | 79 | 553 | 1585 | 100% |

| Total % | 44% | 16% | 5% | 35% | 100% |

The data shows strongest demand up to April 2023 for the high-unemployment set-aside (69% of total I-526/I-526E filings) and from applicants chargeable to China (44% of I-526/I-526E filings). Applicants from India showed the second-highest demand (16% of total filings), particularly in the high unemployment category. Surprisingly, USCIS reports a significant number of I-526/I-526E filed outside of TEA categories, a few filings tagged for both rural and high unemployment, and no filings for the infrastructure category. Unlike EB-5 history, where the market went to China first, then later to Indians and the rest of the world, countries from around the world have been filing concurrently in the new EB-5 set-aside categories. This means that at the visa stage, set-aside visa applicants from India and China will be competing with similar priority dates, rather than the unreserved situation where most Indians have recent priority dates compared with Chinese. Additionally, the relatively large number of “rest of the world” set-aside visa applicants will constrain the number of “otherwise unused” numbers that will be left for China and India to share above the 7% country cap limit.

To make a visa demand forecast and backlog assessment, we take I-526/I-526E filing numbers, convert them to an estimated number of future visa applicants, and compare this number against the number of set-aside visas that will be available. The analysis shows that up to April 2023, incoming demand was still far below EB-5 visas to be available in the rural category, and on track to exceed limits for the high unemployment category.

Table 2. Comparison of Demand with Supply

| Rural | High Unemployment |

|

|---|---|---|

| Demand | ||

| Total I-526/i-526E filed as of 4/30/2023 | 377 | 1090 |

| Estimated pipeline visa demand as of 4/30/2023 if 1 I-526=2.5 visa demand on average | 943 | 2725 |

| Average I-526/i-526E filed per month 9/2022 through 4/2023 | 45 | 130 |

| Estimated visa demand from monthly filings if 1 I-526 = 2.5 visa demand on average | 113 | 324 |

| Supply | ||

| FY2024 visas available, including FY2023 carryover (based on FY2024 EB limit of 161,000) | 5085 | 2542 |

| FY2025 visas available with carryover, if assuming all new FY2024 visas were unused | 4274 | 2137 |

| FY2025 visas available without carryover, if assuming all FY2024 visas were used | 1988 | 994 |

Note that while pipeline demand for high unemployment visas may already exceed visa supply, retrogression will not happen until this demand can reach the visa stage. So long as USCIS and NVC processing steps remain slow/low-volume, I-526E filed in 2023 are unlikely to all become qualified visa applicants in 2024, meaning the visa bulletin will likely remain open in 2024.

The I-526/I-526E filing numbers are important primarily because they indicate, for someone entering the end of the pipeline, how many have an earlier position in that pipeline. At what date the pipeline reaches the visa stage is a question that depends on USCIS processing. But the fact of the pipeline will determine visa demand and the visa wait times that are a function of demand/supply balance.

Backlog assessment requires looking first at the worldwide number of I-526/I-526E filings for each category, and comparing it with worldwide supply. So long as demand is lower than supply overall, then investor country of birth does not matter. As soon as total demand exceeds supply at the visa stage, then the outlook for Chinese and Indian investors becomes worse because their country cap kicks in, limiting each country to 7% of available visas plus any otherwise unused visas, while the rest of the world can enjoy access to at least 86% of annual visas protected by country caps. The country-specific demand/supply analysis is complex and beyond the scope of this blog post, but AIIA is working on the analysis using the granular data that AIIA has requested.

A prospective investor needs to know “what is the pipeline of demand up to Date X, when I plan to file my I-526E.” Thanks to a FOIA success, AIIA has now data up to April 2023 only, and the fight for data on incoming demand since then must continue. We made the I-526E data request one of its top agenda items for discussion with the CIS Ombudsman, and may need to litigate additional FOIA requests.

To support our work remediating the information gap between USCIS and its stakeholders, consider signing up for our email list, becoming a member, or making a donation to our organization. All donations are put towards our advocacy campaign, which strives to resolve the issues plaguing USCIS and the EB-5 program at their source. We appreciate all our supporters and the work they do to ensure we can continue advocating for equity and transparency in the EB-5 program for all investors.

Excellent work!